Jittery Natural Gas Forward Prices Plunge; Outlooks Indicate Warmer Temps Ahead

A jittery natural gas market plagued by a historic storage deficit that has only worsened before the peak of the winter season got some good news on the weather front as outlooks showed warmer temperatures beginning next week, a trend that could last for the next several weeks. January forward prices plunged an average 41 cents from Nov. 29-Dec. 5, while the balance of winter (February-March) dropped an average 31 cents, according to NGI’s Forward Look.

Most of the week’s declines occurred in Monday trading as futures traders appeared more confident in the warmer weather outlooks that had begun showing up in forecasts last week. The Nymex January contract shed 27 cents that day but then went on to notch three straight days of gains amid some slight variations in weather data. The prompt-month contract ultimately dropped 23 cents from Nov. 29-Dec. 5 to reach $4.469, while February slid 21 cents to $4.33 and the balance of winter dropped 21 cents to $4.17.

As for the latest weather models, there continues to be modest changes in day-to-day runs, but “the key theme across guidance was an easy ability for gas-weighted degree days (GWDD) to continue running below average through Dec. 20 with no clear indication of a pattern transition back colder yet,” Bespoke Weather Services said.

Indeed, Global Ensemble Forecast System (GEFS) guidance added back a significant number of GWDDs overnight Wednesday and again showed far more muted warmth in the long range, while European guidance actually ticked a bit more bearish, increasing what was already a very strong long-range warmth signal and showing it could have more staying power, according to Bespoke.

Meanwhile, the March futures contract stopped leading early Thursday as storage concerns appear to be easing off with such long-range warmth, “and that at least seems to put $4.25 back in play by the end of the week,” Bespoke chief meteorologist Jacob Meisels said. Still, production is off highs and burns were again revised far tighter with the current cold shot blanketing the eastern United States, “so current tight balances will keep prices bid and can result in short-term cash rallies. However, as long as these medium- and long-range warm risks remain, risk will be skewed lower, especially into earlier next week as cold breaks.”

As for storage, this week’s report, due out Friday, is not expected to move the needle much unless a large miss is reported by the Energy Information Administration (EIA), according to EBW Analytics. Estimates have clustered around a withdrawal in the low to mid-60 Bcf range, which would widen the deficit to year-ago levels but keep the deficit to the five-year average relatively steady.

A Bloomberg poll of 14 market participants showed a withdrawal range of 51 Bcf to 77 Bcf, with a median draw of 63 Bcf. A Reuters survey of 19 participants had estimates ranging from withdrawals of 57 Bcf to 77 Bcf and a median drawdown of 64 Bcf. Kyle Cooper of IAF Advisors projected a pull of 62 Bcf, while EBW expected a 61 Bcf draw.

Last year, EIA recorded a 3 Bcf withdrawal for the period, and the five-year average is a withdrawal of 58 Bcf.

Meanwhile, December’s most-likely weather outlook from Weather Decision Technologies (WDT) would portend 864 gas-heating degree days (gHDD), 7 gHDDs below 30-year normals and as much as 25 gHDDs below other widely followed meteorologists, according to EBW.

January is subject to the greatest upside risk as the coldest month of the year, the firm said. WDT’s forecast of 950 gHDDs is slightly below the 30-year average of 951 gHDDs, and other leading forecasters are relatively close. Potentially extreme outcomes are likely, EBW said.

“Even adding 100 gHDDs — 190 Bcf — of demand to January could erase the current storage cushion above the estimated 800 Bcf minimum national operating threshold and completely reshape the winter outlook,” EBW CEO Andy Weissman said.

February similarly holds the potential for significant colder-than-expected forecasts, as the back half of a moderate El Niño winter typically sees the most cold, according to the firm. WDT’s forecast at 783 gHDDs — which is 11 gHDDs above 30-year normals — is relatively benign compared to other forecasters with up to an additional 75 gHDDs, EBW said.

“As long as the February outlook contains the possibility of extreme cold, it will continue to support the idea of a bullish winter nationally and extreme price spikes, even if actual February forecasts shift and ultimately turn benign,” Weissman said. “In other words, as long as risk-averse local distribution companies respect the risk of an extremely cold February, rampant price spikes are possible.”

Northeast, Rockies Plunge

While forward price weakness was seen across North America, several key demand regions posted far more substantial declines than those seen in the futures curve. The most notable decline occurred in the Rockies, where increasing gas flows on Enbridge Inc.’s Westcoast Transmission system led to a sharp price drop at Northwest Sumas.

Northwest Sumas January prices plunged $2.37 from Nov. 29-Dec. 5 to reach $7.46, while February lost 86 cents to reach $5.05 and the balance of winter shed 64 cents to hit $4.34 according to Forward Look.

Other points out West also lost ground amid the increasing imports from Canada. Malin January was down 58 cents to $5.06, February was down 41 cents to $4.455 and the balance of winter was down 36 cents to $4.02.

The volatile SoCal Citygate saw January tumble almost $1 to $10.22, while February slipped just 19 cents to $8.495 and the balance of winter fell 27 cents to $6.96.

Although not directly tied to forward market prices, a pair of maintenance events planned on two natural gas pipelines could lead to some volatility in Thursday cash trading, which then could spill into forward trading.

Southern California Gas (SoCalGas) and Mojave Pipeline have scheduled pipeline work for Friday that will cut about 0.5 Bcf/d of gas at the Arizona-California border at Topock, according to Genscape Inc. Mojave’s planned force majeure valve repair will cut its receipt capacity from El Paso Natural Gas (EPNG) to zero. This will be the third force majeure to affect this interconnect in the past three weeks; volumes have averaged 364 MMcf/d during that time in spite of the flow disruptions, Genscape said.

“Mojave flows molecules from Topock west and delivers a portion of them back to EPNG’s Line 1903 at the Cadiz interconnect in California, with the remainder continuing west to the Mojave-Kern jointly owned line,” Genscape natural gas analyst Joe Bernardi said.

EPNG flows gas from Cadiz back southeast toward Arizona to the Ehrenberg border point, where much of it goes to SoCalGas. “Ever since SoCalGas has been able to receive gas at Topock again — which started in mid-September after a long outage — EPNG has been simply delivering more gas to SoCalGas at Topock instead of using the more complicated Line 1903 route,” Bernardi said.

Line 1903 flows have only averaged 17 MMcf/d in the past three weeks, according to Genscape. This force majeure will mean that EPNG’s ability to move gas on the Line 1903 route will drop off completely for one day.

EPNG, however, will not be able to simply reroute these Mojave/SoCal-bound molecules onto SoCalGas at the Topock interconnect, because SoCal is starting its own maintenance there on Friday as well, Genscape said. Its receipt capacity from both EPNG and Transwestern Pipeline at Topock will go to zero for one week, which would cut roughly 130 MMcf/d.

Transwestern’s deliveries at Topock have already been at zero for the last several weeks, but it could deliver more gas to SoCal at the nearby Needles interconnect in order to make up for SoCal’s lost receipts from EPNG at Topock, Bernardi said.

“These two events complicate SoCal’s import options, which could lead to more upward pressure on SoCal basis prices — particularly Citygate — to incentivize alternative supply, including storage withdrawals,” he said.

Genscape meteorologists are forecasting milder weather for southern California on Friday as the current cold snap there fades out. “This cold weather has driven SoCalGas’ system-wide demand above 3.0 Bcf/d for the first time since March, leading to the second-highest SoCal Citygate price spike since August,” Bernardi said.

On the opposite side of the country, Northeast prices barrelled lower as demand was set to retreat given the milder weather in the weeks ahead. New England points registered the steepest losses as multiple pricing hubs in the region posted declines of more than $1 at the front of the curve.

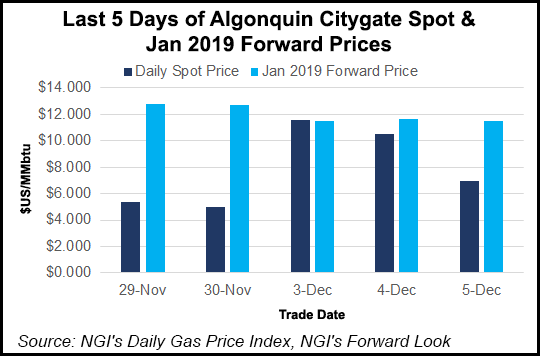

Algonquin Citygate January plunged $1.31 from Nov. 29-Dec. 5 to reach $11.52, according to Forward Look. February was down $1.29, while the balance of winter was down 90 cents to $9.34.

Sharp decreases, though not to the same extent as New England points, were seen along the Transcontinental Gas Pipe Line system. Transco Zone 6 NY January dropped nearly $1 to $10.50, February fell 71 cents to $10.38 and the balance of winter slid 54 cents to $7.53. Transco Zone 6 non-NY January was down 53 cents to $8.11, while February was down 48 cents to $7.83 and the balance of winter was down 41 cents to $6.10, Forward Look data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |