NGI Weekly Gas Price Index | Markets | NGI All News Access

Arrival of More Moderate Temps Sends Weekly NatGas Physical, Futures Prices Tumbling

Natural gas prices plummeted during the Dec. 10-14 week as demand retreated with milder weather moving across the United States. Steep losses of 20-30 cents were seen across much of the country, with far more dramatic declines in the West, Rockies and the Northeast. The NGI Weekly National Avg. plunged 59 cents to $4.25.

Over in the natural gas futures market, the January contract — with help from a large drop on Friday — finished 66.1 cents lower for the five-day trading week at $3.827.

Even points across the South and Southeast posted substantial declines for the week, even as demand was set to remain above seasonal norms thanks to a weather system that began moving across the region Thursday evening. Benchmark Henry Hub fell 24 cents for the week to $4.265, while Transco Zone 5 South tumbled 80 cents to $4.435.

Prices across the country’s midsection posted losses of 20-30 cents, although both OGT and Panhandle Eastern in the Midcontinent notched decreases of more than 40 cents.

Similar declines were seen in Appalachia, while Northeast market hubs posted more dramatic declines. Points across New England tumbled more than $2 for the week, but prices remained at a sharp premium to other points in less constrained areas. Transco Zone 6 NY plunged 67 cents to $4.50, a more than $2 discount to Algonquin Citygate.

Over in the Rockies, Northwest Sumas continued to retreat, not only because of the milder weather but also due to increased Canadian imports on Enbridge Inc.’s Westcoast Transmission. Prices tumbled more than $3 to $5.21. Other regional points fell anywhere from 34.5 cents to $1.945.

Similar weakness was seen in California, where Malin dropped $1.815 to $4.58 and SoCal Citygate shed $3.96 to $6.945.

Futures Still Jittery, But Latest Forecasts Ease Concerns

Natural gas futures prices continued to swing wildly during the Dec. 10-14 week as traders responded to any modest flip in weather data given ongoing concerns about supply this winter.

Most of the action was concentrated at the front of the curve, with winter strip prices continuing to see wide intraday trading days throughout the week, even as milder temperatures began spreading across the country. The Nymex January contract surged as high as $4.666 at the start of the week but then plunged back below the critical $4 technical support level on Friday as overnight weather model guidance trended significantly more bearish, with all model runs showed ridging able to build across the East in the long range that would prevent gas-weighted degree days (GWDD) from rising back to seasonal averages into the end of December.

Global Ensemble Forecasting System guidance remained by far the coldest as there was a very large spread across models, according to Bespoke Weather Services. The model showed a couple of cold fronts across the northern tier that would keep GWDDs near average for a few days late in the month before warming again with an eastern ridge Days 14-16. During its midday run, however, it, too trended milder.

European model guidance showed even more pronounced warmth with sustained ridging that only looks to begin to be disrupted into early January, according to Bespoke. “This matches both tropical forcing propagation and climate guidance with analog support, meaning we favor warmth still winning out through December before cold gradually returns,” Bespoke chief meteorologist Jacob Meisel said.

Nymex January futures went on to settle Friday roughly 30 cents lower at $3.827, while February slid 27.4 cents to $3.753 and March dropped 25 cents to $3.606.

This decline, however, does not mean the end of severe upside price risk, according to EBW Analytics. In the Polar Vortex winter of 2013-14, for example, prices plunged 46 cents to $4.00 in January before rocketing higher to ultimately reach $6.14/MMBtu in February.

“Still, if the cold weather widely expected by leading meteorologists to materialize by early January turns out to be a bust, the price trajectory of winter 2014-15 — with a high of $4.49 in mid-November shrinking to $3.46/MMBtu one month later — offers a cautionary tale for bulls,” EBW CEO Andy Weissman said.

In the meantime, production was expected to return during the next several days following maintenance, and balances were rapidly loosening as warmth spreads across the country, according to Bespoke. Warmth dominating through the month should allow balances to stay loose and will ease the majority of storage concerns, which could even make prices around $4 appear overvalued if warmth can win out into the first third of January as well, the firm said.

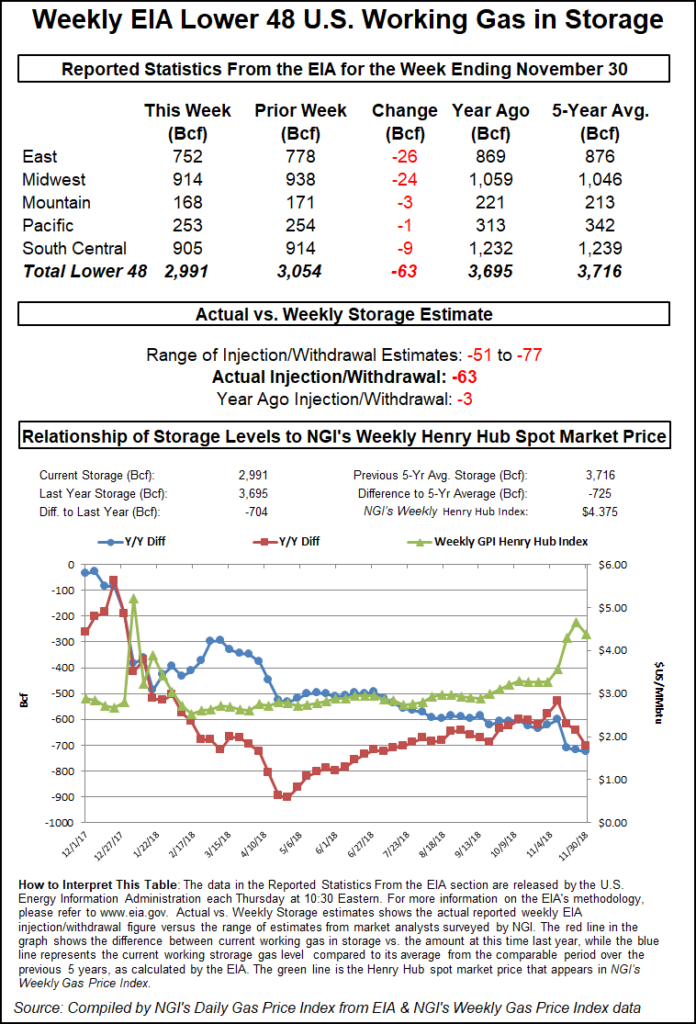

Indeed, the latest Energy Information Administration (EIA) storage report already reflected looser balances as it showed that 77 Bcf was withdrawn from inventories for the week ending Dec. 7. The reported draw was slightly below market expectations and left gas stocks at 2,914 Bcf, 722 Bcf below last year and 723 Bcf below the five-year average.

Meanwhile, salt dome facilities in the South Central region reported a 8 Bcf injection for the week, which caught many market observers by surprise but offered some additional reassurance of supplies for the rest of winter. Most observers agreed additional injections into salt dome facilities could be expected, although weather will remain the main determinant, they said.

Meanwhile, most market observers expect production to return to recent highs after a couple of weeks of significant day/day swings. Commodity Research firm Societe Generale said it expects production growth to remain strong enough to flip current storage deficits to a year/year surplus by the end of the 1Q2019, assuming normal weather.

“That surplus is expected to increase dramatically through 2019 courtesy of the strong production level that is already in place and the more muted year-on-year demand upside (assuming normal weather) in the first half of 2019 in particular,” natural gas analyst Breanne Dougherty said.

As of Friday, however, production remained off. In the Gulf of Mexico, a couple of the larger offshore production platforms were curtailing or shutting in production, according to Genscape Inc. There were no notices or maintenance scheduled for these platform outages, which may indicate field maintenance, the firm said.

“The drops are concentrated at the Auger platform connections with Garden Banks and KDWE, and MarsGath/Ursa on Mississippi Canyon. The Delta house platform on Destin was shut-in during the beginning of the month but has since resumed flows,” Genscape natural gas analyst Nicole McMurrer said.

In the Haynesville, the decreases were more concentrated on individual pipelines due to maintenance events. Columbia Gulf Transmission revised dates on one of its planned maintenance events to extend through Dec. 15 (instead of Dec. 1), which indicates a high potential impact to firm services, and outages for maintenance work related to pigging, valve maintenance and emission testing.

In the Permian Texas sample, Genscape showed substantial drops on the intrastate interconnects. “This often happens during cold weather spells and does not necessarily mean that there is a true drop in production. More likely, gas is being absorbed on the intrastate systems to serve higher local demand,” McMurrer said.

Genscape also was seeing a similar story play out in Ohio, where the Dominion East Ohio, Eureka Hunter Pipeline, Eureka Midstream and Ohio River System interconnects were down. Receipts from the Kensington gas processing plant were also down slightly.

Northeast Pennsylvania production was down mainly on Transcontinental Gas Pipe Line at Tomb’s Run, with a smaller drop along Tennessee Gas Pipeline at Teel. “Neither pipeline has any notices or maintenance posted that would explain these drops, however, when we see production declines at individual points and on individual pipelines, it’s more likely that it would be some sort of field maintenance or repair than freeze-offs, where we would see production drops across a number of points and pipelines,” McMurrer said.

Southwest Pennsylvania flows told a similar story, down mainly at the Steinmiller point on Dominion Transmission, according to Genscape.

Milder Temps Send Spot Gas Tumbling

Spot gas prices were overwhelmingly lower Friday as most of the country was expected to have mild weather through early in the upcoming week. The exception was in the South and Southeast as a strong weather system was forecast to sweep across those areas during the next couple of days with areas of rain, and as much as 7 inches of snow in some areas, according to AccuWeather.

Some of the heaviest rainfall from the storm was expected to fall from Florida to the Carolina coast. Low-lying areas in cities near the coast could be especially vulnerable, including Charleston, SC, and Tampa, FL, the forecaster said.

Meanwhile, other parts of the country were expected to be mostly mild, with high temperatures forecast in the 40s and 50s across the northern tier and 60s to locally 70s elsewhere, according to NatGasWeather. A fast-moving weather system was expected to race across the Northeast early in the week ahead with colder temperatures, but remaining mild over the rest of the country.

Additional weather systems were expected late in the upcoming week, “just not very cold ones,” the forecaster said.

The expected drop in demand led to dramatic 30-cent-plus decreases at most pricing hubs across the United States, with even steeper drop-offs in California and the Rockies. Points along the El Paso Natural Gas System in the Rockies fell more than 40 cents day/day as did Stanfield, which hit $3.97.

In California, PG&E Citygate was down 36 cents to $4.295.

One of the sharpest declines in the Northeast was seen at Tenn Zone 6 200L, where spot gas plunged 74 cents to $4.625. Other regional markets fell between a quarter and $1, and Appalachia points posted similar decreases.

Benchmark Henry Hub spot gas was down 33.5 cents to $3.895, while Southeast prices saw similar losses.

On the pipeline front, Gulf South was scheduled to perform overlapping maintenance on two main compressor stations in Louisiana. A notice of maintenance to the McComb compressor station in Tangipahoa County affecting Segment 130 was scheduled to be completed on Dec. 29 and cut capacity through the segment by 97 MMcf/d, according to Genscape.

Maintenance to the Delhi compressor station in Richland County affecting Segment 150 is set for Dec. 17- 22. Capacity on this segment will be cut by 136 MMcf/d, Genscape said.

Gas flows through the McComb and Delhi compressor stations have averaged 650 MMcf/d and 163 MMcf/d during the past 30 days. “With these restrictions in place, approximately 233 MMcf/d of gas flows will be cut on Gulf South,” analyst Dominic Eggerman said.

Even though East Texas and Louisiana were forecast for colder temperatures beginning Friday, temperatures were expected to gradually ease to seasonal norms by the middle of the week.

Meanwhile, West Texas markets recorded the only gains in Friday trading, although outright prices still trailed other hubs by well over $1. Waha spot gas jumped more than 20 cents to $2.315.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |