NGI All News Access | Infrastructure | LNG

Venture LNG Awards EPC Contract for Calcasieu Pass Export Project

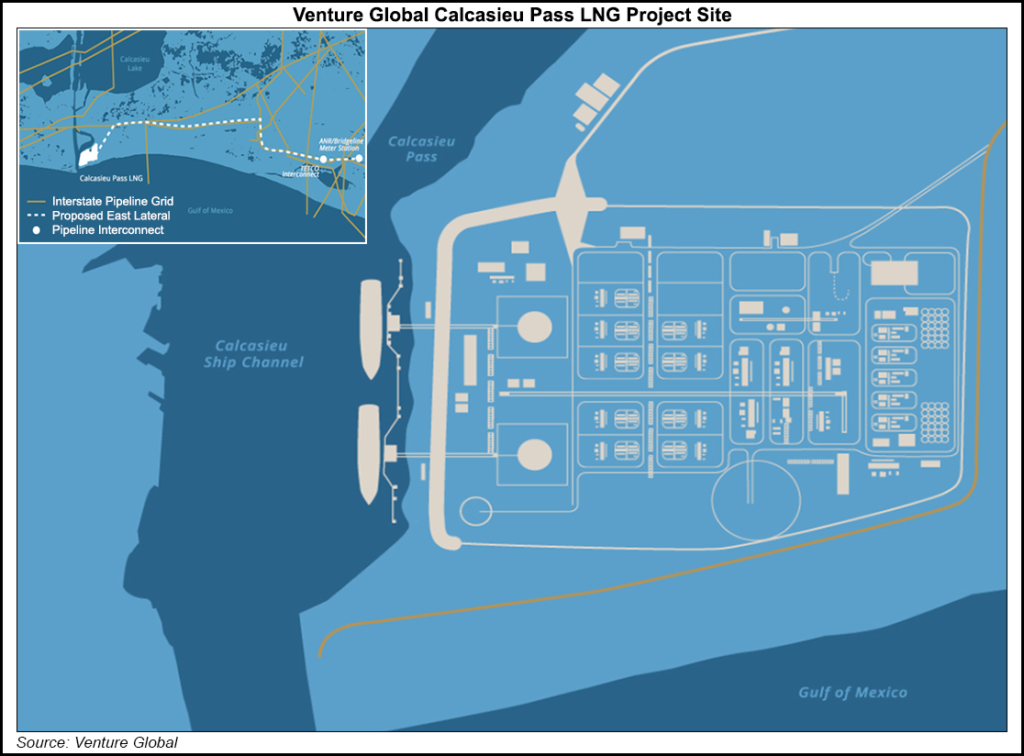

Venture Global LNG Inc., which has two Louisiana-based natural gas export projects on the drawing board, has awarded Kiewit the engineering, procurement and construction (EPC) contract for the Calcasieu Pass facility under development in Cameron Parish.

Under the terms of the turnkey EPC contract, Kiewit Louisiana Co. agreed to design, engineer, construct, commission, test and guarantee the liquefied natural gas (LNG) facility, which carries a 10 million metric tons/year (mmty) nameplate. If all things go to plan, completion of the first project is expected in 2022.

“We are thrilled to partner with one of North America’s leading contractors for our Calcasieu Pass project,” Co-CEO Bob Pender said. “The Kiewit team brings decades of construction experience, an unparalleled safety record, and on-time, on-budget execution of major infrastructure projects,” including the Dominion Cove Point LNG project on the Chesapeake Bay in Maryland, which has 5.3 mmty of capacity. Cove Point began commercial service in the spring.

“Kiewit is equally committed to our strategy of realizing the highest quality at the lowest achievable cost,” Venture Co-CEO Mike Sabel said. “They drive not only to execute but to continually improve and optimize their approach. Finalizing this contract, which meets our budget, schedule, and finance requirements, is one of the most important milestones to date for our company and the culmination of our development plans.”

Kiewit CEO Bruce Grewcock said the Calcasieu Pass facility would be “a model for supplying low-cost, clean and reliable energy to the global market. It’s exciting to be asked to bring our extensive industry experience and capabilities to help Venture Global LNG deliver the Calcasieu Pass LNG export project safely, on-schedule and on budget.”

The Calcasieu Pass facility would employ a comprehensive process solution from GE Oil & Gas LLC, which uses mid-scale, modular, factory-fabricated liquefaction trains as well as combined-cycle gas turbines to support the trains’ electric-drive system.

Construction is set to begin in early 2019 once Venture has all regulatory approvals in hand, including a final order from FERC, which is currently scheduled to be issued by Jan. 22. The Federal Energy Regulatory Commission in October issued a final environmental impact statement for Calcasieu Pass.

Calcasieu Pass already has binding 20-year offtake agreements with several European-based LNG supply leaders, including BP plc, Royal Dutch Shell plc, Edison SpA, Galp, Repsol SA and Polskie Gornictwo Naftowe i Gazownictwo SA, aka PGNiG.

Venture’s proposed 20 mmty Plaquemines LNG export facility in Plaquemines Parish executed its first binding 20-year offtake agreement with PGNiG.

Formal final investment decisions (FID) on the Calcasieu Pass and Plaquemines projects are planned in 2019.

Venture, headquartered in Arlington, VA, said it also has entered into a $220 million bridge loan facility with Morgan Stanley Senior Funding Inc. and associated lenders that would be used to finalize engineering work and begin site construction activity for the Calcasieu Pass project before the formal FID.

The $220 million loan, along with the $635 million of equity capital raised to date, “allows us to finalize advanced engineering, purchase equipment, and commence construction activities at our Calcasieu Pass facility in the near term, reducing schedule risk for our offtake customers,” Pender and Sabel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |