NGI Weekly Gas Price Index | Markets | NGI All News Access

Mild Christmas Week Temperatures Weigh Down Weekly Prices

Mild weather and light holiday demand combined to send weekly natural gas prices crashing down for the short Dec. 26-27 trading week, with some of the steepest losses occurring in the usually high-priced Northeast. The NGI weekly National Avg. plunged 42.5 cents to $3.07 for gas flowing through New Year’s Eve.

Markets across the United States posted substantial declines as a mostly mild set-up continued across the country during the holiday week. While there were pockets of strong demand due to a storm system moving out of the West and into Texas and the South, most other areas remained mild.

In fact, the storm made for a white Christmas Eve in southern California and brought drenching rain and localized flooding to a large swath of the country’s midsection, but at the same time pumped a warm ridge of high pressure across the eastern United States, according to NatGasWeather. Temperatures of 20-25 degrees above normal were expected to extend from New England to the Gulf Coast, making for lighter-than-normal national demand, the firm said.

“The current mild spell will finally break this weekend as a glancing shot of subfreezing Canadian air sweeps across the northeastern U.S., while milder systems impact the western and south-central U.S,” NatGasWeather said.

Still, with demand coming in below normal this week, prices across the Northeast fell significantly. New England’s Algonquin Citygate plunged $1.505 to $3.485, while Transco Zone 6 NY tumbled 62.5 cents to $3.09.

Appalachia pricing hubs also posted dramatic losses of as much as nearly 60 cents. Similar declines were seen in parts of the Southeast and even extended into south Louisiana, although most decreases there were in the 40-cent range. Benchmark Henry Hub slid 48 cents to $3.14.

Prices across the Midwest and Midcontinent were down mostly 30-40 cents, although OGT and NGPL Midcontinent each posted a whopping drop of more than 80 cents.

In Texas, Houston Ship Channel posted a substantial weekly decline of 75 cents to $2.905, although most other pricing hubs were down around 40 cents or so.

Waha dropped 33.5 cents to $1.33, easily the cheapest gas in the United States and coming in second only to Canada’s Westcoast Station 2, which was flat on the week at Cdn69 cents/GJ.

Futures Sink With Little Cold in Sight

Light holiday trading made for a volatile week for Nymex natural gas futures, despite any significant shift in weather models during that time. The January contract’s expiration added another layer of erratic swings at the front of the curve, as did weather models that so far have yet to reflect a firm timeline for when frigid air could return.

Monday’s action set the tone for the week as the January contract plunged more than 30 cents, although volumes were cut by more than half during the Christmas Eve session. The prompt month began to claw back on Wednesday and then staged a late-session rally on Thursday’s expiration. January rolled off the board at $3.642, while February rose to 3.546.

Several market observers noted that Thursday’s rally was not at all tied to weather, and instead was reflective of market behavior on days of Nymex contract expirations. Bespoke Weather Services said February would struggle to maintains its gains, and Friday’s action proved that theory.

The new prompt month was down nearly 20 cents at the start of trading and remained in negative territory throughout the day as overnight weather models backed off cold both in the near term and in the long range.

Warm changes were seen in the six- to 10-day forecast, especially in the central United States during the mid-period, according to Radiant Solutions. This came with model consistency in the timing and strength of low pressure breaking away from an Alaska trough early on and tracking along the Northern Tier, the firm said.

“This low will enhance downslope winds off of the Rockies, promoting temperatures in the much to near strong above-normal categories at that peak in the North-Central,” Radiant said. Prior to that, however, are below and much below-normal temperatures in the Midcontinent to start the period, with below-normal temperatures lingering into mid-period in Texas.

Meanwhile, overnight weather model guidance continued to warm the long range as well, showing an unfavorable Pacific win out temporarily that would prevent any sustained cold weather from moving down into the East, according to Bespoke.

Tropical forcing has trended slower as it continues to favor a positive Western Pacific Oscillation/Eastern Pacific Oscillation pattern upstream that can flood the country with mild, Pacific air, the firm said.

“Tropical forcing forecasts outside of seven to 10 days are notoriously unreliable, meaning that once models pick up on an eventual propagation, we would look for rapidly cooling forecasts, but that is not yet the case and the end of most models shows a pattern that is not threatening for cold even mid-month,” Bespoke chief meteorologist Jacob Meisel said.

Various weather models do show an impressive transition to a colder pattern Weeks 3-4, and on net, Bespoke continues to forecast a January that comes in slightly colder than average, “but warmth wins first.”

Midday data on Friday remained mixed on if cold shots would return across the northern and eastern United States Jan. 8-10. “Again, there’s likely to be very cold air over Canada during the second week of January, but cold over Canada is not cold over the U.S. and would need to trend further south for bullish sentiment to return,” NatGasWeather said.

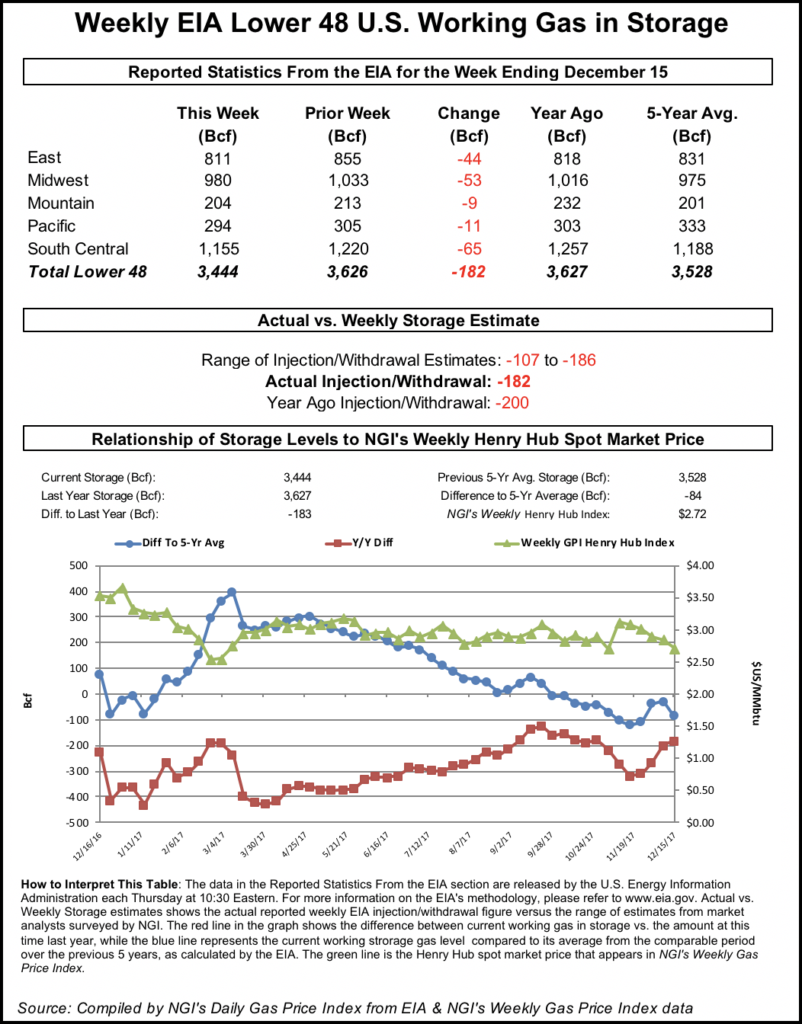

Meanwhile, Friday’s storage report offered no surprises as the Energy Information Administration (EIA) reported a 48 Bcf withdrawal from inventories for the week ending Dec. 21. The draw, which was in line with expectations, left stocks at 2,725 Bcf, 623 Bcf less than last year at this time and 647 Bcf below the five-year average.

Bespoke, which had projected a 50 Bcf draw, said the number may be viewed as “a touch bearish” as looser daily balances this week mean an even smaller draw may be announced next week. This means that with any warmer model guidance, gas can test $3.25-$3.30.

“However, weather remains primarily in control here, with the last couple EIA prints still showing that with enough cold weather, the market can tighten quickly, so once models cool, prices can bounce quickly,” Meisel said.

Furthermore, “…deficits are still quite hefty where buyers could be willing to step in if prices fall too much further,” NatGasWeather said.

Last year, a draw of 122 Bcf was reported, and the five-year average draw for the week is 121 Bcf.

Broken down by region, the EIA reported a 23 Bcf draw in the Midwest, a 16 Bcf pull in the East and a 2 Bcf pull in the South Central.

The Nymex February contract settled Friday at $3.303, down 24.3 cents. March dropped 20.5 cents to $3.148.

Cold Snap Lifts Spot Gas

Spot gas prices bounced back on Friday as trading was for gas flowing Jan. 1 and 2, right when a cold shot was expected to hit the country, boosting demand temporarily before mild conditions were expected to return. The NGI Spot Gas National Avg. rose 13 cents to $3.18.

The strong weather system that was expected to bring rain and snow over the Great Lakes and east-central United States on Friday was forecast to move into the East on Saturday, according to NatGasWeather. Other systems were forecast to impact the western and south-central United States/Texas during the weekend, although a milder break was expected to follow across the Great Lakes and East early in the week ahead, the forecaster said.

Another strong cold blast was still on tap to track across the country late in the first week of the new year and where demand “should briefly increase to above normal” as overnight temperatures were forecast to drop into the single digits to 20s behind the cold front, outlooks show.

“It’s the milder trending break that follows Jan. 4-6 where a considerable amount of demand has been lost as highs again warm above normal over the northern and eastern U.S.,” NatGasWeather said.

With some of the chilliest weather forecast for Texas, spot gas prices there put up some of the largest increases. Houston Ship Channel jumped 22.5 cents to $3.185, although some of that gain was likely tied to the return of industrial demand after the New Year’s holiday. Most other points in East Texas rose less than 15 cents and many climbed less than a dime.

West Texas prices put up far more substantial increases amid the stronger demand and resumed gas flows following weeks of various maintenance events in the region. Waha jumped more than 60 cents to $2.165.

Benchmark Henry Hub was up 16 cents to $3.225, while most prices in the Southeast rose anywhere from 8 cents to 19 cents day/day.

Over in the Midcontinent, most pricing hubs netted gains in the double-digits, but NGPL Midcontinent surged a far more substantial 85.5 cents to $2.635 due to a force majeure called Thursday on the Natural Gas Pipeline Company of America (NGPL) system.

NGPL’s force majeure limits flow through Station 103 to Station 106 on its Amarillo Mainline in Ford County, KS, by 70 MMcf/d. Citing electrical issues at Compressor Station 104, a notice on the pipeline’s website stated that the capacity reduction would continue until further notice.

Timely cycle nominations for gas day Dec. 28 showed the capacity reduction being buffered by an increase in receipts at the “NBORDER/NGPL HARPER KEOKUK” interconnect with Northern Border Pipeline, according to Genscape Inc.

Depending on the length of the outage, an increase in midwestern heating degree days forecast for the first week of January could continue to drive increased receipts at Northern Border and Trailblazer interconnects, Genscape natural gas analyst Matt McDowell said.

In the Midwest, prices were up less than 10 cents across most of the region, with Chicago Citygate climbing to $3.075.

Most pricing hubs in Appalachia and the Northeast were up a nickel or more, although New England’s Algonquin Citygate slipped a penny to $3.39 and Transco Zone 6 NY shot up more than 20 cents to $3.15.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |