Natural Gas Futures Take Hit as ‘Extremely Loose’ EIA Storage Number Surprises Market

The Energy Information Administration (EIA) on Friday reported a 20 Bcf withdrawal from natural gas stocks for the week ended Dec. 28, sharply to the bearish side of expectations for what already figured to be a lighter-than-normal pull.

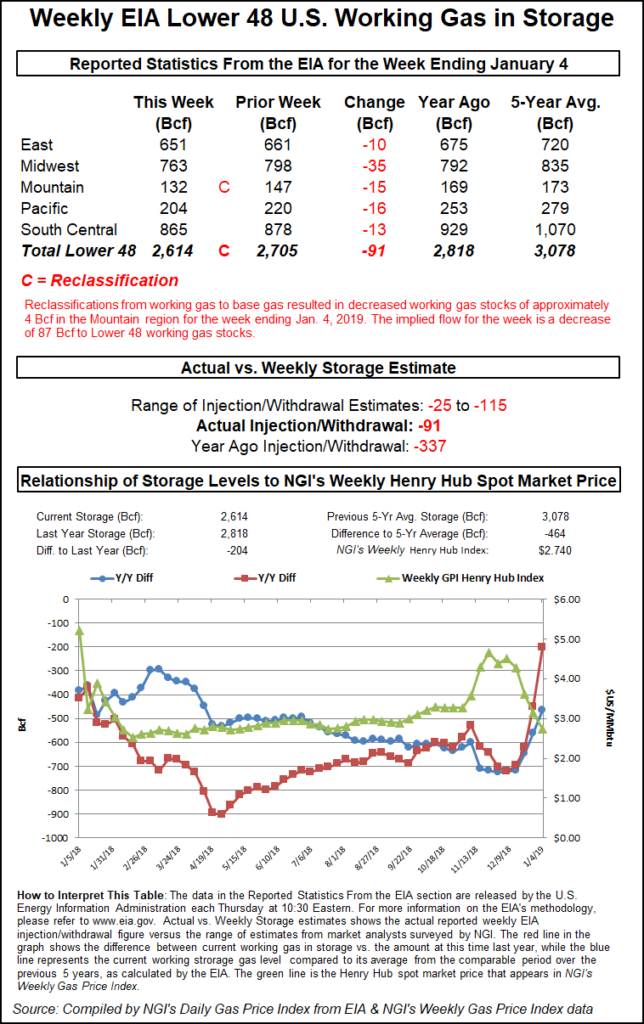

The report, released a day later than usual because of the New Year’s holiday, initially had a relatively muted impact on Nymex futures, despite the 20 Bcf withdrawal coming in much lighter than estimates and the year-ago and five-year-average comparables. Last year, EIA recorded a 193 Bcf withdrawal for the period, and the five-year average is a pull of 107 Bcf.

Bolstered by the prospect of colder temperatures returning to key markets later this month, the February contract had ventured above $3 earlier Friday morning. As the lighter-than-expected withdrawal popped up on trading screens at 10:30 a.m. ET, the prompt month dropped from around $2.980-2.990 down to around $2.955, with some trades as low as $2.917. By 11 a.m. ET, February was trading around $2.973, up about 3 cents from Thursday’s settle but down a few pennies from the pre-report trade.

Estimates ahead of the report pointed to a light withdrawal, but few market participants had pegged a pull as light as the actual number. Responses to major surveys had clustered around minus 44 Bcf to minus 47 Bcf, with estimates ranging from minus 25 Bcf to minus 92 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Thursday at a 33 Bcf pull.

“While we had seen bearish risks with this print, the actual number was a very bearish surprise,” said Bespoke Weather Services, which had predicted a 42 Bcf withdrawal. “As has been the case of late, almost the entire surprise was in the South Central, where we saw a 22 Bcf injection in salts and only a 2 Bcf withdrawal in nonsalts. Wind was elevated and demand minimal over a holiday week, and holiday demand destruction can explain away some of this incredible looseness.

“We did observe the loosest weather-adjusted burns of the year with production near highs, and data is beginning to tighten up, but this is still an extremely loose EIA number that advertises we need significant cold in order for prices to stabilize and bounce. A sustained move above $3 can come with enough cold, but it is harder now.”

The 20 Bcf withdrawal for the week made a big dent in the hefty year-on-year and year-on-five-year deficits. Total Lower 48 working gas in underground storage stood at 2,705 Bcf as of Dec. 28, 450 Bcf (14.3%) below last year’s stocks and 560 Bcf (17.2%) lower than the five-year average.

By region, EIA reported 20 Bcf build in the South Central that caught a number of market observers by surprise, including a 22 Bcf build into salt stocks. EIA reported the largest weekly withdrawal in the Midwest region at 20 Bcf, followed by the East, which withdrew 15 Bcf for the week. The Mountain and Pacific regions each withdrew 3 Bcf, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |