NGI Mexico GPI | Markets | NGI All News Access

January Natural Gas Expires Sharply Higher Despite Lack of Fundamental Support; Spot Gas Rises in Texas

Another day, another wide trading range for natural gas futures prices, which ended Thursday’s session higher after unrelenting volatility. After dropping as low as $3.441, the Nymex January gas futures contract expired 9.9 cents higher at $3.642. The February contract edged up 8.8 cents to $3.546, and March rose 7 cents to $3.353.

Spot gas prices, meanwhile, were mixed amid ongoing light holiday demand and mild weather in much of the country as traders locked in deals for delivery through the end of the month. The NGI Spot Gas National Avg. fell 3.5 cents to $3.05.

On the futures front, despite the erratic swings that characterized Thursday’s trading session, weather was likely not behind the nearly 10-cent rally at the front of the curve. Instead, several market observers said dramatic moves have become common on days of Nymex contract expirations.

Thursday was no different as the January contract was up about a nickel at the start of trading but then fell to a 10-cent discount to Wednesday’s settle later in the morning. In fact, the spike that sent the prompt month rolling off the board nearly a dime higher occurred within minutes of closing.

“The January natural gas contract expired with strength today despite unimpressive afternoon weather model guidance and far weaker cash. Short-term, we remain concerned that weak cash, loose balances and unimpressive early January cold will prevent the February contract from moving much higher. However, by next week, balances should begin to tighten and models should increase long-range cold risks, skewing risk higher still over the next week or two,” Bespoke Weather Services said.

Midday weather data on Thursday continued to show a strong cold shot sweeping across the country Jan. 2-4 but with a milder-trending break Jan. 5-7. The data still showed at least some cooler air arriving across the East Jan. 8-10, but it was not as cold as the data showed a couple days ago, according to NatGasWeather.

“Overall, weather patterns don’t look quite cold enough the next couple weeks besides the Jan. 2-4 system,” the firm said.

Bespoke said it sees risk skewed colder beyond Jan. 10, although weather models “are still noisy and struggling” to show much cooler weather with the gradual Madden-Julian Oscillation (MJO) progression.

The tropical MJO remained on track for phases 7 and 8 during the 11- to 15-day period, according to Radiant Solutions. Historically, these phases have resulted in a colder outcome across the eastern half of the United States this time of year.

“However, models are reluctant to weaken tropical convection west of the International Dateline or firmly extend that convection eastward. As a result, this lowers confidence in the forcings’ role in changing the pattern,” the forecaster said.

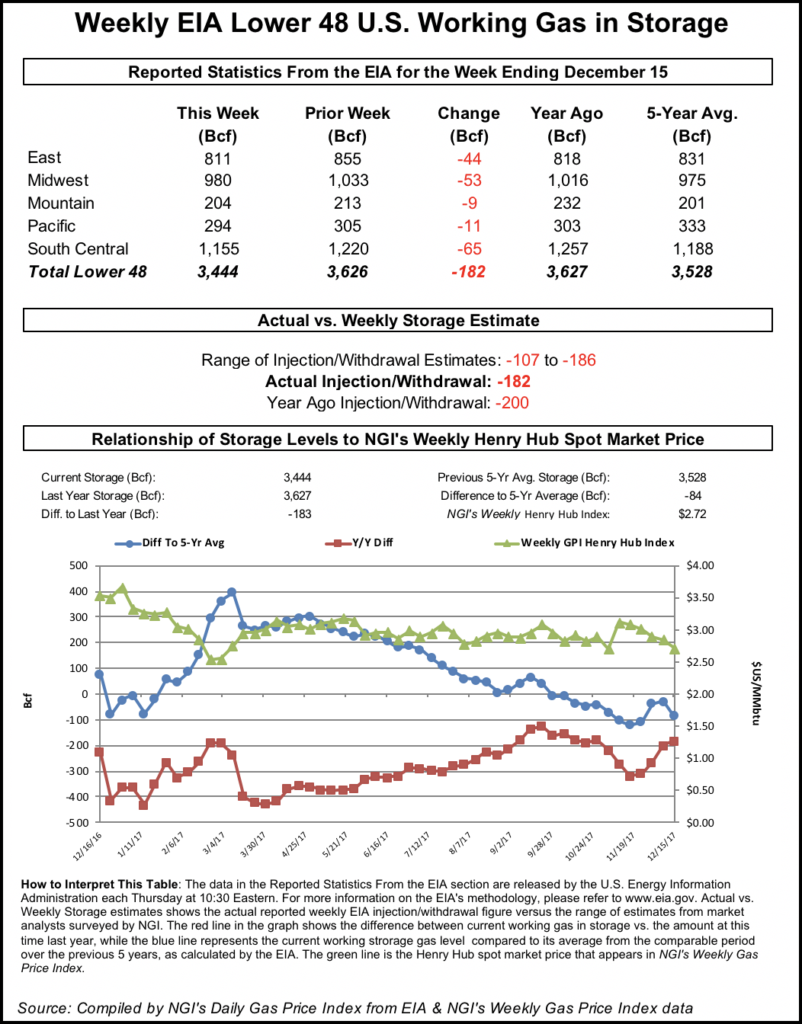

With unseasonably mild weather expected to remain largely in the forecast for the early part of January, persistent storage deficits that have plagued the natural gas market since the summer are expected to improve. Deficits are expected to tighten to around 620 Bcf from 720 Bcf after the next couple of Energy Information Administration (EIA) storage reports are accounted for, according to NatGasWeather.

Even as a partial U.S. government shutdown continues, the EIA energy inventory reports will be released as scheduled, with the natural gas storage report for the week ending Dec. 21 set to be released at 10:30 a.m. ET on Friday, a day later than usual due to the Christmas holiday.

“EIA is not affected by the lapse in funding for some federal agencies,” a spokesperson told NGI. On the agency’s website, EIA added that it has “FY 2019 appropriations and will continue publishing and collecting data.”

Estimates for Friday’s report pointed to a withdrawal in the high 40 Bcf range. Kyle Cooper of IAF Advisors projected a 45 Bcf withdrawal, and Bespoke expected a 50 Bcf pull. A Bloomberg survey of nine market participants ranged from a pull between 39 Bcf and 56 Bcf, with a median draw of 47 Bcf.

A withdrawal of 47 Bcf would leave gas stocks at 2,726 Bcf, which is 646 Bcf below the five-year average of 3,372 Bcf, according to EIA. Last year, a draw of 122 Bcf was reported, and the five-year average draw for the week stood at 121 Bcf.

Last week, the EIA reported a 141 Bcf withdrawal that left inventories as of Dec. 14 at 2,773 Bcf, about 20% below last year and the five-year average.

Still, while the span of mild weather is likely to improve the storage picture, the stock cushion remains razor thin and the market is prone to another spike if weather maps turn blue again, according to Barclays Commodities Research. As stocks are expected to end December about 20% below the five-year average, they will exacerbate the market’s usual sensitivity to winter weather at least through the end of January when heating loads typically peak, the firm said.

“After that, the market’s risk premium should subside as storage operators will be more willing to pull gas with the end of winter in sight,” Barclays analysts Samuel Phillips and Michael Cohen said.

Until then, the market should expect continued above-normal volatility at the front of the futures curve, “especially in light of the favorable setup for polar vortex conditions in early January.

“For the time being, any rally is likely to be easy come, easy go as production growth and low storage battle it out to determine the direction of the market,” the analysts said.

Indeed, the market hyped up production growth throughout the summer and pinned its hopes on the increased supply tightening storage deficits, but strong summer demand prevented that from happening. Still, Barclays expects post-winter balances to loosen considerably given its forecast for near-normal end-March storage (1.5 Tcf) and production growth (up 4 Bcf/d year/year in 2019).

Cracks, however, have started to emerge in the production growth story that warrant caution against becoming more bearish for next year just yet, the firm said. The investment bank reiterated its 2019 Henry Hub forecast of $2.92/MMBtu.

While Permian and Appalachia production slowdowns in recent weeks have different underlying drivers that are likely temporary in nature, the respective causes of their decline are further risk factors to its production growth forecast, according to Barclays.

“If production growth falls flat of our expectations by, say, 1-2 Bcf/d, then gas burns would have to be reduced by a proportional amount to maintain injections next summer. To achieve that, prices would have to increase towards coal switching levels,” Phillips and Cohen said.

Texas Gas Strong, But Mexican Exports Sink

While the majority of pricing hubs across the United States continued to see spot gas prices trim back, points across Texas and the Midcontinent posted gains of as much as 50 cents as colder weather was expected to move into the region in the next few days.

Demand was expected to increase this weekend as a glancing shot of subfreezing Canadian air was forecast to sweep across the northeastern United States, with additional weather systems impacting the western and south-central United States/Texas, according to NatGasWeather.

“There’s expected to be a brief break over the Great Lakes and East Dec. 31, but with additional cold shots following Jan. 2-4 and where colder trends occurred overnight in most datasets besides the European model,” the forecaster said.

Given the approaching cold, Genscape Inc. projected East Texas demand to jump to 3.27 Bcf/d for Friday and then remain above 3 Bcf/d through Monday. By next Wednesday, demand was expected to reach 3.40 Bcf/d.

Houston Ship Channel spot gas rose 11 cents Thursday to $2.96, while Waha in West Texas jumped 43.5 cents to $1.545.

South Texas price increases were more muted as exports to Mexico have tapered off due to the holidays, although Texas Eastern S. TX gas rose more than 15 cents to $3.08. Genscape noted last week the potential for these drops, having identified that Mexican gas demand historically drops about 11% during the Christmas-to-New Year’s week versus the prior month-to-date average.

So far this week, Mexican demand is down nearly 0.34 Bcf/d with power burn sinking to 3 Bcf/d — its lowest single-day since March 31 — and industrial falling to 2.32 Bcf/d, the firm said.

This resulted in commensurate drops in U.S. pipeline exports. Genscape’s modelled estimate of exports fell to just 4.14 Bcf/d on Christmas Eve with each U.S. exporting region recording declines. The most pronounced were out of South Texas, where each pipe reported notably lower flows, especially the Los Ramones system (fed by NET Mexico), which fell to just 1.57 Bcf/d, a 270-day low.

In the Midcontinent, OGT shot up more than 40 cents to $2.34, although most other regional hubs were up a dime or less.

Prices across the rest of the country were mostly lower given the light demand and taking into account the extended flow period. Benchmark Henry Hub tumbled 15 cents to $3.065, while Transco Zone 5 in the Southeast fell similarly to $3.03.

Transco-Leidy Line posted the sharpest decline in Appalachia, tumbling more than 25 cents to $2.785.

In the Northeast, prices were down between 15 and 80 cents as a strong weather system that was expected to bring heavy rain and snow to the central United States during the next few days was also expected to amplify a warm ridge across the eastern part of the country. Temperatures from New York City to the Gulf Coast were forecast to warm into the 50s to 70s, as much as 25 degrees above normal, according to NatGasWeather.

On the pipeline front, Columbia Gas Transmission requested federal approval to add two new turbines to the Mountaineer XPress Pipeline (MXP) Sherwood Compressor Station (CS) by Jan. 15. These facilities will allow MXP to provide another 100 MMcf/d of incremental capacity through the project, bringing capacity up to 800 MMcf/d once approved.

MXP additionally filed a separate letter clarifying that its Dec. 12 in-service authorization request included the 24-inch tap and associated facilities for the connection to the MarkWest Energy Partners LP pipeline located at the Sherwood CS.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |