Shale Daily | Bakken Shale | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

New Bakken Oil, Gas Takeaway Underway Unlikely to Be Enough, Says North Dakota Regulator

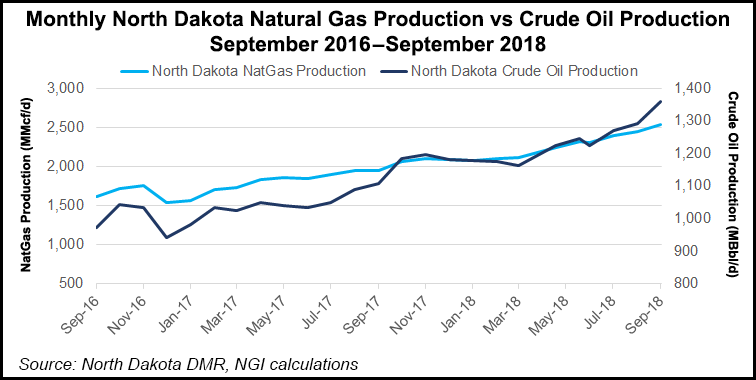

With oil and natural gas production growing at a record-setting pace, North Dakota officials are closely tracking industry plans for pipeline takeaway infrastructure that at the end of 2018 included natural gas liquids (NGL) and oil projects, along with processing plants and a refinery.

North Dakota Pipeline Authority Director Justin Kringstad said he thinks more infrastructure will be needed as the only Bakken pipeline system since last year to start up has been the Dakota Access Pipeline.

Kringstad said even with new projects on the drawing board, after 2020 the state will be short of takeaway capacity by 400,000-500,000 b/d.

“By our analysis, North Dakota will need continued investment in all midstream sectors,” Kringstad told NGI’s Shale Daily. Even with Phillips 66 and Bridger Pipeline LLC’s Liberty oil pipeline and Meridian Energy Group Inc.’s Davis Refinery under construction, up to 500,000 b/d would have to be made up by rail shipments.

The Davis Refinery is under construction on a 620-acre site near Belfield, ND, with a rated capacity of 49,500 b/d, and could produce as much as 800 million gallons/year of refined products.

Additional gas transmission capacity also will eventually be required from 2022-2027, he said, and post 2020, the area will begin to be short of gas processing. Eight new and/or expanded gas plants are scheduled to come online in the next 18 months, but their advantage is gone after 2020.

NGL production already exceeds the takeaway capacity, and while Oneok Inc.’s 900-mile, 240,000 b/d Elk Creek Pipeline project from the Williston Basin to the Midcontinent will help, more capacity is necessary over the longer term, Kringstad said.

The Elk Creek NGL pipeline, which is under construction, has a targeted start-up date of late next year. The 20-inch diameter line would complement Oneok’s existing Bakken Pipeline NGL transmission line and its half-stake in the Overland Pass Pipeline.

The $1 billion-plus Elk Creek project is designed to transport NGLs from Oneok’s Riverview terminal in eastern Montana to existing Midcontinent facilities in Bushton, KS. The current oil pipeline project includes the Liberty and the Red Oak lines, An open season is underway to take up to 350,000 b/d, including up to 200,000 b/d of Bakken crude, to Gulf Coast refineries.

“It’s the next big system, and it’s not solely just for Bakken crude, but also includes Rockies production as well,” said Kringstad. “I have not seen any of the route details; I think that depends on what shippers are lined up.”

Sponsored jointly by units of Houston-based Phillips 66 and Wyoming-based Bridger Pipeline LLC, the Liberty/Red Oak lines are the biggest project to come along since DAPL, Kringstad said. The systems are tentatively set to begin operations in late 2020.

Eight natural gas processing plants also are in development or under construction. Kringstad said gas production, which set an all-time record of more than 2.5 Bcf/d in the month of September, will eventually grow to more than 4 Bcf/d. In total, there are more than $3 billion in processing plant projects are on the drawing board.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |