Markets | Mexico | NGI All News Access | NGI Mexico GPI

Brazil Looking to Jump-Start Natural Gas Market

CEO Roberto Castello Branco of Brazil’s Petroleo Brasileiro SA (Petrobras) at his recent swearing-in ceremony said the state-owned energy giant needs to divest natural gas assets and end its domination of the gas supply chain to increase the number of participants in the market.

“We’re pro-market economists,” he said earlier this month. “We like competition.”

Brazil’s new government, headed by right-winger Jair Bolsonaro, has made it clear it will continue to shed noncore assets at the state company.

As part of an ongoing divestment program, Petrobras plans to sell Transportadora Associada de Gas, or TAG, which operates a gas pipeline network in the north of Brazil. Petrobras has already sold off natural gas distributors, as well as a 90% share in southeast pipeline operator Nova Transportadora do Sudeste, or NTS.

Reducing Petrobras’ role in the gas market is also part of the initiative started by what is known as the “Gas to Grow” program, whose goal is to create a market comprised of suppliers/operators of pipelines, as well as distribution companies, removing the producer’s monopolistic position across the supply chain.

As part of the initiative, in December outgoing Brazilian President Michel Temer signed a decree allowing for more third-party access to gas pipelines and regasification terminals. The decree could also mean third-party access to the Bolivia-Brazil gas pipeline, or Gasbol. Brazil has a long-term natural gas import contract with Bolivia that expires later this year.

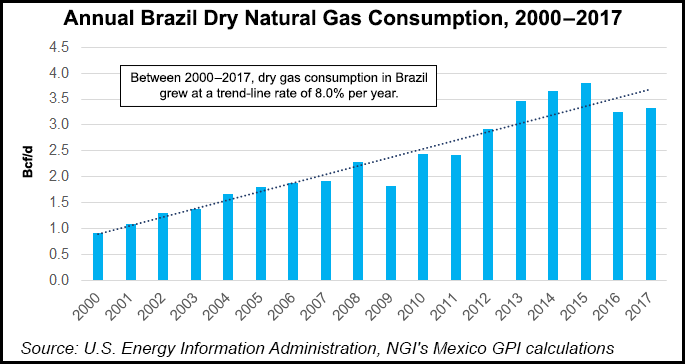

Gas production in Brazil continues to rise on the back of booming oil production in the offshore pre-salt basin, although not all of it reaches the market. The country still needs to import gas via pipeline and liquified natural gas to meet domestic demand. In October, Brazilian production hit 117 million cubic meters/day (MMcm/d), or 4.13 Bcf/d, up 3.7% month/month and 2.1% year/year, according to hydrocarbons regulator Agência Nacional do Petróleo, Gás Natural e BiocombustÃveis (ANP). The country aims to double gas production by 2030.

In a recent report, the International Energy Agency (IEA) said “with domestic supply and demand expected to grow in the coming decades, the prospects for the natural gas industry in Brazil are promising. However, the legal and regulatory frameworks will need to evolve to allow the country to reap the benefits of a competitive gas market.”

The global energy watchdog recommended establishing independent transmission system operators and designing/implementing operational and technical rules based on regulatory policies. In many ways, the process started in Brazil mimics the recent gas changes seen as part of the energy reform in Mexico.

Brazil’s energy planning company Empresa de Pesquisa Energética (EPE) has said developing underground storage could further develop the gas market.

Around 80% of Brazilian gas is extracted offshore, the IEA said, tying it to the rapid development of the pre-salt, one of the fastest growing oil patches globally. The ANP expects oil production in Brazil to double to 5.5 million b/d by 2027 on the back of offshore production. But pre-salt operators in Brazil have expressed concern that they can’t go ahead with associated gas programs because they don’t have access to pipelines and midstream infrastructure. Instead, gas is often reinjected or flared.

The Brazilian energy sector will require investment of about $480 billion by 2027, with the oil and gas industry making up $373 billion of this figure, the country’s new energy minister Bento Albuquerque said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |