NGI The Weekly Gas Market Report | LNG | Markets | NGI All News Access

Europe on Tap to Absorb Surplus LNG in Record 2019

Europe, specifically the northwest part of the continent, will have to absorb the surplus liquefied natural gas (LNG) supplies expected to hit the market this year as an economic slowdown, a more thoughtful approach on coal-to-gas switching and increased domestic infrastructure availability will lead to slower demand in China, according to Wood Mackenzie.

Chinese demand for LNG will still grow at around 20%, by far the largest source of LNG demand growth in the global market, but that growth will be a far cry from the 40-45% growth seen in 2017 and 2018, Wood Mackenzie said.

Beijing, however, announced a series of gas policies in 2018 aimed at relieving supply tightness and import dependency.

“In 2019, there will be more clarity on the level of ambition of Chinese domestic supply growth and the ramp-up of Power of Siberia. We are bullish about both and the competition they will provide for LNG growth potential post-2020,” Wood Mackenzie research director Giles Farrer said.

Coal-to-gas switching in China and recent coal power retrials in Europe have provided headroom for gas demand growth. But Europe needs additional imports and flexibility, given its increased reliance on maxed-out Russian and Norwegian imports, the firm said.

“While there will be more LNG imports than required, providing competition to pipe imports and putting pressure on prices, we think this will unlikely bring the level of oversupply that some fear,” Farrer said, noting that Europe will need to ramp up demand during the summer especially.

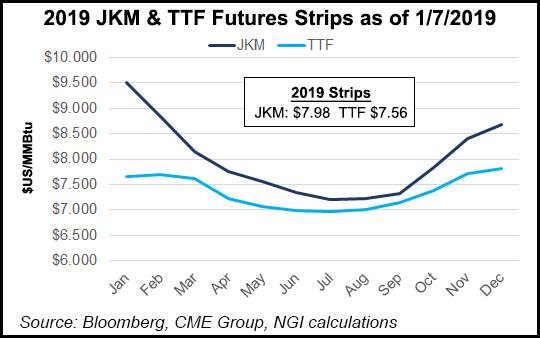

Wood Mackenzie’s forecast for 2019 is for title transfer facility (TTF) to average U.S.$6.90/MMBtu (from $8/MMBtu in 2018) and Asian LNG spot prices to average U.S.$8.50/MMBtu (from $10.30/MMBtu in 2018) assuming normal weather patterns. But weather is something the consultant group will watch closely in 1Q2019 as a mild end to winter could send more LNG into Europe and drive prices down further.

Elsewhere around the world, a new electricity plan is expected to be introduced in South Korea this year, which may push further the adoption of higher taxes on imported coal and make the restrictions that were imposed on old coal plants last year more onerous, according to Wood Mackenzie.

In Japan, the government could scrutinize more heavily the 8 gigawatts (GW) of coal under construction and the 8 GW at the planning stage, after most of the country’s financial institutions toughened their lending criteria for new coal projects, the firm said. Meanwhile, in India, the National Clean Air Action Plan is aiming to reduce Particulate Matter 10 and 2.5 concentrations by 20% to 30% over the next five years.

“If it is rigorously implemented, it could force the shut down of old polluting coal plants,” Farrer said.

And in Germany, the Coal Commission on Feb. 1 is set to publish its recommendations on the timing of a coal phase-out. A leaked document suggests the initial phase-out could start as early as 2022, according to Wood Mackenzie.

The consultant already forecast declining coal usage in these countries. “But the scale of what is at stake in those decisions could well exceed our assumptions,” Farrer said.

Still, coal demand is growing in some regions because of its affordability and availability. India is forecast to see the largest increase of any country, although the rate of growth, at 3.9%/year, is slowing, according to the International Energy Agency. Coal in China still accounts for 14% of global primary energy, the largest in the world, but efforts to clean the air should constrain coal demand going forward.

In Ukraine, the transit and supply contract between Russia’s Gazprom and state-owned oil company Naftogaz Ukrainy is due to expire at the end of 2019, at which time Wood Mackenzie expects to have more clarity on the commercial terms for Russian gas transiting Ukraine in the early 2020s. A new commercial agreement is the most likely outcome, Farrer said.

“But relationships between Ukraine and Russia remain fraught, and a no-Ukraine transit scenario cannot be ruled out. Should that happen, Europe would be at risk of supply disruption in 2020, rather than oversupply.”

This year is expected to be a record one for project sanctions, with the amount of capacity likely to take final investment decisions (FID) tripling the 21 million metric tons/year (mmty) in capacity that was sanctioned in 2018, according to Wood Mackenzie.

Frontrunners in the race to hit FID include three in the United States, including Sabine Pass Train 6 in Louisiana, Golden Pass in Sabine Pass, TX, and Calcasieu Pass in Cameron Parish, LA. The small Woodfibre project in Canada may also get the green light in 2019.

“Other projects in the United States, Qatar, Papua New Guinea, Australia and Nigeria are targeting FID in 2019 too, providing upside to our already bullish view,” Farrer said.

However, following eight years of global economic growth, economists agree a downturn is simply a matter of when and how deep. A recession would bring gas/LNG demand and oil prices down, delay FIDs and push the global LNG market back a few years, according to Wood Mackenzie.

But there could be a worse scenario for the gas market: a major economic downturn happening in 2020 or 2021, just after 60-100 mmty of LNG has taken FID. “That would wipe out our forecast price recovery post-2020 and make our forecast that prices soften a little around 2025 look a lot worse,” Farrer said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |