Mild January Forecast Brings Bears Out of Hibernation as Natural Gas Futures, Spot Prices Under Pressure

Forecasts showing overall mild conditions through mid-January continued to pressure natural gas futures lower Thursday as traders looked ahead to another potentially bearish government storage report. In the spot market, expectations for Lower 48 weather-driven demand to ease into next week accompanied declines across most regions; the NGI Spot Gas National Avg. slid 11.5 cents to $2.690/MMBtu.

With the market seemingly sapped of all the volatility it had flashed earlier in the winter, February Nymex futures settled 1.3 cents lower at $2.945 Thursday after probing as high as $3.011 and as low as $2.878. March fell 1.7 cents to settle at $2.812.

As of midday Thursday, weather models continued to suggest the next opportunity for “more intimidating cold fronts” to reach key markets in the northern and eastern United States won’t be until at least Jan. 15-20, and even then models have more to prove, according to NatGasWeather.

“As such, bearish weather sentiment continues as prices continue to lose ground,” the forecaster said. “There will still be weather systems and associated cold shots sweeping across the country in the coming weeks, just not widespread or sustained.

“…No change bigger picture as a rather bearish pattern is expected into mid-January, rapidly improving deficits in supplies from 720 Bcf toward 400 Bcf. There will be a little stronger demand Jan. 13-15, but not widespread enough with sub-freezing temperatures to impress. Cold will need to show up during the second half of January or further improvements in deficits should be expected.”

Estimates this week suggest the Energy Information Administration (EIA) will report another light withdrawal from gas stocks Friday. The report, scheduled for release a day later than usual because of the New Year’s holiday, covers the week ended Dec. 28. Given recent mild temperatures, this week’s number could look particularly bearish compared to a year-ago period that saw the onset of a potent cold spell.

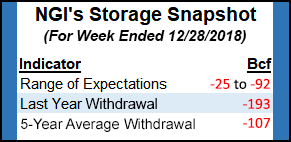

As of Thursday afternoon, a Bloomberg survey of eight market participants showed estimates clustering around a median withdrawal of 44 Bcf, with estimates generally ranging from minus 31 Bcf to minus 75 Bcf. A Reuters survey pointed to a withdrawal of 47 Bcf. That was based on a wide range of responses, from minus 25 Bcf to minus 92 Bcf.

IAF Advisors analyst Kyle Cooper called for a 31 Bcf withdrawal for this week’s report, while EBW Analytics Group predicted a 36 Bcf pull. Bespoke Weather Services was calling for a 44 Bcf withdrawal, while Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a 33 Bcf pull.

For the week ended Dec. 21, EIA reported a 48 Bcf withdrawal, leaving inventories at 2,725 Bcf, 623 Bcf less than the year-ago period and 647 Bcf below the five-year average.

Forecasts have missed the mark this winter, first with November surprising to the cold side and then December (and potentially January) missing to the warm side of expectations, according to EBW CEO Andy Weissman.

The magnitude of these recent misses could have broader implications.

“The cause is increasingly clear: climate change is wreaking havoc with the atmosphere and the ocean,” Weissman said. “The temperature gradient between the Arctic and lower latitudes has fallen sharply, altering the flow of the jet stream, and oceans have become much warmer. As a result, the European and American super-models, which of necessity are the starting point for all forecasts, are no longer accurately predicting how the atmosphere will behave.

“In assessing the direction in which gas prices will move next, therefore, it is necessary to anticipate the potential for extreme, unpredictable weather and examine a broad range of scenarios,” he said. “Further, while both extreme heat and extreme cold (as occurred in April and November) are possible, the overall pattern is for temperatures to more often than not trend much warmer than expected. If this continues to occur this winter, gas prices could drop significantly further — not just this winter but for most of 2019.”

HDD Outlook ”Keeps Turning Bearish’

Coming off widespread heavy losses as spot traders returned to action following the New Year’s holiday, physical markets continued to slide Thursday amid calls for mild conditions to dominate the Lower 48. Henry Hub dropped 10.5 cents to $2.685.

The near-term natural gas demand outlook “keeps turning bearish,” according to Genscape Inc. The firm’s meteorologists on Thursday were calling for Lower 48 population-weighted heating degree days (HDD) to see consecutive daily declines through early next week. The 150 HDDs projected for Tuesday would come in nearly 87 HDDs, or 37%, below normal for this time of year.

Genscape senior natural gas analyst Rick Margolin said the firm’s daily supply and demand models as of Thursday showed demand averaging 83.9 Bcf/d over the next seven days.

“While this will be a slight increase over the last seven-day average due to the Christmas/New Year’s break, it will be about 20 Bcf/d less than the demand average during the same time last year and the three-year average,” Margolin said.

Margolin did note a “cold-weather system stretching from the Pacific Coast over the Rockies and into the Midwest” that led a number of major pipelines in those regions to issue weather-related alerts to customers this week.

“But that system is expected to quickly depart, which is pushing the seven-day forecast for each of those three regions below their recent seven-day averages,” the analyst said. “Those declines will only be moderately” offset by a “return to post-holiday normal levels” in the East and South Central regions.

Points throughout the Midwest and Midcontinent tumbled by 10-20 cents Thursday. Northern Border Ventura shed 16.5 cents to $2.410.

In the Northeast, Algonquin Citygate dropped 25.5 cents to $2.710, while further south, Transco Zone 5 slid 11.0 cents to $2.665.

The outlook for January temperatures has taken a turn for the mild, but the prospect of a repeat of last year’s East Coast price spikes still could have implications for liquefied natural gas sendout at Dominion Energy’s Cove Point LNG facility, according to analysts with global consulting firm Energy Aspects. Through the first three weeks of December, Cove Point was taking 0.75 Bcf/d of feedgas, consistent with the volumes flowing to the facility since the start of the heating season on Nov. 1, the firm said.

“It remains to be seen how flows to Cove Point will react to a true cold-weather event,” the firm said, noting the exorbitant price spikes in the Northeast and Mid-Atlantic during last January’s cold snap.

Cove Point offtakers GAIL (India) Ltd. and Sumitomo Corp. both have firm purchase agreements with Appalachian producers for close to 0.3 Bcf/d each, according to Energy Aspects.

“As such, both have supply that could be sold into the Transco Zone 5 hub when global arbs close,” the firm said. “With Transco Zone 5 cash prices having the potential to peak significantly over the rest of the winter, netbacks could be higher selling gas into Transco Zone 5 than exporting gas as LNG.”

Mid-Atlantic spot prices just above $6 in early December were likely “not enough to entice either offtaker” to curb exports and sell into the North American physical market “given around $3.50/MMBtu liquefaction and shipping costs to Asia. Delivered LNG prices in India and Japan remained above $10/MMBtu for peak winter contracts through November” and were still above $9/MMBtu for February 2019 as of Dec. 20.

A number of West Coast points continued to trade at a premium to Henry Hub Thursday as forecasts were calling for storms in the region. In the Pacific Northwest, Northwest Sumas tacked on 14.0 cents to average $3.750.

“An area of weakening upper-level energy just off the Northwest coast will move inland to Ontario by Saturday morning,” the National Weather Service said Thursday. “A second area of upper-level energy will move onshore over California on Saturday morning into afternoon. The system will produce rain and higher elevation snow over parts of the Pacific Northwest, with snow extending into part of the northern Rockies that will wane overnight Friday.

“As the second area of upper-level energy moves onshore, rain and higher elevation snow will move into California on Saturday morning into evening. Likewise, rain and higher elevation snow will return to the Northwest on Saturday.”

North of the Canadian border, Westcoast Station 2 picked up 20.0 cents to $1.575.

“An unplanned outage requiring repairs at the McMahon Plant in northern British Columbia could cut as much as 500 MMcf/d of production flowing onto Westcoast,” Genscape analyst Joe Bernardi told clients Thursday, citing a notice posted earlier in the week. “As a result, Westcoast asked shippers to decrease production nominations to accommodate these repairs. Westcoast’s ”McMahon Plant’ location had averaged 537 MMcf/d in the previous month, although it had declined to the 400-500 MMcf/d range over the last week.

“Elsewhere on Westcoast, a planned tool run could cut around 150 MMcf/d of flows into the Vancouver/U.S. Pacific Northwest area,” Bernardi said. “Huntingdon Delivery Area capacity will be limited to 1,199 MMcf/d on Friday (Jan. 4), almost exactly 150 MMcf/d below the previous two-week average of 1,350 MMcf/d…Fairly mild, warmer-than-average temperatures are expected for the Pacific Northwest, which is likely to mitigate any sizeable spike in Sumas basis.”

This is the first of a series of tool runs Westcoast has planned for January, potentially leading to temporary price spikes depending on demand, according to Bernardi.

Meanwhile, in Southern California, SoCal Citygate moderated 99.5 cents to average $6.655 Thursday following a price spike of more than $1 a day earlier.

The elevated prices in Southern California this week come amid a stretch of cooler temperatures in the region and higher demand on the Southern California Gas (SoCalGas) system. This week the utility implemented a voluntary curtailment for electric generation due to the high demand for gas.

SoCalGas total system sendout has recently topped 3.5 Bcf/d for the first time since February 2018, “when extended cold weather led to basis blowouts and last-resort withdrawals from Aliso Canyon,” Bernardi said. “This time around, SoCal Citygate basis prices have rallied, but only modestly compared to previous periods of similar demand.”

As of Thursday, SoCalGas had posted storage withdrawals over 1 Bcf/d four times over the previous seven days, driving a “rapid drop in system-wide inventories,” according to the analyst. “In the past, withdrawals greater than 1 Bcf/d have sometimes been made possible via gas from Aliso Canyon, but the pipe has not yet announced any recent Aliso withdrawals. Genscape meteorologists are forecasting colder-than-average weather in Southern California to continue, although warming up slightly through the end of this week and into this weekend.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |