Models Differ on Timing of January Cold as Natural Gas Futures Range-Bound

Varying outcomes from weather models for the final third of January accompanied a day of range-bound trading for natural gas futures Wednesday. Physical prices strengthened across the East Coast with wintry conditions moving in this week following recent mild temperatures; the NGI Spot Gas National Avg. added 30.0 cents to $3.155/MMBtu.

The February Nymex futures contract settled at $2.984 Wednesday, up 1.7 cents after probing above the $3 threshold around midday. The March contract settled 0.5 cents higher at $2.840.

European weather data released Wednesday afternoon trended slightly colder for the 15-day outlook period but came in milder compared to the Global Forecast System (GFS) on the potential for colder temperatures to hit the Lower 48 starting around Jan. 20, according to NatGasWeather.

As of Wednesday, the European model was “still not nearly as cold as the GFS model Jan. 20-23, but it does finally tease much colder air” moving in around Jan. 23, “suggesting if the model run went out a little further in time it would show colder air arriving into the U.S.,” NatGasWeather said. “Overall, the European model took a step” toward a more bullish setup but showed cold arriving a couple days later than its GFS counterpart.

“The markets will be watching to see if the European model trends further colder overnight or if the GFS model is too cold Jan. 20-24 and backs off some,” the forecaster said.

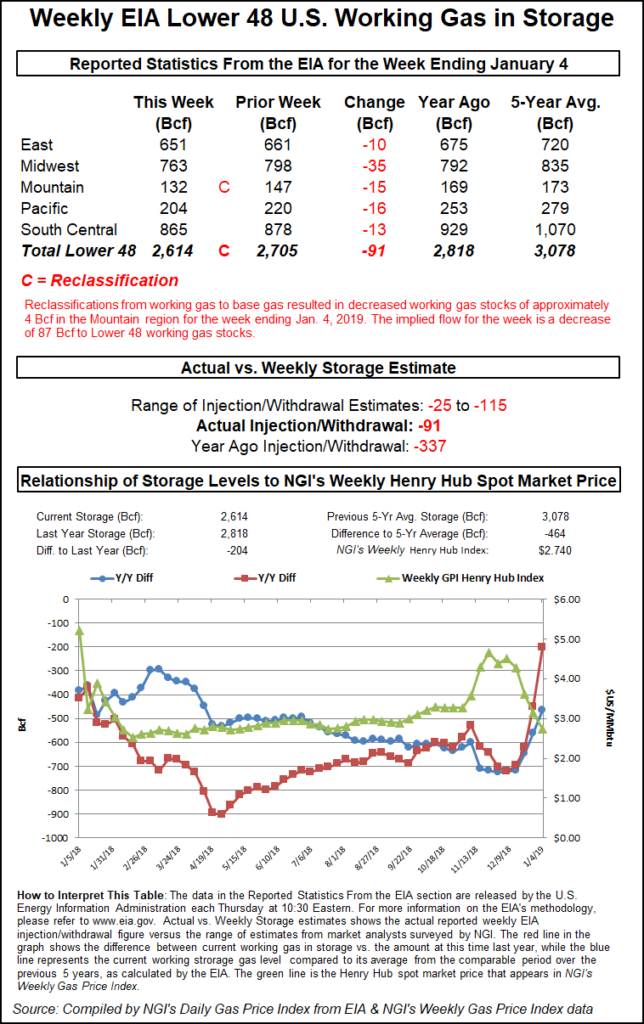

Meanwhile, estimates for this week’s Energy Information Administration (EIA) storage report as of Wednesday were pointing to a double-digit withdrawal for the week ended Jan. 4, which would pale in comparison to the massive pull recorded around this time last year.

A Bloomberg survey of market participants as of Wednesday afternoon showed a median estimate for a 72 Bcf withdrawal, with predictions ranging from minus 25 Bcf to minus 100 Bcf. A Reuters survey pointed to a 76 Bcf pull, with a range of estimates from minus 50 Bcf to minus 115 Bcf.

A year ago, EIA reported a record-setting 359 Bcf withdrawal for the week ended Jan. 5, 2018, a period that saw intense cold drive huge price spikes along the East Coast.

Based on available EIA historical data, the five-year average for the period is a withdrawal of 182 Bcf. As of Wednesday afternoon, EIA had not updated its calculations to show historical comparisons for storage weeks in 2019.

IAF Advisors analyst Kyle Cooper called for an 86 Bcf pull for this week’s report, while Bespoke Weather Services was anticipating a 75 Bcf withdrawal. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at a withdrawal of 78 Bcf.

Last week, EIA reported a deficit-shrinking 20 Bcf withdrawal for the period ended Dec. 28 that surprised to the bearish side of most estimates. As of last week’s report, total Lower 48 working gas in underground storage stood at 2,705 Bcf, down 14.3% from year-ago stocks and 17.2% below the five-year average.

The warm temperatures in December and to start January have created such a “substantial inventory cushion” that it would take a “severe and sustained cold spell” to drive significantly higher gas prices this winter, according to Energy Aspects. The firm estimated it would take an additional 350 Bcf of demand returning to its balances, which as of last week’s EIA report pegged end-December storage at 2.68 Tcf, up from an earlier estimate of 2.57 Tcf issued on Dec. 20.

The firm said that based on recent forecasts for January, “another 250 Bcf or so would be lost in demand versus our projections based on 10-year normal weather. That is a substantial shift in just two weeks, with the likelihood for the staggering year/year storage deficit that has characterized balances to be nearly erased by the end of January” if more cold does not materialize this month.

As of late last week, the firm’s end-March inventory estimate totaled more than 1.55 Tcf, enough to remove “most scarcity concerns” barring a shift to much colder temperatures.

Morningstar Commodities Research analyst Matthew Hong said storage levels are likely to remain top-of-mind for natural gas markets moving forward in 2019, citing two key reasons.

“First, the low inventory levels bring risks for the market as the Lower 48 enter the typical high-demand months of January and February,” Hong said. “Recent milder temperatures provided some wiggle room, but if the weather trends to the colder side, supplies could become exceptionally tight. Second, questions remain about the ability of the market to inject enough natural gas into storage in time to meet summer demand.”

Coal retirements and an increase in natural gas-fired generation point to higher gas demand in 2019, a trend that “changes the market’s perception about the role of storage in pricing,” the analyst said. “If prices fail to react in the high-demand months of January and February at current inventory levels, this may be a sign that the market is confident that natural gas production will continue to be strong.”

Wintry Prices Return To East

Forecasts showing colder conditions moving in along the populated East Coast over the next few days helped drive sharp price increases for some locations in the Northeast, Southeast and Appalachia Wednesday.

Typically volatile points in pipeline-constrained New England led the charge higher. Algonquin Citygate roughly doubled its average, picking up $3.245 to $6.600.

“A rapidly intensifying low pressure system is currently spreading moderate to locally heavy snow across parts of northern Maine,” the National Weather Service (NWS) said Wednesday. “This low is forecast to quickly move away into southeastern Canada” Wednesday night, “ending the snow across northern New England. Cold air will then usher into the Northeast under blustery northwesterly winds behind the system.”

Radiant Solutions was calling for below-normal temperatures to set in along the East Coast by Friday and continue through the weekend, including lows in the teens and 20s in Boston and in the uppers 20s to 30s further south in cities including Washington, DC, and Atlanta.

Transco Zone 5 shot up $2.075 Wednesday to average $5.300, while in Appalachia, Texas Eastern M-3, Delivery jumped $1.860 to $4.845.

Price moves were generally moderate through the middle third of the country, resulting in small adjustments to regional averages across Texas, Louisiana, the Midwest and the Midcontinent.

A number of locations further West posted larger declines. Malin fell 14.5 cents to $3.005, while SoCal Border Avg. gave up 15.5 cents to $3.045.

“After being impacted by a series of energetic weather systems, the Pacific Northwest will get a break in the active weather on Friday,” the NWS said. “In the meantime, mountain snow and coastal rain will continue” through Wednesday night across the region “before gradually tapering off on Thursday. California will also see the rain ending on Thursday, but more rain ahead of another Pacific front is expected to reach the coast later on Friday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |