Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Parsley Joining Peers, Reducing Permian Activity in 2019 on Falling Oil Prices

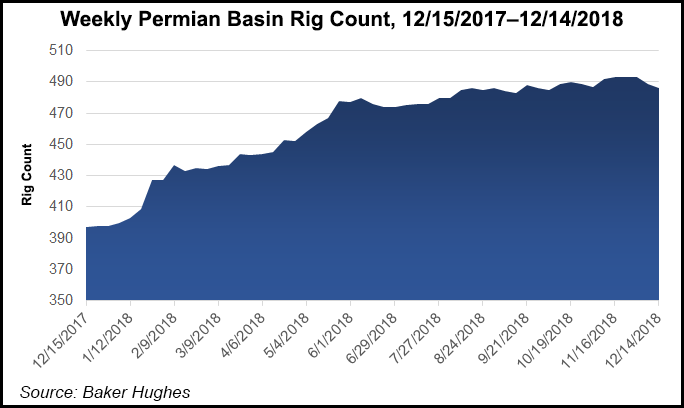

West Texas explorer Parsley Energy Inc. joined a growing chorus of Permian Basin operators in announcing it will reduce development activity in 2019 because of a “less favorable commodity price environment.”

The Austin, TX-based independent late Wednesday said it plans to deploy on average 12-14 rigs and three-four fracture spreads in 2019, down from a recent run rate of 16 rigs and five spreads.

“The proposed development program is consistent with our strategic framework oriented to discipline, foresight and stability,” President Matt Gallagher said. “Despite a less favorable commodity price environment, we still intend to take a significant step toward free cash flow generation in 2019. In fact, we are committed to a material reduction in operational outspend no matter the commodity price environment.”

Diamondback Energy Inc. and Ring Energy Inc., two Permian pure-plays, also said they were reducing activity in the coming year. Crude oil fell again on Thursday, closing below $46/bbl.

Parsley’s capital expenditures (capex) for 2019 have been cut year/year to $1.35-1.55 billion from an estimated $1.65-1.75 billion. Total production for 2019 is estimated at 124,000-134,000 boe/d, which would be up about 20% over 2018 levels.

The baseline capital budget for 2019 is assuming a $50/bbl West Texas Intermediate oil price and relatively “static” oilfield service costs. Parsley expects to outspend cash flow from operations by less than $250 million, representing a year/year decline of more than 50%.

Even in a lower oil price scenario, Parsley expects to target a “maximum outspend” of $250 million, which it would accomplish by incremental activity reductions, likely in combination with lower service and equipment costs, Gallagher said.

In a higher oil price scenario, Parsley still plans to “remain disciplined and would not plan to increase equipment levels in 2019 compared to those associated with the baseline budget.

“In the event of incremental and sustained oil price weakness, we have the operational flexibility to slow activity further even as our hedge book protects a portion of our cash flow; if oil prices rise, our timeline to self-funded growth would shorten.”

Recently completed asset sales in Reagan, Upton and Howard counties provided combined proceeds of $164 million, with divested volumes of around 1,200 boe/d.

The company expects to place at least 40 gross horizontal wells on production during 4Q2018, with net output estimated at 118,000-121,000 boe/d. For the year, Parsley is estimating average net production of 106,000-111,000 boe and oil output of 68,000-75,000 b/d, including the recent divestitures.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |