NGI Mexico GPI | E&P | NGI All News Access

Pemex Upstream Budget Offers Insight into Natural Gas Goals

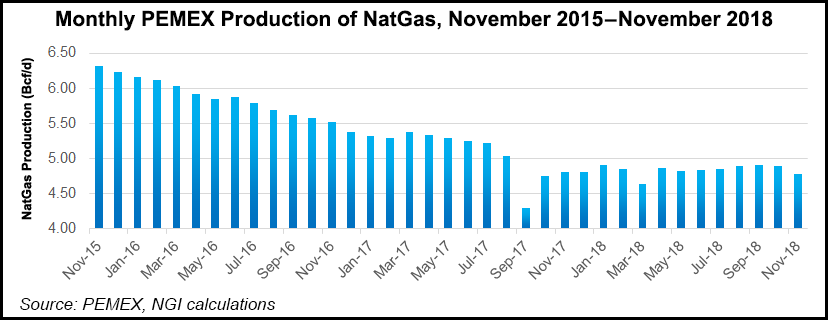

Despite a pledged 50% increase in natural gas output to 5.7 Bcf/d by 2024, the 2019 upstream budget of Petróleos Mexicanos (Pemex) disproportionately prioritizes oil over gas, according to local experts.

The national oil company’s total budget for 2019 is 464.6 billion pesos ($23.7 billion), a 14.1% increase from last year, in line with a campaign pledge by President Andrés Manuel López Obrador to reverse a nearly 15-year decline in hydrocarbon production.

The bulk of the 2019 capital expenditure (capex) budget for upstream subsidiary Pemex Exploración y Producción (PEP) is allocated to mature shallow water oilfields off the southeastern coast, including Ku-Maloob-Zaap (KMZ), Chuc, and Cantarell.

Pemex CEO Octavio Romero Oropeza said last month the increase in gas output would be driven by associated gas from these oilfields, and from a series of new fields that Pemex is developing. According to consultant Luis Miguel Labardini, partner at Mexico City-based energy consultancy Marcos y Asociados, the government should have given higher priority to non-associated gas plays.

“I would have liked to see investment in the two dry gas basins which Mexico has,” acknowledging to NGI’s Mexico GPI they are the Burgos and Tampico Misantla-Veracruz.

The majority of Mexico’s gas reserves are in the Sureste and Tampico-Misantla-Veracruz basins, while most of the prospective gas resources are found in the Burgos and Sabinas-Burro Picachos in the north.

The budget includes 3.35 billion pesos, or about $170 million, for three unconventional pilot projects in Burro-Picachos, Tampico-Misantla and Burgos, despite López Obrador’s vocal opposition to hydraulic fracturing.

The unconventional drilling budget “is not really big,” GMEC energy consultancy founder Gonzalo Monroy told NGI’s Mexico GPI, “but it is good to see Pemex experimenting with the technology.”

Additionally, the budget includes 3.23 billion pesos for the Burgos project, which entails developing 81 fields in the states of Tamaulipas, Nuevo León and Coahuila “through primary exploitation drilling conventional and horizontal wells.”

Another 1.38 billion pesos are allocated to resume activity at the Lakach deepwater gas field, which contains proved and probable resources, i.e. 2P reserves, of close to 1 Tcf. However, Monroy said, Lakach “is still very far from development and eventual production.”

Also featured in the budget is the Ixachi field, which Pemex expects to supply 700 MMcf/d of gas by 2022.

PEP’s capex budget totals 210.3 billion pesos ($10.7 billion), up 25% from the 168.4 billion pesos allocated in 2018.

In this respect, the government appears to have heeded a warning made last year by Juan Carlos Zepeda, former head of upstream regulator Comisión Nacional de Hidrocarburos (CNH), that, “In order to return to a production plateau above 3 million b/d oil and 7 Bcf/d in the next 15 years, Pemex must invest $10-15 billion annually in exploration and production, plus $10 billion annually to service its debt; both figures above what Pemex has invested annually in the last 18 years.”

Pemex for November reported crude and natural gas output of 1.72 million b/d and 3.76 Bcf/d, respectively.

The largest amount of upstream capex in 2019 is 51.5 billion pesos allocated for KMZ, Mexico’s largest producing oilfield since 2009, when it overtook neighboring Cantarell. KMZ accounted for 49% of crude output in November, but just 19% of gas production.

Oil output at Cantarell, for which 10 billion pesos of upstream capex has been earmarked, averaged 158,857 b/d in November from a peak of 2.2 million b/d in 2004. Despite the field’s precipitous decline, López Obrador last month offered “a challenge for the petroleum engineers that if we work on recovery at Cantarell, we can still extract oil from this field.”

The second-largest line item on PEP’s budget is 19.6 billion pesos for the Chuc field, part of the Abkatún-Pol-Chuc complex off the southeastern coast, which accounted for 10.7% of crude and 7.7% of gas output in November. Following Chuc in third place is the Campeche Oriente exploration project, for which 16.9 billion pesos have been allocated for light and heavy crude prospects.

The rationale for Pemex focusing on established, oil-heavy plays in the southeast as opposed to natural gas “is that they want crude to be able to… satisfy the demand of the refineries,” Labardini said, referencing López Obrador’s plan to build an $8 billion refinery in Tabasco state and to revamp Pemex’s existing fleet of six refineries.

“Pemex has not invested in gas for the last six, seven years,” Labardini said. “It’s not a departure from what Pemex has been doing. It’s an economic decision. Natural gas is too expensive to produce in Mexico, so it makes sense to import it from the United States.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |