NGI Data | Markets | NGI All News Access

Winter Natural Gas Prices Yo-Yo, Settling 11 Cents Lower as Spot Gas Retreats Again

After crumbling as much as 27.5 cents earlier in the day, January natural gas prices on Wednesday hit a wall and bounced back to recover a good portion of the losses. The Nymex January gas futures contract went on to settle at $3.726, down 11.2 cents on the day. February fell 8.9 cents to $3.653 and March dropped 5.2 cents to $3.506.

Spot gas markets were a sea of red, with more pricing hubs in the Rockies moving closer to $2 territory after two points crossed that threshold on Tuesday. The NGI Spot Gas National Avg. was down 23 cents to $3.39.

On the futures front, prices were soft from the get-go as the January contract was trading about a nickel lower in the early-morning hours but then plunged as much as 20 cents just before the market’s open. The steep decline was seen as indication that Tuesday’s 30-cent rally was nothing more than a technical bounce, according to NatGasWeather.

With little change in midday weather data, Wednesday’s late-session bounce was likely because of technical trading as well. The latest weather models were quite similar to the overnight Tuesday models that added several heating degree days over the nine- to 15-day period, “but still not cold enough to be considered bullish,” NatGasWeather said.

Overall, national demand was expected to be light and bearish the next 10 days, then it was increasing toward normal/neutral Dec. 30-Jan. 2 as cold conditions over the West spreads eastward, the firm said.

Further out, there was the potential for a colder shift for the first half of January, with likely progression of the Madden Julian Oscillation (MJO) to colder phases and stratospheric warming supportive of more bullish weather, according to Weather Decision Technologies (WDT.)

Other leading meteorologists are even more bullish with an extra 15-25 gas heating degree days — the equivalent of roughly 1.7-2.7 Bcf/d, according to EBW Analytics.

While the stratospheric warming is a large unknown, WDT highlighted the potential for a displacement of the polar vortex leading to blocking patterns and prolonged colder temperatures from mid-January to early March.

“Although cold may take a little while to build given current warmth and low snow cover, it may rapidly become very strong — with the possibility of reversing the sharp price declines of the past seven to 10 days as the risk of price spikes returns,” EBW CEO Andy Weissman said.

For now, the span of mild weather was expected to vastly improve the dismal storage picture. Deficits near 723 Bcf were expected to hold through Thursday’s Energy Information Administration (EIA) storage report, then would likely improve 150 Bcf toward 575 Bcf after the following several EIA reports account for the current mild spell, according to NatGasWeather.

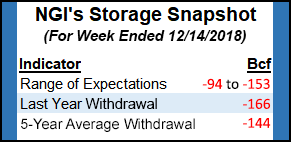

As for Thursday’s storage report, estimates pointed to a withdrawal in the low to mid-130 Bcf range. Kyle Cooper of IAF Advisors and Bespoke Weather Services each projected a 133 Bcf draw, while EBW expected a 145 Bcf pull. A Bloomberg survey of 11 market participants had a range of 118 Bcf to 146 Bcf with a median draw of 135 Bcf. A Reuters poll of 16 market participants had an even wider range, with a lowball estimate of 94 Bcf, a high of 153 Bcf and a median of 133 Bcf.

Last week, the EIA reported a 77 Bcf withdrawal, which left inventories sitting at 2,914 Bcf as of Dec. 7. Thursday’s number for the week ending Dec. 14 will be compared to both last year’s 166 Bcf draw for the week and the five-year average pull of 144 Bcf.

“Any further improvement during the first half of January, and the threat of hefty deficits causing supply issues this winter season will notably lessen and why we view the first two weeks of January as a critical period where strong cold blasts need to return if bulls are going to reignite this market,” NatGasWeather said.

But Mobius Risk Group warned that a normal weather environment from January to March may lead to a withdrawal season-ending inventory level of just above 1.1 Tcf. The estimate is based on Mobius’ view of current weather-adjusted supply and demand.

“A season-ending level this low would likely be uncomfortably low, and thus even a modest colder shift to weather forecasts could drive a very sharp retracement of the recent price decline,” analysts said.

Meanwhile, production remains off highs because of various pipeline maintenance events, and early indications for next year’s drilling programs could portend a possible pullback on growth as oil prices on Wednesday traded near their 15-month low amid growing economic concerns and fears of a supply glut in 2019.

The Dow Industrial Average also lost 1.49% to close on Wednesday at its lowest level of 2018, while the U.S. Federal Reserve, which hiked interest rates for the fourth time this year, said it would raise interest rates more slowly in 2019 as it expects modestly slower economic growth over the next year.

While the lion’s share of gas production growth has occurred in the Marcellus Shale, associated gas from the oily Permian Basin has also grown rampantly this year.

Permian pure-play Diamondback Energy Inc. has dropped three rigs, reduced completion crews and plans conservative spending in 2019 because of the “dramatic decline” in oil prices. The Midland, TX-based independent issued 2019 capital and production guidance late Tuesday, and while activity is expected to ease, production growth was still forecast to reach 275,000-290,000 boe/d, which at the midpoint implies 28%-plus year/year growth.

Meanwhile, another Permian explorer, Ring Energy Inc., boosted its capital spending in September to build out infrastructure in the Delaware sub-basin and Central Basin Platform. But the producer on Tuesday also said it was pulling back, with plans to run only one rig in the play during 2019.

Spot Gas Softens Again

Spot gas prices were overwhelmingly lower with only pockets of seasonally strong demand expected across the South and Southeast on Thursday as a strong weather system moved across those regions. The system was then expected to track up the East Coast Friday and Saturday with areas of rain and snow, “just not very cold,” according to NatGasWeather. The rest of the country was forecast to be mild with above-normal temperatures.

In Texas, most next-day gas prices were down 10-20 cents, although sharper moves lower were seen in West Texas. Waha tumbled 33.5 cents to $1.52.

Louisiana pricing hubs also posted declines of 10-20 cents, as did points across the Southeast.

OGT in the Midcontinent posted the most significant decline in that region as it shed nearly a quarter to reach $2.67, while Southern Star held steady at $3.00 from a planned maintenance event scheduled to start Thursday.

Southern Star plans to conduct pigging runs on segment 315 running from Texas County to Grant County, OK. The first pigging phase is to end on Saturday (Dec. 22), resuming on Dec. 27 for a second phase ending Dec. 31. Operational capacity at the Straight Blackwell compressor station (CS) would be limited to 97 MMcf/d during both maintenance phases.

Flows through segment 315 have averaged 228 MMcf/d over the past 60 days, according to Genscape Inc. This restriction is estimated to cut gas flows by about 131 MMcf/d. “The gas through segment 315 travels toward Blackwell CS in Kay County, OK, and then onto Southern Star’s Market Zone in Kansas and Missouri. The cut gas flows comprise approximately one-fifth of all gas flowing to the Market Zone,” Genscape analyst Dominic Eggerman said.

While current forecasts indicate colder weather in the Midcontinent during these maintenance phases, which would drive increased heating demand, the upside for cold is still below seasonal averages for the winter, he said.

Over in Appalachia, prices were down as much as 24.5 cents at Dominion South, while Northeast points continued to notch far more substantial losses. Algonquin Citygate spot gas dropped $1.005 to $3.845, while Transco Zone 6 non-NY slid a nearly a quarter to $3.545.

On the pipeline front, Enbridge Inc. continued to refine its return-to-service plan for the sections of East Tennessee Natural Gas system, which ruptured last weekend. While the pipeline operator did not have an estimated time of restoration, its teams have procured the necessary resources and materials required for construction, as well mobilized new pipe joints to the site for replacement. It also continues to stage equipment and prepare the site for construction.

“Enbridge is committed to bringing the affected section of its East Tennessee Natural Gas system back to operation in a safe manner,” it said on its website.

Meanwhile, Texas Eastern Transmission (Tetco) on Tuesday declared a force majeure from an unplanned outage on its Entriken, PA, compressor station on M3’s northern Penn-Jersey Line. Capacity through the compressor is limited to 2.59 Bcf/d for the duration of the outage, a 340 MMcf/d reduction from normal operational capacity and a 493 MMcf/d drop day/day, according to Genscape.

“Flows have averaged 2.73 Bcf/d and maxed at 3.00 Bcf/d during the last 14 days, but this is not representative of the volatility the downstream demand over the last month, causing a range of 1.46 Bcf/d between min and max flows over that timeframe,” Genscape natural gas analyst Josh Garcia said.

There was no estimate for a return to service, but last week Tetco experienced an unplanned outage at its Bernville Compressor Station, also located in Pennsylvania, which was resolved in one gas day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |