NGI The Weekly Gas Market Report | Markets | NGI All News Access

Henry Hub Natural Gas to Average $3.11 in 2019, Says EIA

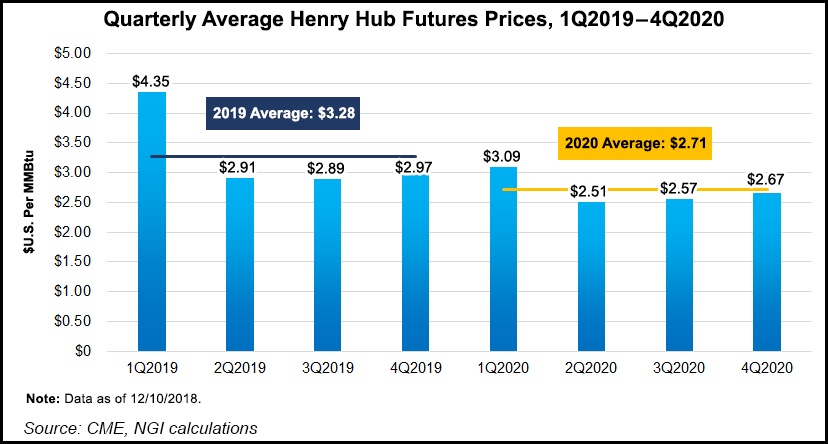

Strong growth in U.S. natural gas production in 2019 will outweigh low inventory levels and put downward pressure on prices, resulting in an average Henry Hub spot price of $3.11/MMBtu for the year, 6 cents below the 2018 average, according to the Energy Information Administration (EIA).

The price forecast, included in EIA’s latest Short-Term Energy Outlook (STEO), is up 13 cents/MMBtu compared with the $2.98/MMBtu prognostication in the previous STEO.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |