E&P | NGI All News Access | Permian Basin

Final Quarter of 2018 Seals Banner Year for Permian-Led M&A

U.S. upstream oil and gas merger and acquisition (M&A) valuations last year rose to their highest level since oil prices fell from their peak in late 2014, clocking in at $84 million as North America’s No. 1 natural gas marketer BP plc and independent Concho Resources Inc. clinched deals that solidified the Permian Basin’s spot as the most active area for deals, according to Drillinginfo.

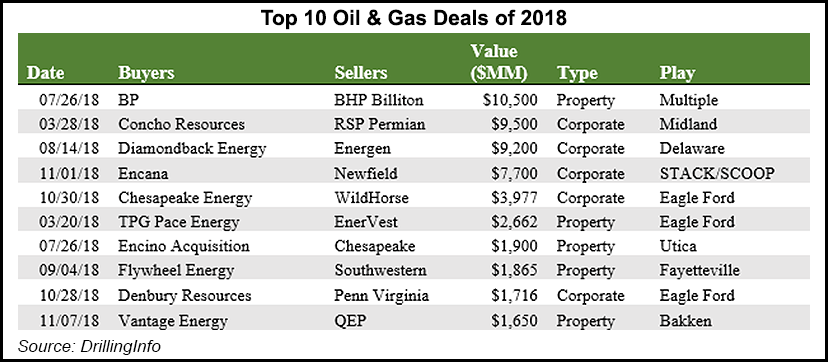

Billion dollar-plus deals fueled the surge in the back half of the year with a record-setting $32 billion in 3Q2018 and $21 billion in 4Q2018. BP’s transformational $10.5 billion buy of most of BHP’s onshore assets was the largest deal of the year and the fourth largest since 2009.

Meanwhile, Concho’s $9.5 million purchase of RSP Permian Inc. created a monster Permian pure play as the independent added nearly 100,000 net acres to its existing leasehold of 500,000-plus net acres. And Diamondback Energy Inc. expanded its Permian position with its $9.2 million acquisition, the third largest, of West Texas-focused Energen Corp.

Drillinginfo completed the Oil and Gas M&A Review and Outlook with its research and database firms PLS Inc. and 1Derrick.

The top 10 deals transacted in 2018 were evenly split between corporate and property deals, although the shift toward corporate-level activity occurred late in the year, accounting for more than 70% of the $21 billion total deal value in the fourth quarter.

“Investors continue to demand that companies deliver a clear line-of-sight to positive free cash flow,” Drillinginfo M&A analyst Andrew Dittmar said.

Scale is “one piece of the puzzle” on how to get there given efficiencies in developing larger acreage blocks, optimizing supply chain logistics to lower costs and general and administrative expense savings. “Wall Street no longer supports growth for growth sakes and is ready to punish buyers who do deals without a clear profit strategy,” Dittmar said.

The shift toward corporate-level M&A late in 2018 also cut into the share of deal activity by private equities (PE). After hitting a high-water mark in 4Q2017 by taking the buyer role in 46% of deals, PE’s share of acquisitions fell to only 7% in 4Q2018. PE wasn’t overly active as a seller in 4Q2018 either, accounting for only 4% of sold deals by value versus 23% in 4Q2017, according to the research.

Private and institutional capital is still highly active in the upstream business and playing an important role, Drillinginfo said. PE-backed companies continue to explore emerging areas like the Austin Chalk, which stretches from South Texas into Louisiana, as well as the margins of more established resource plays.

PE capital is also ready to move in when the financial firms see public markets undervaluing assets or when companies are challenged by stockholders, as seen in recent efforts by Elliott Management to improve the performance or buy out QEP Resources Inc.

Another clear theme from 2018, which ran a close tie with 2014 for the most public company consolidations, was the institutionalization of the minerals market, with deal activity growing 100% over 2017 and deal values reaching nearly $3 billion, according to researchers. Buyers crossed all capital sectors from public royalty companies including Kimbell Royalty Partners, institutional players like Ontario Teachers’ Pension Plan, to publicly held exploration and production (E&P) companies like Continental Resources Inc.

Looking forward into 2019, the firm expects the pace of U.S. oil and gas deal markets to remain impacted by West Texas Intermediate (WTI) oil price volatility, which ultimately provides numerous special situation opportunities, particularly for oil equities that have been oversold.

“The straight-line $31 drop in WTI spot oil prices from $76 to $45/bbl from the start of October to just before Christmas coincided with the risk-off appetite that was pervasive across the capital markets,” Drillinginfo’s Brian Lidsky, senior director of market intelligence, said. “U.S. E&P equities responded largely in lock-step with the rapid decline.”

Although global oil demand may slow, “growth remains unabated, and for all intents and purposes has surpassed the 100 million b/d level.” All eyes are on the impact of potentially more reductions in production by the Organization of the Petroleum Exporting Countries, Iran sanctions and the trend of global oil demand, Lidsky said.

Still, it remains to be seen whether the rapid drop in oil prices will affect the closing of 4Q2018’s corporate deals.

Currently, Drillinginfo said there are about $39 billion worth of deals in play in the United States, of which 50% are in the Permian. There are high-quality assets in the marketplace, and “buyers ready to acquire,” researchers said. “The only barrier is bridging the bid/ask price.”

Historically, if the gap has widened, deals often come with contingent payments predicated on a price or asset performance benchmark.

Researchers expect 2019 to bring the launch of numerous noncore asset sales from public E&Ps, with BP likely leading the charge. PE, meanwhile, is likely to reemerge as a key buyer on asset deals with willingness to pay for proved developed producing reserves and take risk on upside.

In addition, leveraged E&Ps are likely to find themselves under continued pressure to take action to improve balance sheets, researchers said, while the markets will reward scale and low-cost leaders, “which translates into richer equity currency for large players to make accretive buys of smaller players.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |