NatGas Traders Throwing Darts as January Ends Volatile Day Barely Changed; Spot Gas Rebounds

Natural gas traders clearly can’t agree on what the appropriate price for January natural gas should be as prices swung in a nearly 26-cent range before going on to settle a mere penny lower on Thursday.

The Nymex January futures contract ultimately settled at $4.124, down 1.2 cents, while February fell eight-tenths of a cent to $4.027. March, however, rose three-tenths of a cent to $3.856.

Spot gas prices mostly rebounded after a couple of days of declines, although gains were limited to less than a dime at most pricing locations, while the Northeast posted substantial declines amid waning demand in that region. The NGI Spot Gas National Avg. fell 9.5 cents to $4.11.

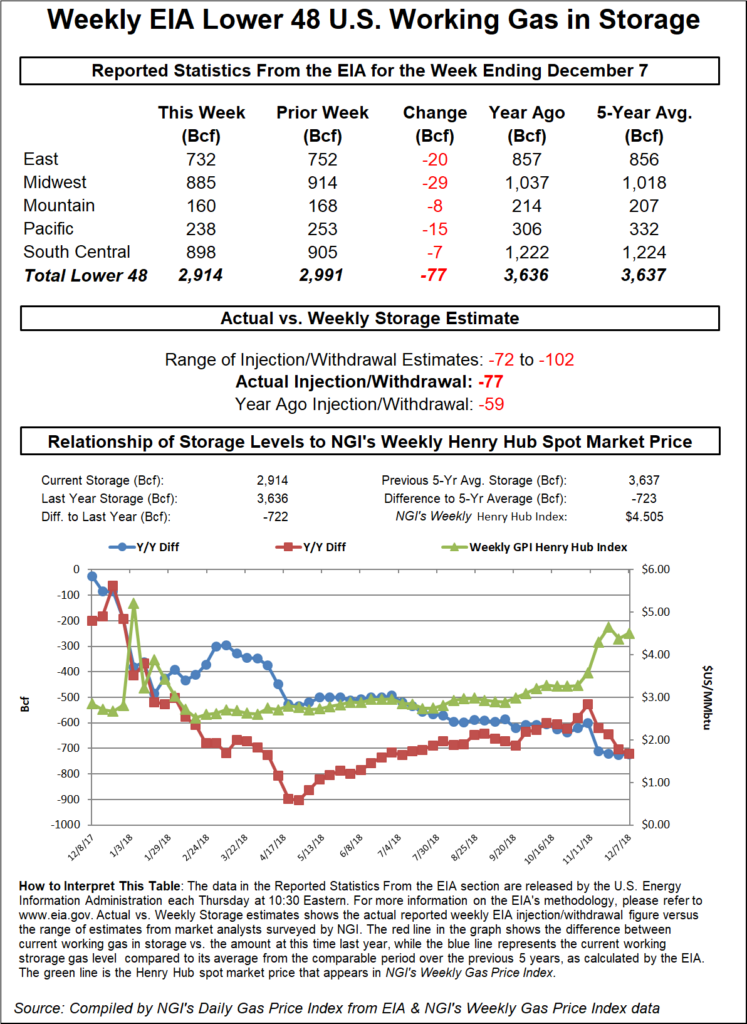

On the futures front, the Nymex January gas contract made a convincing run off multi-week lows early Thursday morning, rocketing some 17 cents higher ahead of the Energy Information Administration (EIA) storage report. Prices were near $4.27 when the EIA printed a slightly smaller-than-market expected draw of 77 Bcf, which was just a touch lighter than the five-year average withdrawal of 79 Bcf but sharply ahead of last year’s 59 Bcf pull.

The latest draw was also 5 Bcf below Bespoke Weather Service’s 82 Bcf estimate. After the firm missed 7 Bcf too low last week, “this again appears to be standard EIA noise as we saw a hefty 8 Bcf build across salts that was a bit larger than expected,” Bespoke chief meteorologist Jacob Meisel said.

The 8 Bcf injection into salt dome storage facilities took some market observers by surprise as well, but there were suggestions more injections could come, given the holidays are soon approaching, and weather is expected to be rather mild.

“The March/April spread will dictate salt injections/withdrawals. March/April is all about fear. Salt storage is a physical option,” one market observer said on Enelyst, an energy-related chat room hosted by The Desk.

The salt build and overall smaller drawdown even with some impressive cold to end the week were seen as slightly bearish for the natural gas market overall, helping ease storage concerns (with the March contract hit hard post-number), according to Bespoke. The Nymex March contract, which had traded as high as $3.976 before the storage report, had fallen to $3.929 just before 11 a.m. ET and dropped as low as $3.777 before recovering a bit.

Of course, weather will remain the main driver of whether salt dome facilities inject or withdraw in the weeks ahead, and Bespoke said it expects a much larger storage draw next week that should be “miles tighter,” thanks to significantly colder weather over the past week.

“However, it is now clearer that we need significant cold to really max out non-linear demand, as this print was solidly looser to our expectations,” Meisel said.

Broken down by region, the EIA reported a 29 Bcf withdrawal in the Midwest, a 20 Bcf draw in the East, a 15 Bcf pull in the Pacific and a 7 Bcf draw in the South Central. Total working gas in storage fell to 2,914 Bcf, 722 Bcf below last year and 723 Bcf below the five-year average.

While the market’s initial reaction to the storage report was rather limited, prices went on to drop several more cents only to rebound later in the session. “Clearly, there’s no reason for hourly 10-plus-cent price moves as algorithms play off technical triggers to aimlessly determine price,” NatGasWeather said.

All overnight weather models showed at least some colder air into the United States Dec. 22-27, just not nearly as impressive as some of the data suggested early in the week, the forecaster said. It’s worth noting that the early morning Global Forecasting System (GFS) data showed a much chillier scenario, “which could have aided morning buying, but the mid-day GFS didn’t hold the colder early morning trend. It does show how colder trends can quickly occur if polar air over Canada during the last week of December were to shift slightly southward.”

For its part, Weather Decision Technologies’ Week 4 preview featured a break from the prevailing Week 3 pattern, with colder-than-normal weather covering portions of the West, central and southeastern portions of the United States. Current forecasts suggest heating demand could increase by 25 gas-weighted heating degree days (GWHDD) from Week 3 to Week 4, potentially increasing weather-driven gas consumption by 7.7 Bcf/d week/week, according to EBW Analytics.

From a meteorological perspective, the stratospheric pattern is expected to once again become more favorable to cold weather during a stretch that includes Week 4 as the Madden-Julian Oscillation weakens and ridging returns over Alaska and the West Coast. “The exact timing of those climatological developments is uncertain, however.

“WDT’s outlook, if it verifies, could substantially bolster the case for bullish Nymex futures trading to close the month,” EBW CEO Andy Weissman said.

Meanwhile, Bespoke said while it does expect colder trends to win out moving into early January, “it looks to happen gradually with risks of a brief eastern ridge limiting how bullish forecasts can look.” Instead, current outlooks reflect a very strong signaling for a cold February.

Spot Gas Prices Bounce

Spot gas prices were higher Thursday even as mild high pressure was expected to dominate much of the country through the weekend, with exceptions across Texas and the South as a weather system with rain, snow and colder-than-normal temperatures tracks through those areas, according to NatGasWeather. A colder trending weather system was expected to race across the Northeast early next week, but it should be countered by mild conditions over the rest of the country.

Prices on the West Coast and in the Rockies recorded the sharpest increases as Malin jumped 30 cents to $4.44, while Kingsgate rose 18.5 cents to $4.30.

Volatility-prone SoCal Citygate moved against the pack as it plunged nearly 40 cents despite a maintenance event on the Southern California Gas (SoCalGas) system that was expected to have negligible impacts on gas flows. SoCalGas on Wednesday began an unplanned nine-day maintenance event, limiting firm operational capacity for its North Wheeler Ridge Sub-Zone to 145 MMcf/d.

That sub-zone had received an average of 141 MMcf/d in the past 30 days, according to Genscape Inc., and consists of SoCalGas’ receipt points from Pacific Gas & Electric and Elk Hills at Wheeler Ridge. “Multiple planned maintenance events have been performed here in the last two weeks: the removal and repair of a compressor turbine, and a remediation of the L225 pipeline,” Genscape natural gas analyst Joe Bernardi said.

This newest event’s description was cited as “leak repair” by the pipeline, and it has the same firm operating capacity limit as the previous two events, he said. “SoCalGas’ Kern interconnect at Wheeler Ridge (located nearby, but outside of this sub-zone’s operating capacity limits) has shown slight increases in scheduled volumes corresponding with this sub-zone’s recent reductions.”

Midcontinent spot gas prices were mixed, although most prices shifted less than a dime day/day. NGPL-Midcontinent was down 6 cents to $3.69 as Natural Gas Pipeline Company of America (NGPL) began a force majeure Thursday that cut roughly 175 MMcf/d of northbound flow through compressor station 103 in Ford County, KS, on the Amarillo Mainline to Chicago. NGPL is reducing capacity through the compressor due to horsepower issues and has no set date for a return to full service.

Month-to-date flows averaged 1,069 MMcf/d and timely nominations for Thursday showed an operational capacity of 926 MMcf/d, according to Genscape. “This translates to an expected reduction of 175 MMcf/d or more as these issues continue. Similar events earlier this year have reduced receipts at NGPL’s interconnects with El Paso Natural Gas,” Genscape analyst Matthew McDowell said.

Prices throughout Louisiana and the Southeast were up less than 10 cents at most market hubs, while Northeast and Appalachia prices softened. Not surprisingly, New England markets posted the most substantial declines, with PNGTS tumbling $2.115 to $7.14. The Appalachia Regional Avg. was down around 3 cents.

On the pipeline front, Tennessee Gas Pipeline (TGP) on Tuesday issued a force majeure at the 323 Compressor Station in Lackawanna County, PA. TGP restricted about 200 MMcf/d of gas through the compressor station beginning on Wednesday (Dec. 12), with no end date given.

The upstream Station 321 in Susquehanna County, PA, reflected the estimated reduction, and has averaged 1,773 MMcf/d in gas flows over the past 30 days, according to Genscape. “Station 321 has flowed near maximum operational capacity over the past week to meet elevated levels of New England cold-driven heating demand. This reduction has not been reflected in major downstream citygates (such as Boston), indicating that residential demand is being fulfilled,” Genscape natural gas analyst Dominic Eggerman said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |