NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Return to Bitter Cold Drives up Weekly Natural Gas Prices

While natural gas futures prices continued to swing wildly in both directions during the Dec. 3-7 period, cash market direction was more clear as mild start to the week quickly gave way to more frigid conditions by midweek.

Several pricing hubs posted gains of a dime or so, but market hubs in the historically volatile New England notched increases of around $3 while some points in the Rockies rose more than $1. The NGI Weekly National Avg. jumped 43 cents to $4.84.

With some of the cold weather expected to hit the traditionally milder Texas and southern United States, pricing hubs in those regions rose around 10 to 15 cents. Henry Hub rose 13 cents for the week to $4.505, while Houston Ship Channel climbed 16.5 cents to $4.57.

Permian Basin pricing also got a boost and notched hefty increases of well more than $1, although prices remained far behind others in the country as pipeline bottlenecks continue to limited outflows from the supply region.

Mostly small gains were seen in the Midcontinent and Midwest, while Appalachia pricing hubs posted increases of as much as 40.5 cents at Texas Eastern M-3, Delivery, which rose to $4.945 due to some ongoing pipeline maintenance.

In the Rockies, El Paso Bondad was up more than $1 to $4.10, but Northwest Sumas plunged more than $6 for the week to $8.30 amid increased Canadian imports via Enbridge Inc.’s Westcoast Transmission.

Futures Go for Another Rollercoaster Ride

On the futures front, erratic — and sometimes unexplainable — price swings continued during the Dec. 3-7 period as weather models just can’t seem to stay on course for longer than a few days. The week started with a dramatic 27-cent plunge for Nymex futures as the warmer trends that had begun showing up in forecasts last week appeared more clear during the Dec. 1-2 weekend.

Despite little change in day-to-day weather data runs, the prompt month bounced off technical support and recovered a good chunk of that loss in Tuesday trading after gaining about 12 cents. After waffling a bit midweek, prices reversed course yet again on Thursday as the milder weather seen on tap beginning next week had no clear end in sight, with some weather forecasts not expecting a return to cold until around the new year.

Just as market bears got comfortable in the driver’s seat, Friday’s weather models flipped again, this time with guidance hinting at the first signs of an upstream pattern change back colder around Dec. 22 that could begin to bring gas-weighted degree days back above seasonal averages by around Dec. 25, according to Bespoke Weather Services. This could stoke “fears that cold returns into the end of the year even as warmth returns next Wednesday and should dominate for at least 10 days,” Bespoke chief meteorologist Jacob Meisel said.

The Nymex January contract went on to settle Friday at $4.488, up 16.1 cents on the day. February also climbed 16.1 cents to $4.378, while March rose a more significant 23.1 cents to $4.155.

Weather models failed to provide advance notice for the very cold weather in mid-November and again over Thanksgiving. Particularly with the bulk of price risk to the upside — as further cold shifts may result in a gas scarcity situation and are likely to have a much greater price impact than any warm shifts — the market remains vigilant for any further bullish signs ahead, according to EBW Analytics.

“If temperatures turn substantially colder, Henry Hub prices may reach as high as $8-10/MMBtu on individual days in mid-winter,” EBW CEO Andy Weissman said.

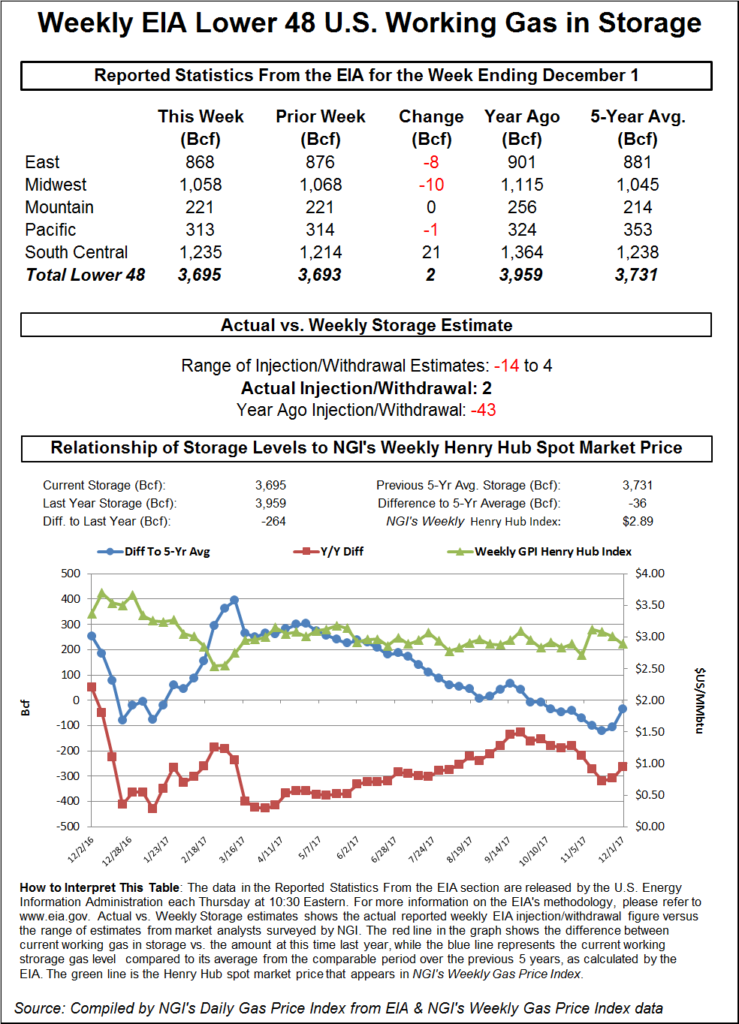

The concern over colder weather — and resulting upside price risk — come as storage inventories trail historical levels by more than 700 Bcf. The Energy Information Administration on Friday reported that gas stocks declined by 63 Bcf for the week ending Nov. 30, leaving inventories at 2,991 Bcf.

Weather Decision Technologies’ current forecast is nearly in line with the 30-year norm, leaving the market with end-of-season storage stocks at an estimated 1,115 Bcf. Many market observers generally consider the minimum operating threshold at around 800-850 Bcf before the ability to maintain pipeline system pressure begins to erode, according to EBW.

“Whether or not this prognosis is accurate, the market begins to react strongly once the end-of-season trajectory falls toward 1,000-1,100 Bcf — and even more strongly if storage is projected to fall into the triple digits,” Weissman said.

Significant risks to the balance-of-winter outlook may increase supply adequacy concerns, he said. “Due to the increasing size of the U.S. natural gas market, weather swings hold greater sway over the storage trajectory, primarily through weather-driven demand but also through supply freeze-offs.”

Indeed, with January historically being the coldest month of the year, the risk of freeze-offs is a concern as absolute gas production levels are at an all-time high. “If freeze-offs remain proportional to total production, one may reasonably conclude that production freeze-offs constitute a larger risk to the market than in the past,” Weissman said.

In addition, a growing percentage of new natural gas production has come from associated gas. Associated gas, co-produced alongside oil, has a higher risk of freeze-offs as liquids can freeze at a higher temperature and limit output flows.

“As a result, freeze-offs may again be larger — should temperatures warrant — and pose a further upside price risk to the market,” Weissman said.

In EBW’s base-case scenario, the firm is projecting 1.0 Bcf/d of freeze-offs for January, with production remaining subdued in February and only beginning to recover in March. “Still, there is a substantial risk that this figure may prove too low — narrowing the supply cushion that is protecting the market from even more severe price spikes — and introducing significant upside price risks for 1Q2019 futures.”

Spot Gas Rises on Frigid Weekend

Spot gas prices across most of the country rose Friday as weather conditions were expected to remain on the chilly side through early into the new week. A storm with heavy snow and ice was forecast to immobilize part of the South, although much drier air was expected to win the battle in the Upper Midwest through Sunday and the upper mid-Atlantic and New England early into the week, according to AccuWeather.

Forecasters expected the blockbuster snowstorm to slide eastward across North Carolina and southern Virginia and not make the northward crawl along the Atlantic coast. “This is not the type of storm where snow will continue to advance northward into the upper part of the mid-Atlantic and New England states,” AccuWeather senior meteorologist Brian Wimer said. “But, rather a westerly flow of dry air across much of the Northeastern states will limit the northward advance of the snow.”

While there was still a remote chance the storm would jog farther north near the coast, every indication pointed toward one-to-two feet of snow centered on western North Carolina, southwestern Virginia, southernmost West Virginia and far eastern Tennessee, the forecaster said.

Meanwhile, temperatures from Minneapolis and Chicago to Philadelphia, New York City and Boston should expect temperatures to average 5-10 degrees below normal, according to AccuWeather. Highs were forecast to range from the 20s across the northern tier to near 40 across the Ohio Valley and the upper part of the mid-Atlantic. Nighttime lows were forecast to range from the teens across the northern tier to the 20s in St. Louis and within a few degrees of 30 around Washington, DC, the firm said.

The frigid conditions on tap were expected to keep gas demand holding strong on Monday and Tuesday at 95.8 Bcf/d, according to Genscape Inc. Demand was then expected to quickly drop into Wednesday at 89.2 Bcf/d and then continue to shed an average 0.38 Bcf/d through the following seven days, the firm said.

Day/day changes to the six to 10-day weather forecast have removed about 0.3 Bcf/d from Thursday’s demand forecast, according to Genscape. “Day-over-day changes to the longer-range 11- to 15-day forecast have shown even more warming than previously expected, resulting in the removal of about 1.6 Bcf/d of demand in the forecast,” senior natural gas analyst Rick Margolin said.

On the pricing front, some of the most pronounced increases were seen in Texas, where double-digit gains were the norm, especially in the eastern part of the state.Katywas up 15.5 cents to $4.455, whileAtmos Zone 3was up 31.5 cents to $4.32.

In the Midcontinent, ANR SW posted a substantial increase of more than 20 cents to reach $4.135, while most other pricing hubs rose less than a dime. Most points in Louisiana notched gains of 10-15 cents, although benchmark Henry Hub lagged behind with an increase of just 7 cents to $4.48.

Meanwhile, Tennessee Gas Pipeline (TGP) on Monday is scheduled to begin repairing the line covering at compressor station 524 in Jefferson County, LA. Maintenance would reduce operational capacity through the station to zero (traditionally 607 MMcf) until the repairs are completed, which is expected by next Saturday (Dec. 15).

Flows through the compressor station had averaged 30 MMcf/d over the last 30 days or so and have maxed at 88 MMcf, according to Genscape. Within the last three months, flows maxed out at 164 MMcf/d, demonstrating the volatility of gas flows through TGP’s southern compressor stations.

On the East Coast, spot gas markets were mixed as New England pricing hubs tumbled lower despite the projections for stronger demand there through the weekend. Demand in the region was at 3.7 Bcf/d as of Friday timely cycles, and was expected to add another 8 heating degree days on average by Saturday, according to Genscape.

Although current demand is roughly 800 MMcf/d short of peak deliverability, “we are firmly in the molecule bidding demand range, already causing daily swings to the tune of several dollars during elevated demand days,” natural gas analyst Josh Garcia said.

Meanwhile, Algonquin Gas Transmission declared an operational flow order in anticipation for the weekend’s increased demand.

Nevertheless, Algonquin Citygate spot gas plunged $1.39 to $7.77, with only a slightly smaller decline seen at Tenn Zone 6 200L. Elsewhere in the Northeast, Transco Zone 6 NY jumped 77 cents to $5.435.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |