NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Natural Gas Bears Ring in Rocking New Year as February Sheds 70-Plus Cents

The downward trajectory of natural gas continued during the Dec. 27-Jan. 2 period as Old Man Winter remained elusive following an early season appearance, significantly easing concerns about low storage inventories. February forward prices tumbled an average 73 cents, while March dropped an average 53 cents, according to NGI’s Forward Look.

Recent weakness in the natural gas futures and forwards markets has occurred in dramatic fashion as bone-chilling conditions early in the season that lifted the December futures contract to a $4.929 high quickly thawed and sent the January contract rolling off the board at just $3.642. For its part, the February contract dropped roughly 59 cents between Dec. 27 and Jan. 2 to reach $2.958, while March slid about 52 cents to $2.829.

After such a colossal decline, the market may need a breather before taking another leg lower, according to EBW Analytics. The potential for strong technical support at $2.88 could mean the market may be nearing a level that may slow the recent declines, the firm said.

Furthermore, last year’s market behavior stands to be a cautionary tale for market bears getting comfortable in the driver’s seat. The February contract traded at $2.80 on Jan. 5, 2018 before rising sharply to roll off the board at $3.631 later that month. At a high level, natural gas storage will be in roughly the same place year/year by mid-January, according to EBW.

“February 2019 weather is expected to be much colder than February 2018. If substantial freeze-offs occur and February trends colder, potentially significant price increases are not off the table,” EBW CEO Andy Weissman said.

Weather model guidance overnight Wednesday remained mostly unimpressive for the next couple of weeks, with Global Ensemble Forecast System (GEFS) guidance (more commonly known as American guidance) losing a solid number of gas-weighted degree days (GWDD) while Ensemble Prediction System (EPS) guidance (European guidance) added a small number to finally begin to come a bit closer to a consensus, Bespoke Weather Services said.

“We did note that the pattern at the end of the GEFS finally began to look a bit more threatening,” Bespoke chief meteorologist Jacob Meisel said.

A weak positive Pacific North American/negative Eastern Pacific Oscillation pattern upstream may have attempted to combine with a weak negative North Atlantic Oscillation downstream to increase cold risks Week 3 on the American guidance, “even if it had not translated into real GWDDs yet.

“If models continue to trend in this direction, which EPS guidance made slight indications of as well, then we can see the more significant cold in the second half of January we are still watching for,” Meisel said.

Indeed, Weather Decision Technologies’ (WDT) Week 4 preview features normal or below-normal temperatures across the central and eastern United States, with current forecasts suggesting heating demand could increase 15 gas-heating degree days from Week 3 to Week 4 and potentially boost weather-driven gas consumption by 4.8 Bcf/d week/week.

From a meteorological perspective, a major stratospheric warming event is splitting the polar vortex, with one-half expected to settle over Hudson Bay in the next few days. That shift could rapidly deliver colder-than-normal weather over the Northeast into February, according to the firm.

“WDT’s forecast, should it verify, could provide some support to beleaguered natural gas futures rocked by repeated bearish forecast shifts,” Weissman said.

Before then, however, warming “rather easily wins on out” with very significant warmth during the next week, limiting any kind of rally for natural gas prices, Meisel said.

Indeed, January will probably become the third straight month for which forecasts by nearly every weather vendor are likely to prove far off the mark. The cause is increasingly clear, according to EBW. Climate change is wreaking havoc with the atmosphere and the ocean, the firm said. The temperature gradient between the Arctic and lower latitudes has fallen sharply, altering the flow of the jet stream, and oceans have become much warmer.

“As a result, the European and American super models, which of necessity are the starting point for all forecasts, are no longer accurately predicting how the atmosphere will behave,” Weissman said.

Weather aside, all eyes will be on continued production growth this year as recent output appears to have slowed. Several producers including Parsley Energy Inc. and Goodrich Petroleum Corp. have indicated plans to tap the breaks on activity amid lower oil prices (which could lead to lower associated gas output), growing economic concerns and continued fiscal responsibility.

The outlook for the oilfield services (OFS) sector also has become increasingly gloomy, with growth in energy sector activity slowing significantly in the final three months of 2018, according to the quarterly Dallas Fed Energy Survey of oil and gas executives. In fact, OFS pricing could remained squeezed through the middle of the year as Lower 48 producers trim spending plans for 2019, according to analysts.

Recent pipeline flow estimates show roughly 1.0 Bcf/d of increased output in November before flat-to-lower output in December, EBW said.

Meanwhile, potential well freeze-offs during the winter may further dampen high-level monthly production totals. In addition, associated gas infrastructure is insufficient, with recent industry reports suggesting that more than 1.0 Bcf/d may currently be flared in the Bakken Shale and Permian Basin combined, the firm said.

Slowing production growth may limit the extent of downward price pressure during the 2019 injection season. With EBW’s projected output growth in 4Q2018 revised lower by 1.0 Bcf/d, this could reduce the amount of supply to be soaked up by the market during the 2019 injection season.

“While the extent — if any — of winter production freeze-offs remains to be seen, decelerating production growth narrows the potential risk for prices to touch below $2.00 in a bearish 2019 scenario,” Weissman said.

A return to growth is likely as the winter passes, however. “As new infrastructure turns flared gas into usable output and Appalachian producers grow into new takeaway capacity, we expect notable growth to resume by late spring 2019,” he said.

Meanwhile, the recent span of mild weather has market observers looking for current storage deficits to significantly tighten in the weeks ahead. The Energy Information Administration (EIA) reported a 48 Bcf draw that left gas stocks for the week ending Dec. 21 at 2,725 Bcf, 623 Bcf below 2017 levels and 647 Bcf below the five-year average.

NatGasWeather expects those deficits to shrink to around 400 Bcf by mid-January, and EBW said the storage week ending Jan. 18 may show a rare 53 Bcf surplus year/year. “If this verifies, it would constitute a stupefying 775 Bcf shift over a mere six weeks,” the firm said.

The current projections for a cold February and March, however, may lead to a quick return for the year/year storage deficit. It is also possible that even a brief stretch of extremely cold weather could lead to widespread production freeze-offs and tighten the market considerably relative to current expectations, according to EBW.

“But with recent cold forecasts a bust and the recent trend definitively toward warmer weather, the odds that the market will see the first year/year surplus in 25 months appears to be increasing rapidly,” Weissman said.

Market estimates for this week’s EIA storage report for the week ending Dec. 28 called for a withdrawal in the mid- to high 40 Bcf range, which would compare to the five-year average withdrawal of 107 Bcf.

A Bloomberg survey of eight market participants had a withdrawal range of 31 Bcf to 75 Bcf, with a median of 44 Bcf. Bespoke Weather Services called for a 44 Bcf draw, while EBW projected a 36 Bcf pull. A Reuters poll of 20 market participants had a withdrawal range from 25 Bcf to 92 Bcf, with a median of 49 Bcf.

Northeast Leads Steep Declines

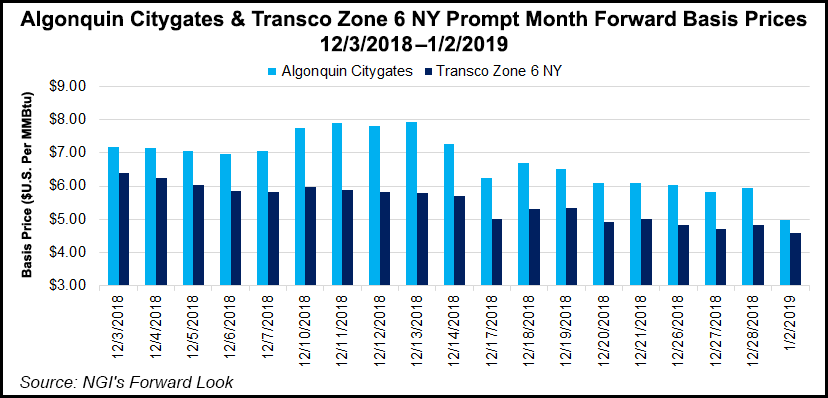

With only brief periods of cold weather to start the new year, and more sustained cold not likely until Jan. 15-20 according to the latest weather outlooks, forward prices continued to plunge. Northeast prices posted the most dramatic losses as chilly conditions on Thursday were expected to quickly warm back above normal Friday and Saturday.

High temperatures were forecast in the 40s and 50s across most of the northern United States, with highs in the 60s and 70s expected across the southern United States, according to NatGasWeather. “There’s still expected to be at least some cooling into portions of the East Jan. 9-10, just not widespread enough to impress, especially when considering conditions over the southern U.S. will be unseasonably comfortable.”

Another weather system was possible across the North and East around Jan. 13-14, although with the weather data inconsistent on how much cold air to expect, the firm said.

On the demand front, Genscape Inc.’s daily supply/demand team projected it would average 83.9 Bcf/d for the upcoming seven days. While this would be a slight increase over the last seven-day average because of the Christmas/New Years break, it would be about 20 Bcf/d less than the demand average during this same time last year and the three-year average, the firm said.

As such, prices along the Transcontinental Gas Pipe Line tumbled more than $1 during the Dec. 27-Jan. 2 period. Transco Zone 6 NY February plunged $1.21 to $7.546, and March dropped 59 cents to $3.433, according to Forward Look.

Algonquin Citygate February was down $1.78 to $7.948, and March was down $1.09 to $5.823.

Appalachia pricing hubs also posted steep declines, although losses were more in line with those seen in Nymex futures. Columbia Gas February slid 61 cents to $2.682, and March fell 54 cents to $2.538.

Meanwhile, a cold-weather system stretching from the Pacific Coast over the Rockies and into the Midwest has prompted numerous pipelines including Colorado Interstate Gas, Kern River Gas Transmission, Northern Border Pipeline, Panhandle Eastern Pipe Line Co., Southern California Gas Co. (SoCalGas) and Southern Star Central Gas Pipeline to issue weather warnings or operational flow orders.

“But that system is expected to quickly depart, which is pushing the seven-day forecast for each of those three regions below their recent seven-day averages. Those declines will only be moderately cancelled out by the East’s and South Central’s return to post-holiday normal levels,” Genscape senior natural gas analyst Rick Margolin said.

Still, the cold weather and elevated demand led to SoCalGas issuinga voluntary electric generation curtailment that went into effect on Wednesday. The pipeline’s system-wide sendout has exceeded 3.5 Bcf/d for the first time since late February 2018, when extended cold weather led to basis blowouts and last-resort withdrawals from Aliso Canyon, according to Genscape. This time around, basis prices have rallied, but only modestly compared to previous periods of similar demand. For example, SoCal Citygate basis hit $4.86 during Wednesday’s trading, a sizeable day/day increase of more than $1.50. “But during the cold snap last February, it reached up to $16.97, shattering the previous record high,” Genscape natural gas analyst Joseph Bernardi said.

SoCalGas has also posted storage withdrawals in excess of 1 Bcf/d four times in the last week, leading to a rapid drop in system-wide inventories. “In the past, withdrawals greater than 1 Bcf/d have sometimes been made possible via gas from Aliso Canyon, but the pipe has not yet announced any recent Aliso withdrawals,” Bernardi said.

Weather outlooks show conditions warming slightly through the end of this week and into this weekend.

Given the brevity of the cold snap, SoCal Citygate February gas tumbled $1.07 from Dec. 27-Jan. 2 to reach $5.698, and March dropped 42 cents to $4.099, Forward Look data show.

Price declines of 50-70 cents were common across Midcontinent forward curves, as well as at Northwest Sumas in the Rockies, where February fell 75 cents from Dec. 27-Jan. 2 to reach $3.455, and March dropped 53 cents to $2.612.

Forward prices, however, could see some upside in the coming weeks as an unplanned outage requiring repairs at the McMahon Plant in northern British Columbia could cut as much as 500 MMcf/d of production flowing onto Westcoast Transmission. A notice posted Wednesday announced that McMahon would go offline by 10 p.m., with the duration of the outage still to be determined.

As a result, Westcoast asked shippers to decrease production nominations to accommodate repairs. Westcoast’s “McMahon Plant” location had averaged 537 MMcf/d in the previous month, although it had declined to the 400-500 MMcf/d range over the last week, according to Genscape.

Elsewhere on Westcoast, a planned tool run could cut about 150 MMcf/d of flows into the Vancouver/U.S. Pacific Northwest area. Huntingdon Delivery Area capacity was to be limited to 1199 MMcf/d on Friday, almost exactly 150 MMcf/d below the previous two-week average of 1,350 MMcf/d in deliveries at the “Total Huntingdon” point, Gencape said.

“Fairly mild, warmer-than-average temperatures are expected for the Pacific Northwest, which is likely to mitigate any sizeable spike in Sumas basis price that might be attributable to this work,” Bernardi said.

This event is the first of several tool runs Westcoast has in store for January, which could lead to transient price spikes depending on demand conditions. The next impactful tool run is currently scheduled for Jan. 12.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |