NGI The Weekly Gas Market Report | Infrastructure | LNG | NGI All News Access

Tellurian Secures MOU with Vitol to Supply LNG from Driftwood Export Project

Tellurian Inc. has secured a memorandum of understanding (MOU) with Vitol Inc. to supply 1.5 million metric tons/year (mmty) of liquefied natural gas (LNG) for at least 15 years from the planned Driftwood LNG export facility on the Louisiana coast.

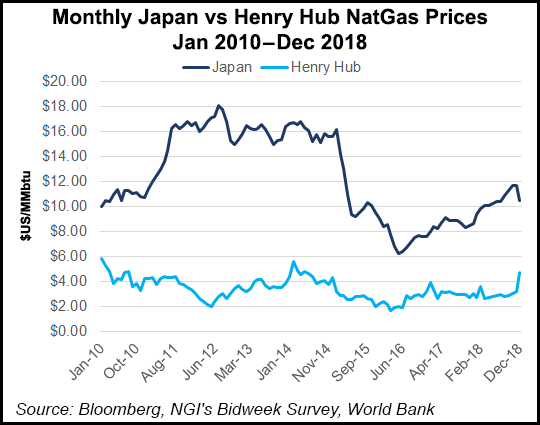

The transaction with one of the world’s leading traders by Tellurian Trading UK Ltd. is based on the Platts Japan Korea Marker (JKM), the Houston-based company said.

“The LNG business is evolving into a true commodity market, which includes LNG purchases and sales based on actual LNG prices rather than indexing to other energy products,” Tellurian CEO Meg Gentle said.

“JKM has emerged as the most liquid and transparent pricing mechanism for LNG.” Gentel noted that Vitol “has long been known for its innovation and creativity in the energy commodity markets,” which should help lead to “market transformation with a long-term LNG sale at the market index.”

Under the MOU, Tellurian and Vitol agreed to negotiate a sale and purchase agreement (SPA) under which Vitol would purchase LNG free on board (FOB). The SPA is to contain certain conditions, including Tellurian’s receipt of regulatory approvals and a final investment decision (FID) to construct the export terminal.

Vitol also is evaluating a potential equity investment in the Driftwood Holdings partnership.

Tellurian is designing a 27.6 mmty export project for Calcasieu Parish to be fed from its own Lower 48 production.

Vitol’s Pablo Galante Escobar, who is head of LNG, said Tellurian “is at the forefront of LNG in the U.S.,” noting the Driftwood project “offers a unique value proposition, which we are pleased to participate in as off takers and potential equity investors.”

Tellurian’s unique strategy centers around eliminating Henry Hub gas price volatility by owning the volumes. Proposed pipelines on the drawing table would move up to 4 Bcf/d to Driftwood from the Permian Basin and Haynesville Shale.

In October, Tellurian reduced the equity investment for the estimated $28 billion terminal in Calcasieu Parish, designed with five export trains, to $500/ton from $1,500/ton. The capital mix would shift from roughly $24 billion equity and $3.5 billion debt under the previous equity heavy structure to roughly $20 billion debt and just $8 billion equity under the new proposed levered approach.

Tellurian also in October revised the cost to deliver LNG FOB to $4.50/MMBtu, including $3.00 for feed gas/liquefaction and $1.50 for debt servicing. The previous total estimate was $3.00/MMBtu FOB.

As of August, about two dozen customers/partners had expressed interest in taking equity in Driftwood, according to Gentle.

France’s Total SA, one of the largest LNG buyers in the world, owns an estimated 23% stake in Tellurian, and GE Oil & Gas has a $25 million preferred equity investment. In addition, Bechtel Oil, Gas and Chemicals Inc. owns stakes and is working on the project design. How the revised financial strategy could impact current investments was not detailed.

A draft environmental impact statement for Driftwood was issued in September by the Federal Energy Regulatory Commission. An FID tentatively is scheduled by mid-2019. If it were to move forward, LNG exports could begin in 2023.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |