NGI Mexico GPI | Markets | NGI All News Access

Whipsaw Trading Action Ends with Natural Gas Futures Lower as Market Mulls Storage, Weather

Another day of whipsaw price action saw natural gas futures slip lower after probing both sides of even, with a larger-than-expected storage withdrawal from the Energy Information Administration (EIA) failing to spark much momentum for the bulls. In the spot market, forecasts calling for mild temperatures sent Northeast prices lower as points throughout the middle third of the Lower 48 rebounded; the NGI Spot Gas National Avg. added 7.5 cents to $3.465/MMBtu.

The January Nymex contract settled at $3.583 Thursday, down 14.3 cents on the day after trading as high as $3.938 and as low as $3.572. But true to form on a day of back and forth moves, after the settle the front month had already recovered to around $3.706 shortly after 4 p.m. ET.

Further along the strip, February settled at $3.526, down 12.7 cents, while March settled 12.6 cents lower at $3.380.

“As has been a theme we have highlighted all week, the gas market continues to overreact in both directions to varied weather model guidance, overshooting higher overnight” heading into Thursday’s session in response to “only marginally more favorable trends in the Pacific for colder weather in January,” Bespoke Weather Services said.

Despite large withdrawal from the EIA’s weekly storage report, prices then sold off on warmer trends in the American guidance midday before European guidance “trended back decently colder,” Bespoke said.

“…Even European model guidance is not perfect for cold; a lingering” positive Western Pacific Oscillation “signal upstream will keep any cold shots weak the first week of January, and warmth may be able to hold on across the East Coast,” the forecaster said. “However, with production off highs and power burns tightening up under $3.75, the market is certainly tight enough to rally on any sustained cold signal. Model noise may allow further pullbacks, but we continue to see natural gas prices as undervalued around or below $3.60, and expect a rally toward $4 next week as models pick up on colder risks.”

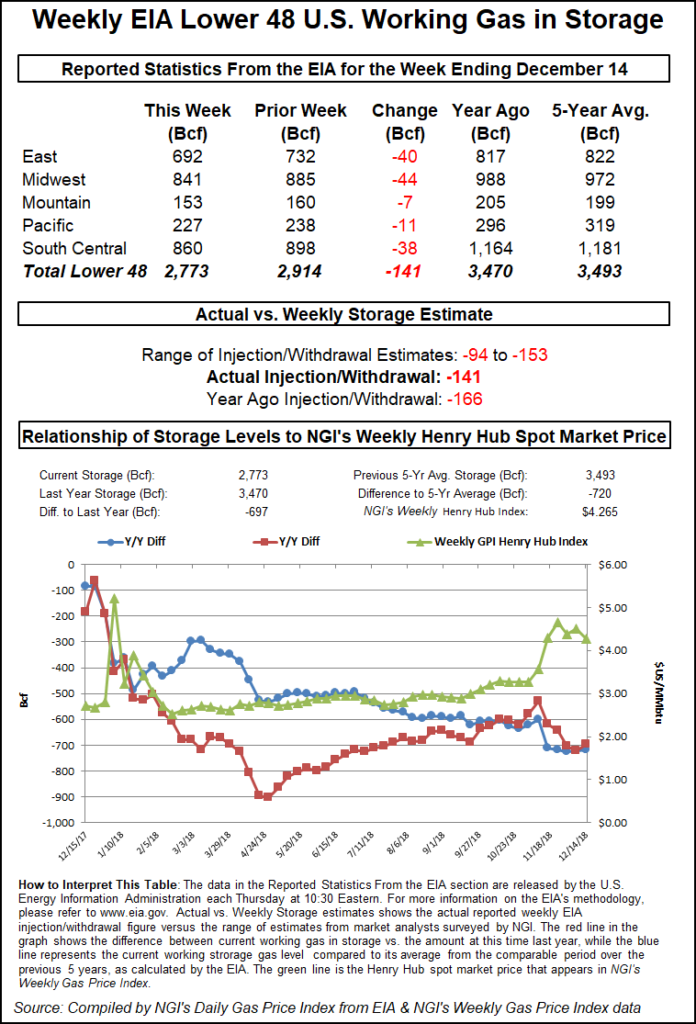

The EIA on Thursday reported a 141 Bcf withdrawal from U.S. natural gas stocks. Nymex futures, trading higher along the winter strip when the report came out, initially gained slightly on the somewhat larger-than-expected withdrawal before dropping below pre-trade levels as a stretch of mild temperatures figures to ease storage concerns heading into the new year.

The 141 Bcf withdrawal for the week ended Dec. 14 compares to a year-ago withdrawal of 166 Bcf and a five-year average pull of 144 Bcf. Prior to Thursday’s report, estimates had been pointing to a withdrawal in the low to mid-130 Bcf range, with responses to major surveys coming in as low as 94 Bcf and as high as 153 Bcf.

As the number crossed trading screens at 10:30 a.m. ET, the January Nymex contract, already up about 6-8 cents from Wednesday’s settle, added another 4 cents or so, trading as high as $3.837 before pulling back into the $3.810-3.820 area.

But bulls couldn’t sustain any momentum on the EIA report, as prices reversed in short order to trade as low as $3.700 less than a half hour later. By 11 a.m. ET, the January contract was trading around $3.775, up about a nickel from the previous settle.

Total Lower 48 working gas in underground storage as of Dec. 14 stood at 2,773 Bcf, 697 Bcf (20.1%) below last year’s stocks and 720 Bcf (20.6%) below the five-year average, according to EIA.

By region, the Midwest posted a 44 Bcf withdrawal for the week, while 40 Bcf was withdrawn in the East. The Pacific saw an 11 Bcf pull, with 7 Bcf withdrawn in the Mountain region. In the South Central, 29 Bcf was pulled from nonsalt for the week, while 9 Bcf was pulled from salt stocks, according to EIA.

Meanwhile, the recent weakening in crude oil futures continued Thursday, with the Nymex WTI February contract selling off sharply to settle at $45.88/bbl after trading above $76 as recently as Oct. 3.

The sell-off for crude futures also coincides with concerns about the broader economy, including signs of weakness in the stock market. The U.S. Federal Reserve on Wednesday hiked interest rates for the fourth time this year, saying it would raise interest rates more slowly in 2019 as it expects modestly slower economic growth over the next year.

From a technical standpoint, February crude futures on Tuesday broke below a key support level at $49.57 on a closing basis, noted analysts with Rafferty Commodities Group.

“This caused us to cut losses by abandoning any long positions and to trade in the direction of the breakdown,” the Rafferty team said.

The analysts said they would look for the market to test the $45.25-$45.00 area, with the previous support level at $49.57 now likely to act as resistance.

Above-Normal Temps Sink Northeast

Day-ahead prices strengthened throughout much of the middle third of the Lower 48 Thursday, partially recovering from broad declines posted a day earlier. Benchmark Henry Hub added 13.5 cents to $3.695, setting the tone for gains throughout Louisiana and Texas.

A strong weather system was expected to track through the Southeast Thursday, then move up the East Coast Friday and Saturday, bringing rain and snow but not a lot of cold, according to NatGasWeather.

“The rest of the country will be mild with above normal temperatures to aid in lighter than normal national demand,” NatGasWeather said. “There’s still expected to be another modest cold shot sweeping across the Great Lakes and Northeast Christmas Eve/Christmas, but still not looking as cold or widespread as needed to increase national demand above normal.

“Colder systems are expected into the West next week, but with mild high pressure dominating the eastern U.S. Dec. 26-29 for light demand.”

Prices at a number of points in the Northeast and Appalachia continued to decline Thursday. Transco Zone 6 NY shed 30.0 cents to $3.330, while Texas Eastern M-3, Delivery dropped 37.5 cents to $3.230.

Radiant Solutions was calling for well above normal temperatures Friday along the Interstate 95 corridor. New York City, Boston, Philadelphia and Washington, DC, were all expected to see highs warm into the upper 50s to low 60s, with temperatures about 20 degrees warmer than normal on average.

Meanwhile, prices at several West Texas locations rebounded from steep losses a day earlier. El Paso Permian picked up 24.0 cents to $2.075.

El Paso Natural Gas (EPNG) began service earlier this month on its Permian North expansion, adding 182 Bcf/d of incremental northbound capacity out of the West Texas/southeast New Mexico producing region, according to Genscape Inc. analyst Vanessa Witte.

“The Permian North project is designed to utilize EPNG’s northern system by receiving gas at the primary points of Ramsey North and the Goldsmith Plant to travel northwest through the Plains Compressor Station for ultimate delivery” at an interconnect with Southern California Gas at Topock along the Arizona/California border, Witte said. “Despite outstanding work left to be completed, such as backfill, painting and other clean-up efforts, EPNG is allowing service on the project to begin, adding approximately 182 MMcf/d of incremental northbound capacity.

“On Dec. 5, operational capacity out of the Permian North, as taken at ”PERMPLNS’ on EPNG, increased from 185 MMcf to 381 MMcf, a 196 MMcf difference,” Witte said. “Since that time, flows through this meter have been at around 99% utilization. A notable increase in production has not been seen; rather, rerouted gas on the EPNG system in combination with increased receipts and decreased deliveries at various inter- and intrastate interconnects has accounted for the increased flows to date.”

Further west in California, prices picked up across most of the state. SoCal Border Avg. gained 13.5 cents to $3.860, while PG&E Citygate jumped 42.0 cents to $4.595.

Meanwhile, Cheniere Energy Inc.-backed Midship Pipeline Co. LLC received FERC authorization Thursday to begin constructing parts of its 1.44 Bcf/d Midcontinent Supply Header Interstate Pipeline Project (MIDSHIP), a move that will likely be welcome news for Anadarko Basin producers seeking another takeaway route to markets along the Gulf Coast.

Federal Energy Regulatory Commission staff gave Midship the go-ahead to start construction on a roughly 186-mile stretch of the project’s mainline, the Velma Lateral and associated aboveground facilities.

MIDSHIP as designed would transport supply to existing gas pipelines near Bennington, OK, for subsequent transport to Gulf Coast and Southeast markets. The pipeline would carry gas from Oklahoma’s Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties and the South Central Oklahoma Oil Province — aka the STACK and SCOOP plays.

In the Midcontinent Thursday, NGPL Midcontinent jumped 44.0 cents to $3.030.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |