Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Natural Gas Storage Said Still Viable, with Exports Offering New Opportunities

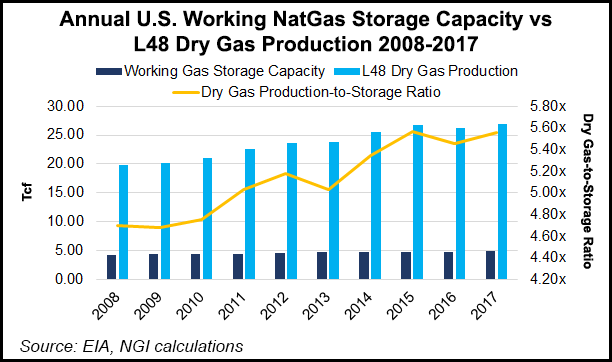

Natural gas storage used to be a must for the Lower 48, but abundant onshore supply has upended the market, reducing the need for developments. Even so, exports and Mexico’s nascent market have opened the sector to more possibilities, executives said last week.

Before the ascent of Lower 48 unconventional drilling in the mid-2000s, the United States relied on gas storage to deal with volatility, often exasperated by weather events and wide pricing spreads in the contract period between January and March.

The surge in gas production means that for now, there’s little need to expand or build greenfield facilities for what storage historically was used for, a panel of experts said last week in Houston at S&P Global Platts’ 17th annual Gas Storage Outlook Conference.

“It’s…hard to see light at the end of the tunnel, at least in the U.S. gas storage market from where I sit,” EnerGnostics LLC Managing Director John M. Hopper told the audience. “We have just seen a steady decline in gas storage rates and asset valuations over the last five to seven years…Generally speaking, it’s because we’ve got too much gas…

“Yes, we do have areas with specific gas price volatility that on paper at least you would think would drive some interest in gas storage.” However, rates have fallen and acquisitions are “well below” replacement costs.

“Obviously, when buying is less than the replacement cost, it could be attractive…The question I have in my mind, is this sort of the buggy whip syndrome? When Henry Ford began producing cars, you could get a hell of a deal on a buggy whip. The question is, what was it worth?

“The market is telling us we don’t need more storage. There haven’t been any greenfield or precious storage capacity additions.” Besides, it would appear that “the market won’t pay for it.”

Gas storage long was a surrogate for long-haul pipeline capacity, but the market is no longer what it once was.

“In the good old salad says, back in the mid to late 2000s, you saw huge seasonal spreads because we didn’t have shale or precious little of it,” he said. “A premium was placed on deliverability during the winter. As we have had more shale gas come on, the premium to pay for it is down substantially.”

Still, there are nascent opportunities for the storage market from liquefied natural gas (LNG) exports, the panelist said. And there are signs that already may be happening. The Energy Information Administration reported a 20 Bcf withdrawal from stocks for the week ended Dec. 28. However, a 20 Bcf build in the South Central caught some market observers by surprise, including a 22 Bcf build into salt stocks.

Salt Storage For LNG Facilities?

King & Spaulding attorney Jim Bowe, who moderated the panel, said reports have surfaced suggesting “that the impact on salt storage in the South Central region is related to LNG exports…” Injections into salt storage near the Gulf Coast could be “because LNG activity is ramping up.”

Cheniere Energy Inc. has the only operating export facility on the Gulf Coast now, Sabine Pass, but “several others are coming on,” Bowe said.

Rystad Energy recently noted that the increasing output from the gassy Haynesville Shale in Louisiana and Texas, which is within the South-Central region, has a ready outlet to exports.

In addition, the Dominion Cove Point export project in Maryland “may have implications for storage in the Appalachian region,” Bowe said.

“As more projects come on, we will see an interesting dynamic as people try to figure out who’s going to bear that risk of flowing gas destruction,” he told the audience. Cheniere buys and sells gas, while other planned LNG export projects will use tolling contracts. “I think there’s a bit of a waiting game going on right now.”

Midstream Energy Holdings LLC CEO Scott Smith, whose company is backed by an affiliate of Quantum Energy Partners, said the current outlook for storage “doesn’t paint a positive picture in the near term for greenfield development” unless there is a “unique location or a unique need.”

Storage for LNG export projects could make sense, he said.

Added Enstor Gas LLC CEO Paul Bieniawski: “LNG operators recognize they will have process upsets. When it will happen, nobody knows…”

Incidents that would reduce LNG volumes may have a low probability, but if they were to happen, it could have a “high impact,” Bowe said. “It could make things quite constipated on the Gulf Coast very quickly.”

LNG operators using storage “makes perfect sense to me,” Hopper said. The question is figuring out whether adding it makes economic sense. “If I were doing calculations on that, I’d make an educated guess about how many events are going to take place in the timeframe of a year.”

Without storage, LNG buyers might have to sell their gas back to the market, he said.

“If I’m obligated to buy at $3, what do I have to sell it for to clear the market? $2? $1.50? I don’t know. It’s going to be case specific. Say it’s $2. I lose a dollar on how much supply for each of those events. Divide that number into storage capacity to get enough injectivity and that gives you a marker price in my mind about what I might be willing to pay for that service.”

Bottom Line Economics

It takes a lot of money to convince a U.S. developer that more storage is needed, Smith said. “Gas storage is a tough animal to get to the investment decision and start construction.” There could be uncertainty about the quality of the gas reservoir or its geologic capability, issues that require upfront funding before a developer considers huge financial commitments.

“It’s a different development cycle versus other midstream investments like pipelines,” Smith said. “The risks are higher.”

Building a storage facility can cost about $14 million/Bcf for a salt cavern and $25 million/Bcf for a reservoir project, Smith estimated. If the need for storage is low, not many investors would be willing to take a bet on a greenfield project, much less an expansion.

Preceding the unconventional gas boom, buyers often took 10-year terms for storage, with the expectation they could recontract at similar levels. “That’s not been the case for the last five to 10 years,” Smith said.

Buyers today often are only interested in short-term contracts with one-to-three year terms. The surge in merger and acquisition activity versus short-term rates “indicates no new storage deals in the near term without a physical market need or shifting market dynamics,” Smith said.

“Assets are trading hands and trading hands,” but there are few new projects in the works that have been publicly disclosed.

Opportunities Still There

However, Bieniawski argued that opportunities still abound for traditional storage and beyond. The portfolio company of ArcLight Capital Partners owns and operates underground storage facilities on the Gulf Coast and Southwest regions, with net working gas storage capacity of 67.5 Bcf. Facilities access supply to serve growing demand from LNG exports, industrial expansions, power generation and exports to Mexico.

“When there is ever a bubble in the supply, there’s a disproportionate response in the market. That’s an opportunity for gas storage,” Bieniawski said. “LNG, power generation and Mexico are not like traditional U.S. reservoir demand, but that is an opportunity for gas storage for a different set of markets, different set of customers.”

Don’t discount the need for more Lower 48 storage either, Bieniawski said. Some fields are almost 100 years old and they still are being used for gas storage. Some wells are 30 to 40 years old.

“When you add it all together, I don’t think the need for gas storage is going away,” he said.

Updated storage regulations are expected to be issued as soon as Friday by the Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA). Safety advisories for storage operators were issued by PHMSA in 2016 for operators to inspect facilities following the extended Aliso Canyon storage leak in Southern California.

“As these rules come through and as LNG sorts itself out and as Mexico sorts itself out, you can make the case for the types of gas storage we’ve had historically,” Bieniawski said.

“Nobody’s talking about gas storage scarcity, but as these regulations roll through, I’m fairly confident that some assets on the North American grid today are not going to be on the grid in the future because can’t comply with regulations.”

The updated PHMSA rules presumably would impact older assets for the most part, which tend to be in the Northeast and Midwest, and which are held by large pipeline companies. Some of the storage could be taken up by unconventional gas in those areas, Bieniawski said.

There is a “historic opportunity to buy assets at a low replacement cost,” he said. “If you know how to run the assets, there are opportunities out there.”

Many LNG buyers and sellers rely on tolling agreements, under which the buyers secure feedgas for export. That offers an opening for storage. If shippers need a place to park supplies they are committed to buy, what better method than a storage facility?

Export Market ”Silver Lining’

The “silver lining” is the interest in Gulf Coast storage capacity, Bowe said. The export market is “beginning to present demand for storage services that are unusual and very high…”

Storage contracts to support LNG exports are expected to increase. For tolling customers to make the commitment to gas storage, however, “it’s still early days.”

The name of the game last year was change in ownership for several storage facilities, a trend expected to continue in 2019, Bowe said.

“If asset acquisition activity is any guide, 2018 may end up being the year in which the storage sector began to turn around,” he said. “That activity is what I consider to be the bright spot in the last part of 2018.”

The number of facilities going through a “change of control” offers some indication “at least from what I’ve been able to glean, and not all of it is public knowledge, is that storage acquisitions may be firming up. Fairly slow, stagnant storage may begin to turn around.”

Many of the biggest transactions in the space of late have been helmed by affiliates of private equity giant ArcLight. For example, affiliate Amphora Gas Storage USA LLC last year scooped up Enstor Gas facilities on the Gulf Coast and in the Southwest with a total storage capacity of 88.5 Bcf and net working gas storage capacity of 67.5 Bcf.

Via the Enstor storage platform, ArcLight earlier this month acquired Sempra Energy’s storage facilities in Mississippi and Alabama. In addition, early in January Enstor acquired the 12 Bcf East Cheyenne natural gas storage facility in Logan County, CO, which is interconnected to the Trailblazer pipeline.

The combination of East Cheyenne, the pending acquisition of Sempra’s gas storage facilities and the existing Enstor platform are expected to create the largest independent gas storage operator in the United States with net working gas storage capacity of more than 120 Bcf.

Other big storage turnovers last year included the sale of the Gill Ranch in Northern California by NW Natural (75% stake) to eCorp Storage. Pacific Gas and Electric Co. owns a one-quarter stake.

Spire Inc., whose natural gas utilities and gas-related businesses serve 1.7 million customers across Missouri, Mississippi and Alabama, last year took a majority stake in the Ryckman Creek Storage Project in Wyoming. Ryckman and its backer Peregrine Midstream Partners LLC had declared voluntary bankruptcy in 2016.

In addition, Castleton Commodities International LLC acquired NorTex Midstream Partners LLC, giving it 36 Bcf of working gas capacity in two depleted reservoir storage facilities that serve the Dallas-Fort Worth metroplex with 850 MMcf/d of maximum deliverability.

South Of The Border Eyed

Hopper, who formerly helmed U.S. gas storage, including for Peregrine, for the last four years or so has been working on gas storage growth in Mexico. The process, slowed after President Andrés Manuel López Obrador took office Dec. 1, should accelerate again this year, he told the audience.

Some operators are working to build Mexico gas storage tied to pipeline projects, but storage is not a reality yet. The country relies today on the Altamira and Manzanillo LNG import terminals for system balancing, but the energy ministry in March published a public policy for storage, which calls for 45 Bcf of inventory by 2026.

The first construction site nominated for the first 10 Bcf is the depleted Jaf dry gas field. The new administration has not indicated whether the energy ministry will give the order to proceed with the tender.

In Hopper’s view, Mexico’s electric utility Comision Federal de Electricidad, aka CFE, “purposely oversized the pipes relative to what real demand was on those pipes, principally for electric generation, so that they would have room to pack.”

The pipelines could be used as a “surrogate for storage,” he said. “I firmly believe gas storage is needed in Mexico…It will be interesting to see how it shakes out.”

The Jaf field was selected as the first field for storage because it was dry gas, “so they don’t have liquids to deal with,” he said. The field also had been abandoned by Petroleos Mexicanos, the state-owned oil and gas producer. “Technically, whatever reserves may remain belong to the state or people of Mexico. Those reserves have been deemed to be nonrecoverable, so the value is zero.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |