NGI Mexico GPI | E&P | NGI All News Access

Amid Challenges, Majors Digging in at Argentina’s Vaca Muerta

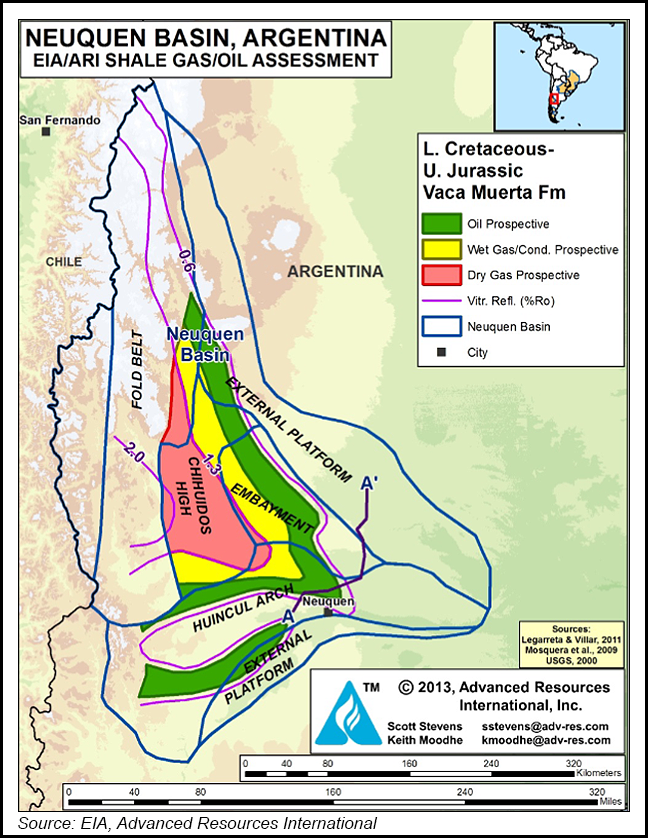

Royal Dutch Shell plc joined the list of companies announcing big plans for Argentina with the decision to begin full-scale development at the Sierras Blancas, Cruz de Lorena and Coirón Amargo Sur Oeste blocks in the Vaca Muerta deposit in Neuquén province.

“Vaca Muerta occupies an important part of our unconventional global portfolio,” Shell upstream director Andy Brown said. “We see significant potential for long-term growth.”

The first development stage would include bolstering infrastructure to increase Shell’s installed processing capacity in Vaca Muerta to 40,000 boe/d, from 12,000 boe/d. Shell is aiming to reach 70,000 boe/d at the three blocks by 2025.

“Preliminary results of early production at our Vaca Muerta pilot projects were positive and compare well with our other unconventional areas globally,” said Shell Argentina President Sean Rooney.

The news comes as other Big Oil companies also ramp up their Vaca Muerta activity. In December, Malaysia’s state-owned Petroliam Nasional Berhad, i.e. Petronas, announced a $2.3 billion joint venture with Argentina’s national oil company YPF SA in a bid to produce 60,000 boe/d by 2022.

YPF is planning a capital expenditure (capex) budget of $4-5 billion over the next four years, with plans to operate 18 rigs and drill 1,700 shale wells in Vaca Muerta through 2023.

Others with stakes in Vaca Muerta include BP plc, ExxonMobil Corp., Chevron Corp., Equinor ASA (formerly Statoil ASA), Total SA, and Qatar Petroleum, the no. 1 natural gas exporter in the world.

Rystad Energy researchers have said “several gas-rich areas in the play already compete with the best U.S. shale gas reservoirs.” They pointed to YPF’s performance in the El Orejano area, Argentina-based Tecpetrol’s wells in Fortin De Piedra, as well as BP’s and Total’s results in Aguada Pichana, which “all exhibit gas well productivity on par with the core areas of the Utica, Haynesville and Marcellus shale basins in the U.S.”

Challenges Persist

Despite increased activity, numerous political, economic, and infrastructure challenges threaten to slow development.

In late December, Argentina Energy Secretary Javier Iguacel was forced out after six months on the job. A champion of Vaca Muerta, Iguacel’s position had been demoted in September when President Mauricio Macri folded the energy ministry into the finance ministry, part of austerity measures tied to a $50 billion International Monetary Fund (IMF) loan to stabilize the nation’s sputtering economy.

The austerity plan includes reducing natural gas subsidies that have helped propel exploration and production.

“A series of measures are being taken to change the natural gas subsidy program because they are incompatible with the IMF loan and the macroeconomy of the country,” consultant Gerardo Rabinovich of the Mosconi energy institute in Buenos Aires told NGI’s Mexico GPI. “To incentivize shale in Vaca Muerta, the wellhead price was set at $7.50/MMBtu, which would drop to $6/MMBtu by 2020, but this has proven unsustainable, so the government is reordering the system. They will cap volumes on existing subsidies, and they are also limiting new subsidies.”

Rabinovich thinks this has the potential to impact gas production, given infrastructure and other constraints in Western Argentina.

“Production costs are dropping in Vaca Muerta, but Argentina has problems that don’t exist in other countries, principally infrastructure to get the hydrocarbons to market, supplies at the wells, labor issues and access to cheap financing. So we have seen improvements in efficiency, but the road is long, and it’s not easy.”

Argentina produced 4.66 Bcf/d in October, up 7% annually, giving the country sufficient excess gas to begin exports to neighboring Chile. YPF, meanwhile, expects Argentina to start exporting LNG in the second quarter via a barge-based floating LNG liquefaction unit (FLNG) provided by Belgian shipping company Exmar.

Before Iguacel left office, he said he believed Argentina could double gas production by 2023, making it a large-scale exporter of LNG.

“We are seeing a lot more investment, the resource is there, and it’s a very good resource: Vaca Muerta is a reality,” Rabinovich said. “But it remains subject to the international oil price, the economy of the country, and the state of infrastructure…I think doubling production by 2023 is excessively optimistic.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |