NGI All News Access | Infrastructure

Natural Gas Groups See Little Value in NERC’s BPS Study

A study by the North American Electric Reliability Corp. (NERC) of the implications for the nation’s bulk power system (BPS) related to looming coal and nuclear generation retirements is “too extreme” to aid efforts to secure future grid reliability, according to some natural gas organizations.

The report, which was released by NERC Tuesday, concludes that generator retirements are “disproportionately affecting large baseload, solid-fuel generation (coal and nuclear). If these retirements happen faster than the system can respond with replacement generation, including any necessary transmission facilities or replacement fuel infrastructure, significant reliability problems could occur.”

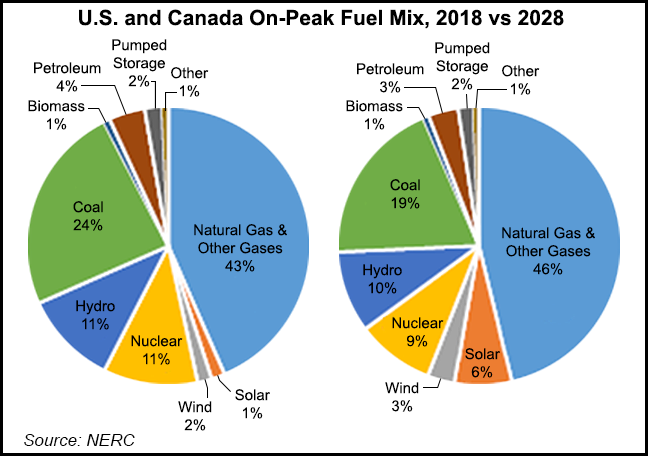

Based on a scenario described as “an extreme stress-test,” NERC concluded that generation retirements “could reduce planning reserve margins to levels that would be near or below reference margin levels.” Replacement resources in the scenario are predominantly natural gas-fired generation, with lesser amounts of utility-scale wind and solar resources, according to the report.

“The natural gas-fired generators are expected to provide the same, or at least adequate, levels of voltage support and frequency response as did the retiring resources,” NERC said. “However, such a significant shift to natural gas-fired generation could leave the BPS more vulnerable to natural gas supply and transportation disruption events or curtailments if firm service and new pipeline capacity are not procured for these replacement resources.”

NERC recommended that industry, stakeholders and policymakers:

However, according to the Natural Gas Supply Association (NGSA), NERC downplayed the potential contributions of new generation, and it didn’t include in its equation recently adopted market mechanisms designed to increase generator performance during extreme weather events.

“Unfortunately, the retirement scenarios incorporated in NERC’s assessment are too extreme to offer useful takeaways about reliability,” said NGSA’s Executive Vice President Pat Jagtiani. “Certainly, there is nothing here that warrants or supports the use of out-of-market actions.”

The Natural Gas Council (NGC) had a similar view of the report.

“While the study’s retirement assumptions and scenarios are extreme and impractical, we are pleased NERC acknowledged the growing importance of natural gas and called for policymakers to explore ways to improve the energy infrastructure permitting process,” NGC said. “The analysis shows the importance of timely permitting and construction of pipeline capacity to ensure the grid can operate under any number of future scenarios, including retirements of generation units.”

FERC Commissioner Cheryl LaFleur said she had concerns about the analysis and conclusions in the NERC report.

“I believe the assessment has a fundamental flaw in the way its assumptions are created,” LaFleur said during a Federal Energy Regulatory Commission meeting in Washington, DC, Thursday. “The report assumes an accelerated retirement of baseload beyond that currently announced or anticipated…but it considers only new resource additions that have actually been announced. So there’s an asymmetry in the way they model what’s coming out and what’s coming on.”

Coal-fired retirements and lower capacity utilization rates in the power sector pushed U.S. coal consumption in 2018 to what may be its lowest level since 1979, according to the Energy Information Administration (EIA). With just one new coal-fired generator expected to come online by the end of 2019 at a “relatively small” 17 MW of capacity, EIA expects coal consumption to decline another 8% year/year in 2019.

A total of nine nuclear facilities are scheduled to retire between 2018 and 2023, with natural gas expected to capture much of that market share.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |