Shale Daily | E&P | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Plenty More Natural Gas in Barnett, Fayetteville, Haynesville and Marcellus, Say Researchers

The amount of natural gas that may be technically recovered from future well locations has improved by 20% from five years ago on technology gains, even while active drilling has depleted the resource, according to an analysis of the Lower 48’s top four shale gas fields.

Researchers with the Bureau of Economic Geology at the University of Texas at Austin (UT) reviewed the production capabilities and total gas in place (GIP) of the Barnett, Fayetteville, Haynesville and Marcellus plays.

The new study updates research conducted by UT on each of the four plays from 2011-2013, research that at the time was considered the most comprehensive of its kind on unconventional resources.

“Five years ago, we hardly thought of multilayer or stacked well drilling, or of quadrupling lateral well length,” said principal investigator Svetlana Ikonnikova, bureau research scientist.

Developments in drilling technologies, market conditions, cost structures and improvement in geological characterization prompted the research team to update the assessment, she noted. The team used 3-D modeling and advanced data analytics to enhance the understanding of:

Researchers determined that future gas wells in the four shale plays may technically recover about 780 Tcf — in addition to about 110 Tcf recovered by wells drilled to the end 2017. Technically recoverable gas may be produced using available technology and industry practices.

The previous estimate by the bureau put technical gas recovery of the four plays at about 650 Tcf. Total gas held in the four shale plays now is estimated to be 3,100 Tcf.

“The United States consumed about 27 Tcf of natural gas in 2017, so the new estimate suggests the addition of about five years of domestic consumption,” researchers said.

New drilling practices were credited with the improved recoveries and reduced costs/unit, which may allow producers to continue drilling “even during periods of low oil or natural gas prices.”

Increasingly, operators use stacked drilling to access gas by expanding the vertical reach of fracturing. Drilling wells closer together and installing wells that may run horizontally for two miles-plus also has improved recovery.

Co-principal investigator Katie Smye, a bureau geologist, said it’s important to understand the amount of GIP to verify what proportion has been recovered, then compare results across the formations to determine where additional wells may be drilled and efficiencies improved.

For instance, in the Haynesville and Marcellus plays, only 2-3% of total GIP is expected to be recovered by wells that have been drilled to date, she said. The percentage is influenced by several factors, including technology, economics and the amount of the play available for drilling.

“The Marcellus contributes the majority of the gas-in-place due to its size and resource density,” Smye said. “However, resource density in the Haynesville is comparable to the best areas in the Marcellus.”

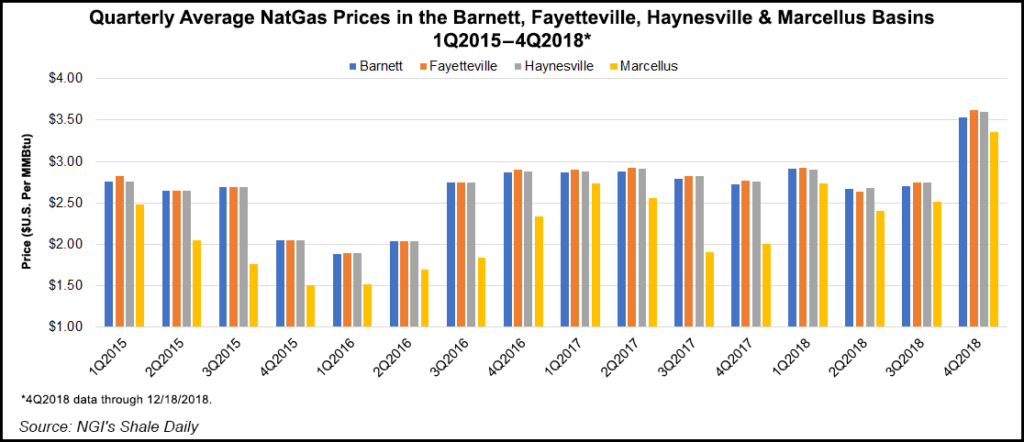

In the base case scenario of the study, researchers assumed a natural gas price of $3.25/MMBtu and an oil price of $65/bbl.

“Despite being lower than price assumptions from the past analysis, these prices yielded a 20% increase in natural gas supply compared with the base case scenario in the original study.,” the research found.

Other price scenarios also were tested. A low gas price was tested at $2.75/MMBtu and an oil price of $50/bbl, as well as a high gas price of $4.50/MMBtu and $80/bbl oil. Scenarios were in line with price projections by the Energy Information Administration to about 2030.

“Even with the boost in production, the analysis shows production will plateau around 2030, barring a more dramatic price increase or boost in technology,” researchers noted.

The analysis emphasized the need to better understand cross-play dynamics in terms of capital allocation and investment decision making.

“Sharp declines in drilling and production from the Barnett and Fayetteville shales imply that these plays have matured, although they may simply be less attractive in terms of return on investment relative to other plays, especially those with more liquids production.”

The bureau’s Tight Oil Resource Assessment consortium also is working on Permian Basin, as it has attracted most investments in recent years.

The bureau is part of the UT Jackson School of Geosciences and is the State Geological Survey of Texas. The 15-member interdisciplinary Shale Production and Reserves Study team integrates engineering, geology and economics. Peer-reviewed studies of the technical analyses, funded by the Department of Energy’s National Energy Technology Laboratory, are be published in the coming months.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |