NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Cheniere’s Sabine Pass LNG Train 6 Near FID as Petronas Contracts for 20-Year Supply

Cheniere Energy Partners LP on Tuesday said it has secured another liquefied natural gas (LNG) supply contract that may help to advance building the sixth train at the Sabine Pass export facility in Cameron Parish, LA.

Petronas LNG Ltd. (PLL), a subsidiary of Malaysia’s state-owned Petroliam Nasional Berhad, aka Petronas, made the sale and purchase agreement (SPA) with Cheniere’s Sabine Pass Liquefaction LLC for 1.1 million metric ton/year (mmty) over 20 years on a free-on-board basis.

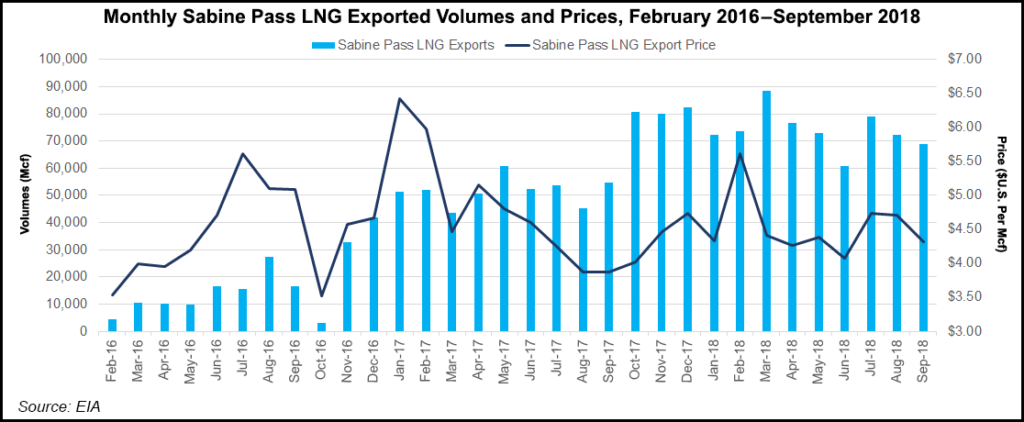

The SPA is subject to a final investment decision (FID) by Cheniere to build Train 6 at the facility, which has been exporting gas overseas since 2016.

“Petronas is one of the largest and most experienced participants in the global LNG market, and we are pleased to have it as our newest foundation customer at Sabine Pass, supporting Train 6,” Cheniere Partners CEO Jack Fusco said.

“This 20-year agreement with Sabine Pass Liquefaction continues our momentum on Train 6, where early engineering, procurement, and site preparation activities have recently commenced ahead of a final investment decision.”

During the third quarter, Cheniere signed an engineering, procurement and construction contract with Bechtel Oil, Gas and Chemicals Inc. to build the sixth train at Sabine Pass. The Petronas SPA will support progress toward an FID in 2019, Fusco said.

Petronas’ Ahmad Adly Alias, vice president of LNG Marketing & Trading, said the contracted volumes would enhance the company’s supply portfolio “and further strengthen our position as a reliable global LNG portfolio player.”

Petronas is a 25% partner in the Royal Dutch Shell plc-led LNG Canada, now under construction on British Columbia’s Pacific coast after achieving FID earlier this year. Swiss trading firm Vitol Group, one of the largest energy traders in the world, in late November stepped forward as a 15-year customer from the Petronas’ share in the LNG Canada project.

Contracts to support Cheniere’s expansions, which include the nascent Corpus Christi LNG export project in South Texas, are progressing. For example, Vitol in September inked a 15-year contract with Cheniere for 70,000 mmty.

In November, Cheniere secured a 24-year SPA with Poland’s state-owned Polskie Gornictwo Naftowe i Gazownictwo SA (PGNiG) for 1.45 mmty beginning in 2019, with the full annual quantity starting in 2023.

The PGNiG SPA last month brought the total amount of contracted volumes signed this year by Cheniere to more than 6 mmty, with an average 20-year contract, Fusco said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |