NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Warm Holiday Week Sends Natural Gas Forwards Down the Chimney

Natural gas prices continued to retreat from recent highs, with January tumbling 20 cents on average during the Dec. 19-26 period as mild weather was expected to continue through the first week of the new year.

The sharpest declines occurred in the Northeast, where truly intimidating cold was expected to remain at bay for most of the next couple of weeks. Meanwhile, the end of several pipeline events in and around the Permian Basin lifted forward prices there by the double-digits, according to NGI’s Forward Look.

Light holiday demand and mild weather blanketing much of the country leading up to the Christmas holiday put market bears in control of forward markets for the better part of the Dec. 19-26 period, although some hints of cold returning in early January were enough to revive markets Friday and again on Wednesday.

Still, some market observers saw Wednesday’s rally as more reflective of the typical volatility that accompanies the expiration of Nymex futures contracts. The January contract is set to expire Thursday, and sure enough, prices were up about a nickel at the start of trading but then fell to a roughly 10-cent discount to Wednesday’s settle later in the morning. The prompt month went on to expire Thursday at $3.642, up 9.9 cents on the day. February rose 8.8 cents to $3.546.

On the weather front, the overnight Wednesday European weather model guidance showed slightly more cold risks at the end of the run but still indicated a generally mild pattern winning out before then as gas-weighted degree days (GWDD) easily run below seasonal averages, according to Bespoke Weather Services.

Overnight Global Ensemble Forecast System (GEFS) model guidance was decently warmer, sending gas prices initially lower before the more bullish ending on the European guidance, which indicated more of a negative Eastern Pacific Oscillation ridge upstream that could lock cold in the East.

“This is a trend we do expect models to gradually move towards into next week, but we also note that GEFS guidance has been breaking this ridge down occasionally and limiting eastern cold,” Bespoke chief meteorologist Jacob Meisel said.

Although Bespoke sees risk skewed colder beyond Jan. 10, weather models “are still noisy and struggling” to show much cooler weather with the gradual Madden-Julian Oscillation (MJO) progression.

The tropical MJO remained on track for phases 7 and 8 during the 11- to 15-day period, according to Radiant Solutions. Historically, these phases have resulted in a colder outcome across the Eastern half of the United States this time of year.

“However, models are reluctant to weaken tropical convection west of the International Dateline or firmly extend that convection eastward. As a result, this lowers confidence in the forcings role in changing the pattern,” the forecaster said.

The midday data on Thursday continued to show a strong cold shot sweeping across the country Jan. 2-4 but with a milder trending break Jan. 5-7. The data still showed at least some cooler air arriving across the East Jan. 8-10, but it was not as cold as the data showed a couple days ago, according to NatGasWeather.

“Overall, weather patterns don’t look quite cold enough the next couple weeks besides the Jan. 2-4 system,” the firm said.

Meanwhile, the recent and coming weather patterns are expected to lead to storage withdrawals that are lighter than five-year averages for the next two Energy Information Administration weekly storage reports, according to NatGasWeather. The expected pulls would improve deficits from 720 Bcf to near 620 Bcf, then stall or improve a little further in the weeks after, the firm said.

“Deficits will still be quite hefty, but for the markets to regain the bullish fire, the markets clearly want sustained cold, which the overnight weather data failed to provide due to notable breaks between cold shots,” the firm said.

The Energy Information Administration (EIA) is scheduled to release its weekly storage report at 10:30 a.m. ET on Friday, a day later than usual due to the Christmas holiday.

Estimates are pointing to a withdrawal in the mid- to high 40 Bcf range. A Bloomberg survey of nine market participants ranged from a pull between 39 Bcf and 56 Bcf, with a median draw of 47 Bcf. Kyle Cooper of IAF Advisors projected a 45 Bcf withdrawal, and Bespoke Weather Services expected a 50 Bcf pull.

Last week, the EIA reported a 141 Bcf withdrawal that left inventories as of Dec. 14 at 2,773 Bcf, about 20% below last year and the five-year average.

Apart from the impact weather could have on storage, production also has been hyped up by a market expecting to see supply growth tighten up deficits. As of Dec. 21, Lower 48 production had rebounded above the 86 Bcf/d level as a smattering of flow-restrictive maintenance events concluded, according to Genscape Inc.

Month-to-date production was averaging just a tick shy of 86 Bcf/d, closing the deficit to the firm’s forecast at the start of the month to just 356 MMcf/d.

Meanwhile, the impact of lower crude oil prices — which remained below $50/bbl even after rallying Wednesday — was not expected to significantly dampen gas production growth in 2019 despite an expected pullback in drilling activity by several producers, including Parsley Energy Inc. and Diamondback Energy Inc. Genscape’s most recent production forecast update on Dec. 24 reflected the Cal. 2019 strip for West Texas Intermediate crude oil at $47.08/bbl, yielding a crude production forecast of 11.83 million b/d for 2019.

And while lower oil output reduces gas production due to lower associated gas volumes from oil production, some of those declines are being cancelled out by a stronger outright gas price, according to the data firm. The Nymex Cal. 2019 gas price had climbed to $3.12 heading into Wednesday’s trading, bringing the firm’s 2019 gas production forecast down to just under 89.6 Bcf/d.

But November’s price action, which saw December close in on $5, refutes the notion that production growth should help alleviate the dependence on storage and contribute to less volatility, according to market intelligence group Alerian. Near-term production growth without adequate pipeline takeaway capacity “is not that helpful” for natural gas prices, though sustained and elevated production levels does create an opportunity for midstream companies to build out pipelines and gas processing plants, the firm said.

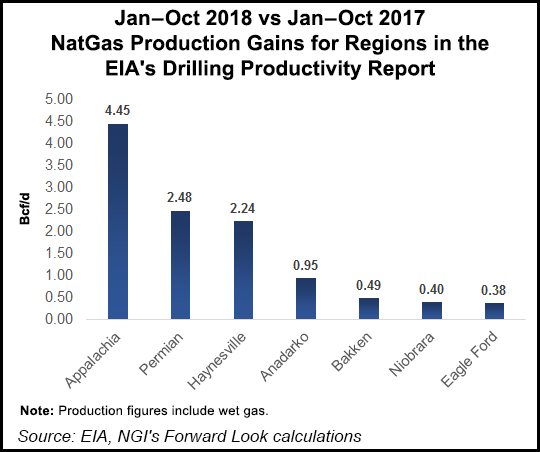

“Natural gas production growth has been dominated by the Marcellus/Utica and the Permian. Pipeline additions have helped debottleneck the Northeast, but Permian natural gas takeaway remains inadequate,” Alerian energy research analyst Michael Laitkep said in a recent note to clients.

Instead of lessening volatility, continued production growth likely creates a ceiling for prices in the upcoming year, particularly as recently added takeaway capacity in the Northeast ramps up and new gas pipelines come online in the Permian, he said.

Permian Pricing Strong

With the conclusion of several pipeline maintenance events that have restricted Permian Basin gas flows in recent weeks, January forward prices in the region moved sharply higher for the Dec. 19-26 period.

Waha January natural gas shot up 46 cents to $1.507, while February slipped 2 cents to $1.252 and the balance of winter (February-March) edged up 3 cents to $1.04, according to Forward Look.

A handful of other markets across the country also put up gains at the front of the curve, although increases were limited to less than a nickel. Chicago Citygate January was up 3 cents to $3.363, while February plunged 21 cents to $3.593 and the balance of winter tumbled 22 cents to $3.41.

At Northern Natural Ventura, January was up 4 cents from Dec. 19-26 to $4.551, while February was down 15 cents to $4.058 and the balance of winter was down 19 cents to $3.70.

Meanwhile, markets in the Northeast continued to post steep declines as weather conditions were expected to remain relatively mild through the early part of next month. Transco Zone 6 NY January plunged 71 cents from Dec. 19-26 to reach $8.363, February dropped 37 cents to $8.704 and the balance of winter slid 30 cents to $6.33, Forward Look data show.

At Tennessee Zone 6 200L, January was down 66 cents to $9.684, February was down 52 cents to $10.048 and the balance of winter was down 48 cents to $8.56.

Appalachia price declines closely mirrored those of Nymex futures, with Columbia Gas January shedding nearly 20 cents for the week to hit $3.295, February falling 20 cents to $3.208 and the balance of winter sliding 21 cents to $3.11.

On the pipeline front, Columbia Gas Transmission requested federal approval to add two new turbines to the Mountaineer XPress Pipeline (MXP) Sherwood Compressor Station (CS) by Jan. 15. These facilities will allow MXP to provide another 100 MMcf/d of incremental capacity through the project, bringing capacity up to 800 MMcf/d once approved.

MXP additionally filed a separate letter clarifying that its Dec. 12 in-service authorization request included the 24-inch tap and associated facilities for the connection to the MarkWest Energy Partners LP pipeline located at the Sherwood CS.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |