Utica Shale | E&P | Haynesville Shale | NGI All News Access

Baker Hughes U.S. Rig Count Steady as Industry Closes Book on 2018

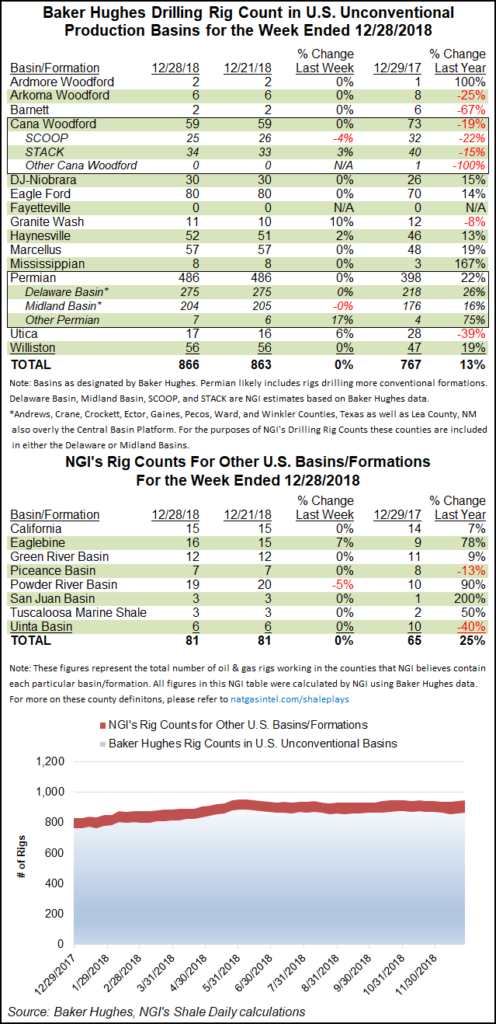

The U.S. oil and natural gas rig count climbed by three to 1,083 for the week ended Friday (Dec. 28), nearly bringing to a close a year of growth in domestic drilling activity, according to data from Baker Hughes, a GE Company (BHGE).

The United States added two oil-directed rigs and one natural gas-directed unit during the last full report week of 2018, putting the combined domestic tally 154 rigs ahead of its year-ago total.

Five horizontal units returned to action for the week, offsetting the departure of one directional unit and one vertical unit. All of the week’s gains occurred on land, as the Gulf of Mexico finished flat at 24 rigs.

Canada’s rig count, meanwhile, fell sharply for the second straight week, with 43 oil rigs and 18 gas rigs packing up shop to put the Canadian count at 70, down from 136 rigs running a year ago. The combined North American rig count finished the week at 1,153, up from 1,065 rigs in the year-ago period, according to BHGE.

Activity across the major plays in the U.S. onshore held steady for the week, which included the Christmas holiday. The Haynesville and Utica shales each saw one rig return to action, as did the Granite Wash.

Among states, Alaska posted a net increase of two rigs to grow its count to seven. Mirroring the gains in the Haynesville and Utica, Louisiana and Ohio each added a rig. Texas also added a rig for the week, while Oklahoma and Wyoming each dropped a rig.

The oilfield services (OFS) sector, slowly returning to normal following the downturn four years ago, now faces more uncertainty as oil prices have weakened and Lower 48 producers have trimmed spending plans for 2019.

The OFS sector’s customers, exploration and production (E&P) companies, began finessing their capital expenditure (capex) plans during the third quarter, just as oil prices began to slide.

West Texas Intermediate (WTI) had moved to above $75/bbl in early October, but a month later, prices had fallen below $60. On Thursday, New York Mercantile Exchange WTI futures slid $1.61 to settle at $44.61/bbl.

Citing commodity prices, Goodrich Petroleum Corp. lowered its capex for 2019 by about $40 million, but said it expects to maintain its previous production guidance for the upcoming year because its wells are outperforming type curves.

The Houston-based producer said it now expects full-year capex to range from $90-100 million, down from a preliminary range of $125-150 million that CEO Gil Goodrich mentioned during an earnings call in November. Still, the company expects to grow production 90-105% compared to 2018, to a range of about 49.3-52.9 Bcfe (135,000-145,000 Mcfe/d) in 2019. Natural gas is expected to comprise about 98% of production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |