January Natural Gas Shrugs Off 63 Bcf Storage Withdrawal

The Energy Information Administration (EIA) reported a 63 Bcf withdrawal from Lower 48 natural gas inventories for the week ending Nov. 30, on the higher end of market expectations but within the range.

Market observers characterized the draw as “neutral” as estimates had clustered around a withdrawal in the low to mid-60 Bcf range ahead of the report’s 10:30 a.m. ET release.

Nymex natural gas futures similarly reflected a neutral stance on the data as the January contract had already climbed about 12 cents ahead of the report, and then only inched up another penny or so to $4.457 as the print hit the screen. By 10:50 a.m., the prompt month was trading at $4.458, up 13.1 cents on the day.

“This moderately tighter print misses in about the same direction as last week’s print missed loose; we had expected slightly more lingering holiday impact in the number and were surprised by the size of the draw in the South Central,” Bespoke Weather Services said.

In fact, a larger 9 Bcf draw in the South Central accounted for almost the entire miss, the firm said. “We see this as indicating the market is slightly tighter than we had been expecting, and are looking for a tighter number to be announced next week with production off solidly over the last few days,” Bespoke chief meteorologist Jacob Meisel said.

This should make it harder for prices to fall off meaningfully unless long-range cold risks ease as such a print will keep storage concerns elevated, “and we would be surprised to see next week’s print do much to ease those concerns,” he said.

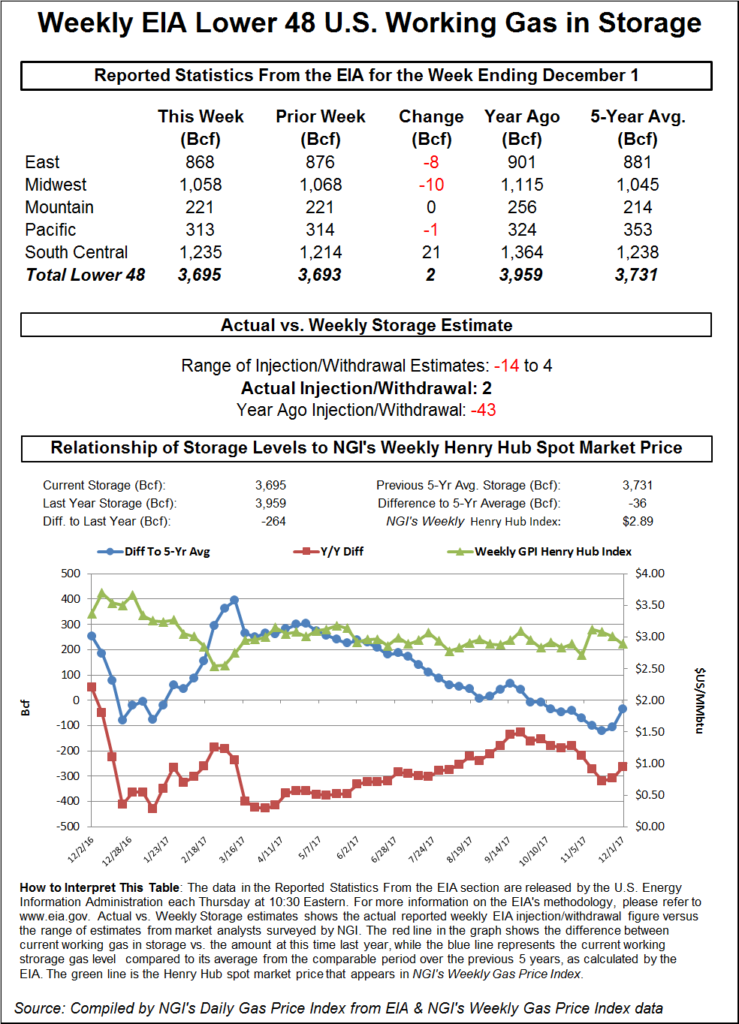

The EIA reported a 26 Bcf withdrawal in the East, a 24 Bcf pull in the Midwest and a 9 Bcf draw in the South Central region. Salt caverns in the South Central region, however, reported a 4 Bcf injection.

Inventories as of Nov. 30 sat at 2,991 Bcf, 704 Bcf below year-ago levels and 725 Bcf below the five-year average, according to EIA.

Even though this week’s storage report failed to move the needle much, colder weather is expected in the next few weeks. The risk to upside is certainly there, market observers said.

If long-range weather models that are currently showing a return to colder weather come to fruition, then the February contract could move into $5 territory, according Wood Mackenzie natural gas analyst Gabe Harris.

“Everyone only wants the strip further out to go up so they can have a good multi-month short opportunity,” Harris said Friday on an social media energy chat room hosted by The Desk.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |