Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Natural Gas Market Shrugs as EIA’s Larger-Than-Expected Withdrawal Seen as Holiday Noise

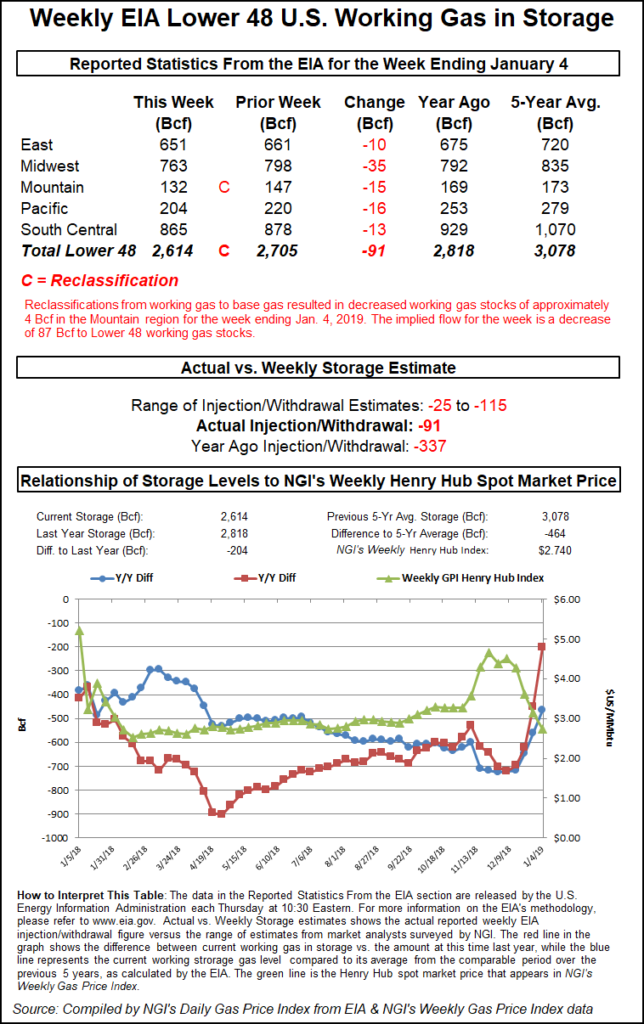

The Energy Information Administration (EIA) on Thursday reported an 87 Bcf withdrawal from U.S. gas stocks for the week ended Jan. 4, a number that fell on the bullish side of expectations but not enough to impress natural gas futures markets.

EIA also reported a 4 Bcf reclassification in the Mountain region that resulted in a net 91 Bcf decrease in inventories for the period.

Perhaps tantalized by the prospect of colder temperatures returning later this month, February Nymex futures had probed above $3.085 earlier Thursday morning before receding to around $3.020-3.030. As EIA’s figure crossed trading screens at 10:30 a.m. ET, the front month briefly popped to as high as $3.066, but by 11 a.m. ET prices had dropped back down to around $2.994, up 1.0 cent from Wednesday’s settle but down from pre-report trading.

Prior to Thursday’s report, major surveys had pointed to a pull in the mid-70s Bcf but with estimates running the gamut from minus 25 Bcf to minus 115 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a withdrawal of 78 Bcf.

The 87 Bcf figure follows last week’s bearish surprise, when EIA reported a meager 20 Bcf pull. While larger than many survey respondents had predicted, 87 Bcf still pales in comparison to the massive pull recorded around this time last year.

A year ago, EIA reported a record-setting 359 Bcf withdrawal for the week ended Jan. 5, 2018, a period that saw intense cold drive huge price spikes along the East Coast. The five-year average for the period is a withdrawal of 187 Bcf, according to EIA.

Bespoke Weather Services said this week’s figure came in 12 Bcf tighter than its estimate for a 75 Bcf pull.

“We see this as more week-to-week noise with this EIA data following a miniscule storage pull last week that surprised,” Bespoke said. “This storage number appears to be an implicit revision during this noisy holiday period, and accordingly should not be read into too much. However, the production dip observed last week that has carried over into this week has certainly played a role, and with balances tightening up here this print can add support moving forward with any colder weather trends.”

Total Lower 48 working gas in underground storage stood at 2,614 Bcf as of Jan. 4, 204 Bcf (7.2%) below year-ago levels and 464 (15.1%) below the five-year average, according to EIA.

By region, the largest withdrawal came in the Midwest at 35 Bcf, while the East withdrew 10 Bcf for the week. In the Pacific, 16 Bcf was withdrawn, while 13 Bcf was pulled from South Central stocks, including a 19 Bcf withdrawal from nonsalt that offset a 6 Bcf injection into salt caverns.

EIA reported an 11 Bcf withdrawal in the Mountain region, with a net 15 Bcf decrease in regional stocks for the week after the reclassification of 4 Bcf from working gas to base gas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |