EIA Reports On-Target 48 Bcf Draw, February Natural Gas Pares Losses

The Energy Information Administration (EIA) on Friday reported a 48 Bcf withdrawal from natural gas storage inventories for the week ending Dec. 21, in line with market estimates.

The reported draw had little immediate impact on Nymex February gas futures, which were trading nearly 20 cents lower ahead of the EIA’s report and then ticked up less than a penny as the print hit the screen. Just before 11 a.m. ET, however, the prompt month was trading less than 15 cents lower at $3.402.

“After quite a bit of weekly noise with the EIA print, we finally see a number that fits our expectations well with no real regional surprises,” said Bespoke Weather Services chief meteorologist Jacob Meisel. “The print was 2 Bcf bearish from our expectation but sits solidly in the middle of market expectations, and accordingly, we are not seeing the natural gas market react much at all.”

If anything, the number may be a touch bearish as looser daily balances this week mean an even smaller draw may be announced next week, according to Bespoke. This means that with any warmer model guidance, gas can test $3.25-$3.30.

“However, weather remains primarily in control here, with the last couple EIA prints still showing that with enough cold weather, the market can tighten quickly, so once models cool, prices can bounce quickly,” Meisel said.

So far, weather models have struggled to reflect a firm timeline as to when significant cold would return. Overnight weather model guidance continued to warm the long range, showing an unfavorable Pacific win out temporarily, preventing any sustained cold weather from moving down into the East, according to Bespoke.

Various weather models do show an impressive transition to a colder pattern Weeks 3-4, and on net, Bespoke continues to forecast a January that comes in slightly colder than average, “but warmth wins first.”

Market estimates ahead of the EIA report had called for a draw in the mid- to high-40 Bcf range. Kyle Cooper of IAF Advisors projected a 45 Bcf withdrawal, Bespoke expected a 50 Bcf pull and Genscape Inc.’s composite estimate called for a 46 Bcf withdrawal. A Bloomberg survey of nine market participants ranged from a pull between 39 Bcf and 56 Bcf, with a median draw of 47 Bcf.

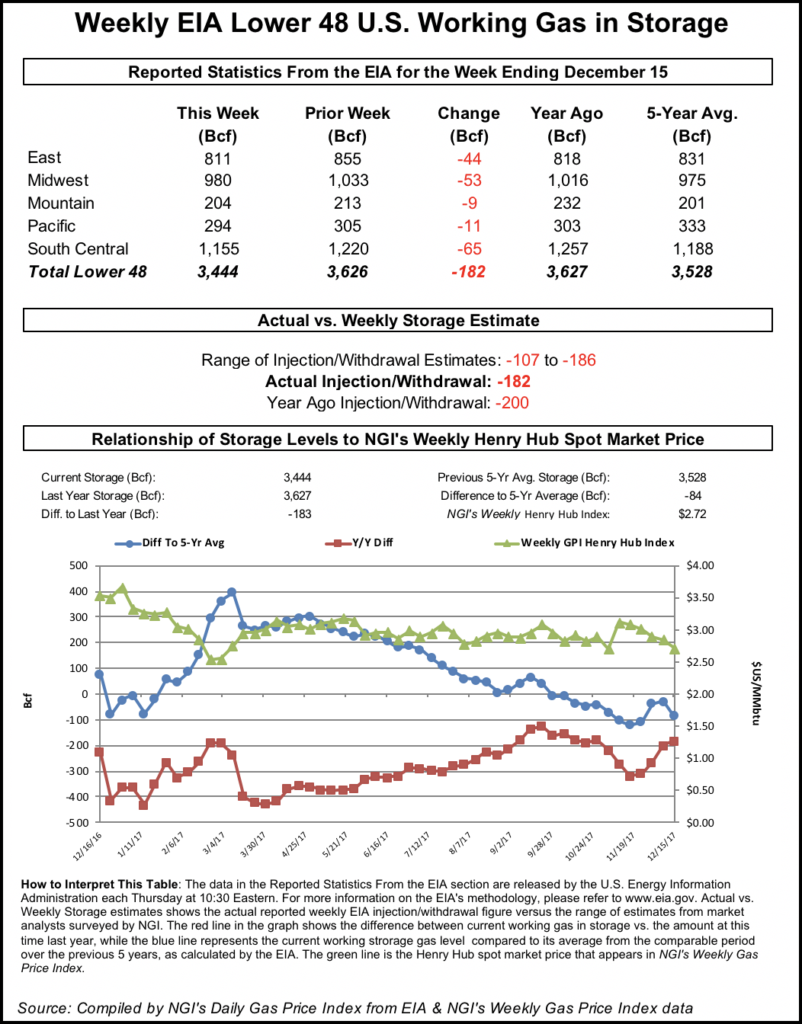

Last year, a draw of 122 Bcf was reported, and the five-year average draw for the week is 121 Bcf.

Broken down by region, the EIA reported a 23 Bcf draw in the Midwest, a 16 Bcf pull in the East and a 2 Bcf pull in the South Central.

Inventories stood at 2,725 Bcf as of Dec. 21, 623 Bcf less than last year at this time and 647 Bcf below the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |