NGI Data | Markets | NGI All News Access

Natural Gas Futures Unimpressed as EIA Reports Slightly Larger Storage Withdrawal

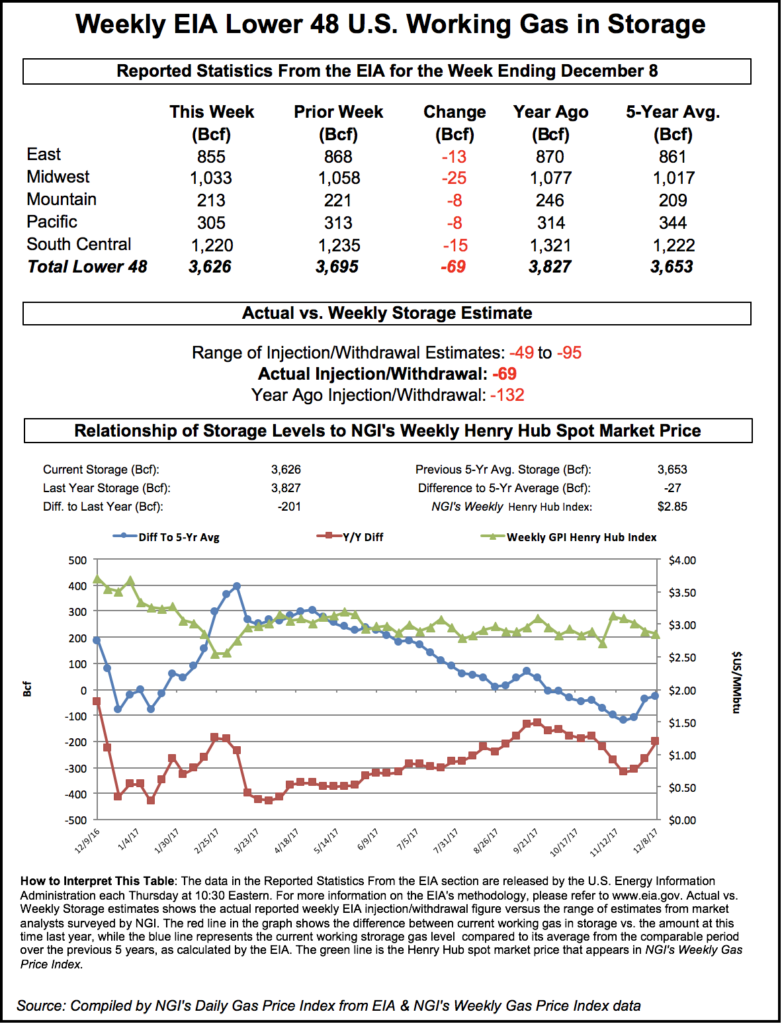

The Energy Information Administration (EIA) on Thursday reported a 141 Bcf withdrawal from U.S. natural gas stocks, but despite coming in on the higher side of estimates the figure failed to impress a jumpy natural gas futures market.

Nymex futures, trading higher along the winter strip when the report came out, initially gained slightly on the somewhat larger-than-expected withdrawal before dropping below pre-trade levels as a stretch of mild temperatures figures to ease storage concerns heading into the new year.

The 141 Bcf withdrawal for the week ended Dec. 14 compares to a year-ago withdrawal of 166 Bcf and a five-year average pull of 144 Bcf. Prior to Thursday’s report, estimates had been pointing to a withdrawal in the low to mid-130 Bcf range, with responses to major surveys coming in as low as 94 Bcf and as high as 153 Bcf.

As the number crossed trading screens at 10:30 a.m. ET, the January Nymex contract, already up about 6-8 cents from Wednesday’s settle, added another 4 cents or so, trading as high as $3.837 before pulling back into the $3.810-3.820 area.

But bulls couldn’t sustain any momentum on the EIA report, as prices reversed in short order to trade as low as $3.700 less than a half hour later. By 11 a.m. ET, the January contract was trading around $3.775, up about a nickel from the previous settle.

“This week we saw an impressive nonsalt draw in the South Central, though the salt draw was less impressive,” said Bespoke Weather Services, who had been looking for a 133 Bcf withdrawal for Thursday’s report. “This is a tight enough print to indicate that there could be a return of significant storage concerns on any sustained, major cold later in January into February.

“However, we are looking for a far looser print next week that will eat quite a bit into the storage deficit, which seems to be lessening the impact of this tighter print,” Bespoke said. “Overall, we see the impact on the market as neutral; it was not the bearish 133 Bcf withdrawal we saw as possible, but is not so tight as to overwhelm next week.”

Total Lower 48 working gas in underground storage as of Dec. 14 stood at 2,773 Bcf, 697 Bcf (20.1%) below last year’s stocks and 720 Bcf (20.6%) below the five-year average, according to EIA.

By region, the Midwest posted a 44 Bcf withdrawal for the week, while 40 Bcf was withdrawn in the East. The Pacific saw an 11 Bcf pull, with 7 Bcf withdrawn in the Mountain region. In the South Central, 29 Bcf was pulled from nonsalt for the week, while 9 Bcf was pulled from salt stocks, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |