NGI All News Access | E&P | Infrastructure

U.S. Natural Gas Rig Count Flat but Oil Drilling Drops, Says BHGE

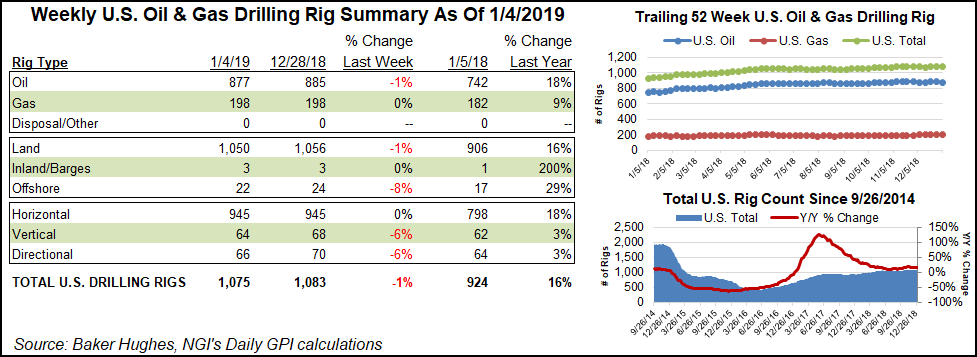

The U.S. natural gas patch held steady at 198 rigs for the week ended Friday (Jan. 4) as a pullback in oil-focused activity paced an overall decline in domestic drilling activity, according to data from Baker Hughes, a GE Company.

The U.S. rig count fell eight units — all oil-directed — to end the week at 1,075, 151 units ahead of the 924 rigs running in the year-ago period. Four directional units packed up shop in the United States, joined by four vertical units. Six of the rigs that exited the patch for the week were on land, with two units departing the Gulf of Mexico, according to BHGE.

Canada added six rigs — five oil-directed, one gas-directed — for the week to finish at 76 units, breaking a stretch of steep losses going back to November. At this time last year, Canada was running 174 rigs. The combined North American rig count ended the week at 1,151, up from 1,098 rigs a year ago.

Drilling counts held steady across the major basins in the U.S. onshore for the week. The Permian Basin added one rig to grow its tally to 487, versus 400 a year ago. The Denver Julesburg-Niobrara also added one rig, finishing at 31 total units, up from 26 at this time last year.

Among states, California saw a large chunk of its active rigs exit the patch during the week, falling five units to finish with 10, down four year/year. Louisiana saw two rigs pack up shop for the week, while New Mexico and Wyoming each dropped one rig. Alaska and Texas each picked up two rigs, while Colorado added one.

The oil drilling declines for the week follow what has been a rough stretch for crude oil prices. As of Friday afternoon on the East Coast, February New York Mercantile Exchange West Texas Intermediate futures had climbed to around $48/bbl. During the broader economic uncertainty that roiled markets on Christmas Eve, crude futures dipped below $43/bbl, a sharp contrast from prices north of $75/bbl back in October.

Upstream oil and gas employment in Texas, home to the Eagle Ford Shale, a chunk of the Haynesville Shale and most of the Permian, is showing signs of wear, with jobs down by 500 in November from October, ending a 23-month consecutive gain.

According to the Texas Workforce Commission, 247,700 people were employed in the state’s upstream sector during November. Jobs had gained for almost two years straight, driven by sharp activity in the Permian, but they still haven’t attained the level they were in December 2014 of 308,900.

The general direction of oil and gas jobs — and enthusiasm by the energy industry — appears to be waning a bit.

According to the Dallas Fed Energy Survey of oil and gas executives in December, growth in energy sector activity slowed significantly in 4Q2018. The regional Federal Reserve Board survey measures conditions facing Eleventh District energy firms in Texas, southern New Mexico and northern Louisiana. Data were collected Dec. 12–20, and 167 energy firms responded, including 104 exploration and production (E&P) firms and 63 were oilfield services (OFS) firms.

The OFS employment index fell sequentially by almost half from 31.7 to 17.5, while the hours worked index for OFS also dropped, from 41.0 to 19.4.

“The declines were smaller for E&P firms as the employment index moved down from 17.4 to 11.5, and the hours worked index fell from 12.8 to 7.7,” Dallas Fed researchers said. “The aggregate wages and benefits index advanced from 23.5 to 32.9.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |