After Rallying Early, Natural Gas Futures Sell Off on Milder Forecast Trends

An underwhelming storage withdrawal and mixed signals from the latest forecasts saw natural gas futures retreat from a morning rally to finish a few pennies higher Thursday. In the spot market, points across the country moderated after widespread gains earlier in the week; the NGI Spot Gas National Avg. dipped 33.0 cents to $3.765/MMBtu.

February natural gas futures settled at $3.413, up 2.9 cents on the day, with the bulls unable to hold their ground after rallying the market overnight. Following a pattern somewhat similar to Wednesday’s trading, the front month reached its intraday high in the early morning hours on the East Coast before selling off later in the session. Further along the strip, the March contract settled at $3.174, up 2.7 cents, while April added 1.7 cents to settle at $2.850.

“Each of the last three trading days have felt like carbon copies of each other, with the February gas contract very strong in the morning on firm cash” as the February/March spread “ballooned out,” Bespoke Weather Services said Thursday. “Through the day weather model guidance has then trended warmer, pulling February gas back lower.”

Still, prices have held above key support at $3.25-3.30 and should continue to do so through the week, the firm said. Cash prices should be strong Friday, but “confidence is lower as we see conflicting factors; Sunday and Monday will bring some of the coldest air of the season and we may be looking at some freeze-offs in the Utica and Marcellus shales accordingly. However, this cold comes over a holiday weekend when demand typically dips and cash weakens, meaning it may be more of a battle of catalysts in the cash market than usual.”

The midday Global Forecast System ensemble data trended milder Thursday, showing a break in the cold around Jan. 22-23, according to NatGasWeather. The afternoon European model also trended milder to lose 10 heating degree days compared to an earlier run.

“Make no mistake, both important weather models see a series of frigid cold blasts lined up this weekend through the rest of the month, just with breaks in between” trending milder in recent runs, the forecaster said. “…Overall, we continue to view weather patterns as at least moderately bullish, but any decent milder trends would be met with big disappointment, while anything colder would rapidly increase levels of intimidation/impressiveness.

“This means every weather model run will be closely scrutinized by the markets for the direction of temperatures trends.”

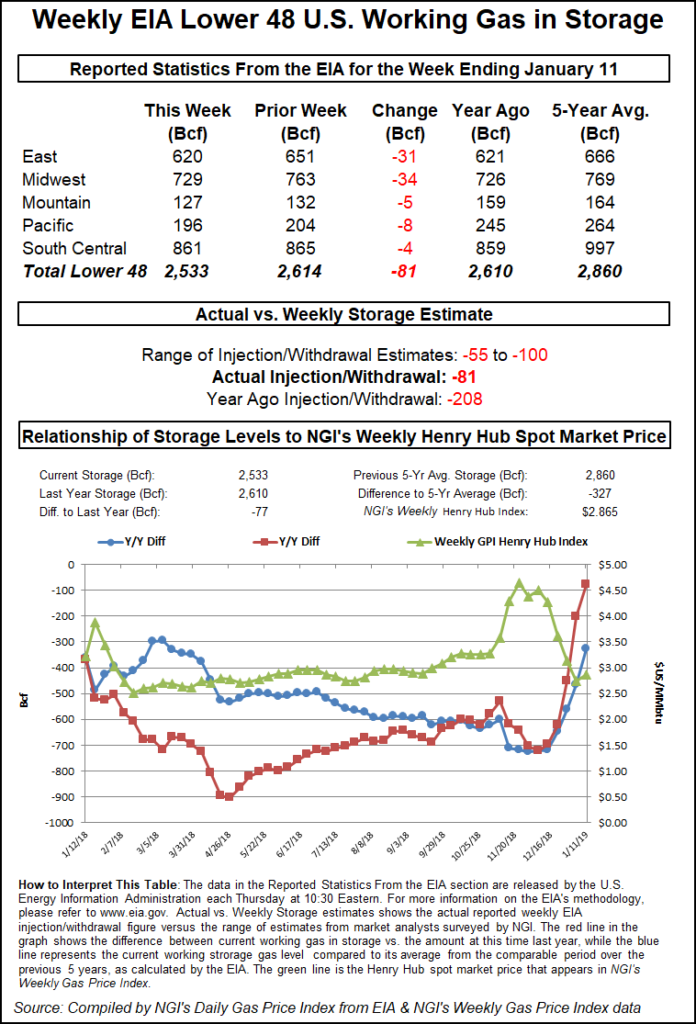

Meanwhile, the Energy Information Administration (EIA) on Thursday reported an on-target 81 Bcf withdrawal from U.S. natural gas stocks that prompted some futures selling but generally left the market to focus on the impact of Arctic cold set to spill into the Lower 48 starting this weekend.

Another in a run of deficit-shrinking storage reports thanks to relatively mild conditions for much of the country in recent weeks, the 81 Bcf pull for the week ended Jan. 11 looks meager compared to both the 208 Bcf withdrawal EIA recorded for the year-ago period and the five-year average 218 Bcf withdrawal.

But market participants had been looking for a light withdrawal in line with the actual figure. Major surveys this week had pointed to a pull of around 76-82 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a withdrawal of 84 Bcf.

Prior to the 10:30 a.m. ET release of EIA’s report, the February Nymex futures contract was up about 15 cents from the prior day’s settle, helped by overnight guidance that advertised the potential for intense cold expected for the final third of January to stretch into early next month.

As the 81 Bcf figure crossed trading screens, the February contract traded as high as $3.554 and as low as $3.501 before settling back into a range of around $3.530-3.540, within pennies of the pre-report trade. By 11 a.m. ET, February had slipped to around $3.447, up about 6.3 cents from Wednesday’s settle.

Total Lower 48 working gas in underground storage stood at 2,533 Bcf as of Jan. 11, 77 Bcf (3.0%) below last year’s stocks and 327 Bcf (11.4%) below the five-year average, according to EIA.

By region, EIA reported a 34 Bcf withdrawal in the Midwest, with the next largest pull occurring in the East at 31 Bcf. The Pacific withdrew 8 Bcf for the week, while the Mountain region pulled 5 Bcf. In the South Central, a 6 Bcf withdrawal from nonsalt offset a 1 Bcf injection into salt stocks, according to EIA.

On the supply side, Lower 48 production has declined since setting a record high in late November, but this is not indicative of a structural shift in producer behavior, according to analysts with Genscape Inc. The firm recently reiterated that it expects February 2019 production to average 88.3 Bcf/d.

“Recent declines are a function of freeze-offs, temporary outages and operational issues associated with cold weather,” Genscape analysts Rick Margolin and Nicole McMurrer said in a recent blog post.

Genscape’s February 2019 production “does not account for further unforeseen disruptions to system operations, nor freeze-offs.” Forecasts as of Thursday showed producing areas in the Northeast and Western Canada at risk of freeze-offs during the upcoming cold shift, according to the firm.

“Risks to Northeast producing areas start to emerge early next week, followed by notable (and rather prolonged) risk around days 11-18, though it is likely those forecasts are bound to change being that far out,” Margolin told clients Thursday, highlighting upcoming cold weather days in Clarington, OH, Morgantown, WV, Harrisburg, PA, and Pittsburgh.

Other major producing areas, including the Permian Basin, the Denver Julesburg-Niobrara and the San Juan Basin did not appear at risk for freeze-offs as of Thursday, according to Genscape.

Cash Slumps After Recent Gains

Spot prices moderated across most of the Lower 48 Thursday even as gas buyers continued to brace for a shift to much colder conditions over the weekend and into early next week. Benchmark Henry Hub fell 9.0 cents to $3.520.

Locations across the Rockies and California sold off Thursday, but a number of points continued to trade at elevated prices with a major winter storm moving in over the West Coast this week.

“Precipitation continues to spread across the West as a strong winter storm system tracks toward the Rockies,” the National Weather Service (NWS) said Thursday. “Blizzard warnings remain in effect for the highest elevations of the northern portions of the Sierras where snowfall amounts in excess of three feet are expected.

“Winter Storm Warnings and Winter Weather Advisories are also in effect for the surrounding areas, as well as Washington, the Great Basin, the Intermountain West and the Central/Southern Rockies,” NWS said. “…Precipitation will begin to wind down overnight as the front tracks further east.”

In the Rockies, Opal tumbled 33.0 cents to $4.155, while in California, Malin dropped 29.0 cents to $4.155. Farther south, SoCal Border Avg. shed 21.5 cents to $4.025.

The upper-level trough responsible for the storm hammering the western United States this week was expected to generate a new surface low over the western High Plains by early Friday, according to the NWS.

“This system is expected to produce a vast area of heavy snow” along with “heavy rain with pockets of freezing rain to the south central states and much of the East Coast,” the NWS said. “Some thunderstorms will also be possible across the Gulf Coast region. Heavy snow will begin Friday evening over the Central Plains and then progress eastward by the weekend. Additionally, snow is expected across portions of the Northern Plains and Upper Midwest as a cold front drops south.

“…In the wake of the storm, an Arctic surface high will plunge southward from Canada and result in frigid temperatures across the Plains and the Upper Midwest, with temperature departures on the order of 15-25 degrees below normal.”

Despite wintry conditions expected over the next few days, spot prices sold off throughout the Midwest, Gulf Coast and East, breaking a run of widespread gains logged since a much colder forecast greeted traders when they returned to work Monday.

In the Midwest and Midcontinent, Michigan Consolidated slid 9.0 cents to $3.410, while Northern Natural Demarc dropped 11.0 cents to $3.350.

Volatile New England points posted heavier losses but continued to trade at hefty premiums to the Hub. Algonquin Citygate averaged $9.820 on the day after giving up $1.555.

Meanwhile, in West Texas prices dropped more than in surrounding regions amid reports of maintenance-related constraints on flows out of the Permian Basin this week. El Paso Permian sold off 59.5 cents to $1.875.

Genscape reported earlier in the week that maintenance planned to start Thursday and continue until Monday could cut more than 200 MMcf/d of flows leaving the Permian on Northern Natural Gas.

A separate event, a force majeure in effect Thursday on Transwestern in New Mexico, was expected to impact less than 20 MMcf/d of flows, according to Genscape analyst Joe Bernardi.

Affecting Transwestern’s Station 7 compressor in Mountainair, NM, the event reduced total capacity for westbound receipt volumes at the station to 680,000 MMBtu/d, according to the pipeline’s electronic bulletin board.

Genscape estimates indicate that the reduced capacity is about 15 MMcf/d below the prior 14-day average flows through the location, Bernardi said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |