NGI The Weekly Gas Market Report | E&P | Infrastructure | LNG | NGI All News Access

‘Biggest Ever’ Year Ahead Predicted for Sanctioned Global LNG Projects

Uncontracted demand by the world’s seven largest liquefied natural gas (LNG) buyers — all based in the Asia Pacific — may quadruple to 80 million metric tons/year (mmty) by 2030, according to Wood Mackenzie.

The seven buyers, which together account for more than half of the global gas export market, are China National Offshore Oil Corp., aka CNOOC, Taiwan’s CPC Corp., Japan’s JERA Corp. Inc., Korea Gas Corp., PetroChina Co. Ltd., China Petroleum & Chemical Corp., aka Sinopec, and Tokyo Gas Co. Ltd.

After several “quiet years,” the Asian players are active again in contracting for global LNG, with more than 16 mmty of contracts announced this year, researchers said.

“As China pushes on toward a lower-emission economy, its demand for gas and LNG has grown significantly and we expect the trend to continue in the longer term,” said research director Nicholas Browne.

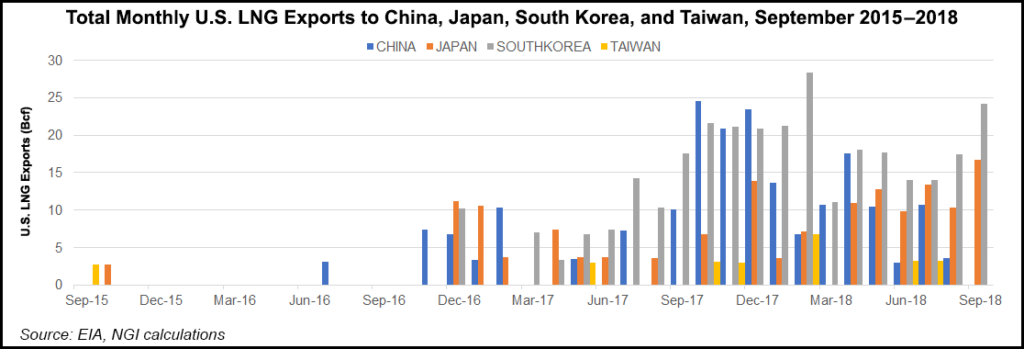

China is expected to surpass Japan as the largest LNG importer, with net imports approaching the level of the European Union by 2040, according to the International Energy Agency (IEA). The IEA’s New Policies Scenario envisions gas demand in China tripling to 710 billion cubic meters (bcm) by 2040, up 100 bcm from the 2017 analysis because of concerted coal-to-gas switching.

“Other traditional major buyers, on the other hand, are facing legacy contract expiries and will be on the hunt for a mix of contracts to lower average costs and security in supply sources,” Browne said.

On the supply front, Wood Mackenzie’s researchers are forecasting 2019 to be a record year for LNG project sanctions with more than 220 mmty of gas targeting final investment decision (FID).

“Some of the less prepared or competitive projects will slip into 2020 and beyond, but nonetheless a bumper year beckons.”

Frontrunners possibly getting the green light to move forward include the $27 billion Arctic LNG-2 in Russia, at least one project in Mozambique and three in the United States.

A bevy of U.S. projects are on the drawing board that are awaiting sanctioning for the Gulf Coast, West Coast and Alaska.

In Mozambique, two projects with U.S. ties are underway. A development plan covering the first phase of Mozambique Rovema Venture SpA’s export project was submitted for government approval, ExxonMobil Corp. and its partners said in July. Last year ExxonMobil and Eni SpA sanctioned the Coral South floating LNG project in Mozambique’s Area 4, which is to have capacity of up to 3.4 mmty.

Also in Mozambique, an LNG project led by Anadarko Petroleum Corp. is securing agreements for long-term supply from its Mozambique LNG1 Co. Pte. Ltd., bringing the project closer to FID.

“Nearer to Asia, expansion and backfill projects in Australia and Papua New Guinea will also be in the running,” Wood Mackenzie noted.

However, LNG suppliers are facing the changing needs of major buyers, which are seeking a variety of contracts.

Besides the price, buyers are looking for “contract flexibility, index, source diversification, upstream participation and seasonality,” researchers noted.

“Market liberalisation and uncertainty on longer-term demand in more mature markets, such as Japan, South Korea and Taiwan, will mean more room for spot and short-term purchases,” Browne said.

“While oil indexation will continue to dominate markets due to familiarity and ability to hedge, Asian buyers should be more inclined toward hub indexation to boost diversity and enable sales into Europe.”

Next year “will be the biggest year ever, in terms of LNG capacity sanctioned, for liquefaction project FIDs,” Browne said. “Asia’s major buyers will be at the forefront in ensuring this next generation of LNG supply is brought to market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |