Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Natural Gas Constraints Unlikely to Slow Oil Momentum, Says Raymond James

Warning lights were going off in the Permian Basin two years ago that a dearth of natural gas infrastructure would surpass production, but the issues can be resolved and overall not pressure oil activity, Raymond James & Associates Inc. said Monday.

The Permian remains paramount as the “primary discussion point” for U.S. and global energy markets, analysts led by J.R. Weston and Justin Jenkins wrote in this week’s Energy Stat.

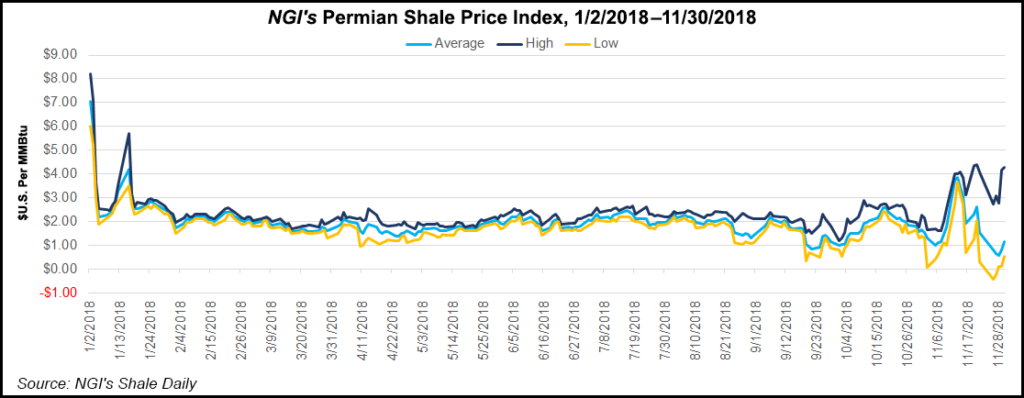

Two years ago, the management team at Enterprise Product Partners LP had warned gas production appeared headed for a train wreck with takeaway. Those constraints reached a pressure point last month, with Waha hub gas prices driving a “massive $4.00 differential to Henry Hub,” analysts said.

“As the Permian crude oil pipeline build-out has been ”pulled forward,’ associated gas production is also arriving sooner rather than later…likely the impetus for the recent decline in Permian gas prices.”

From 2017-2020, the Raymond James team is forecasting as much as 6 Bcf/d of Permian gas growth, nearly doubling output in three years. That means gas pricing likely will stay longer for longer, a view of many analysts.

Jenkins and Weston said Permian gas takeaway capacity is not constrained in the traditional sense, as nominal pipeline takeaway exceeds production. They estimated total takeaway to be about 12 Bcf/d versus production of 9 Bcf/d year-to-date. However, that includes takeaway to “suboptimal” markets, including Mexico.

There’s enough Permian-to-Mexico takeaway, but utilization rates are low, while takeaway is short to evacuate volumes to western and northern markets.

Moving gas to western markets, and eventually to California, is competing with renewables. Gas moving north competes with Rockies/Midcontinent supply. Neither of those outlets are “tremendous options” for Permian exploration and production (E&P) companies, Jenkins and Weston said.

“Putting it simply, because many of these outlets lead to suboptimal gas markets, this means these pipes don’t help regional pricing all that much…Our best guess is that Waha prices ”zipper’ modestly up and right back down with each brownfield pipeline expansion coming online (followed by production gains) in 2018-19.” Smaller capacity additions should provide a bridge until the 2 Bcf/d Gulf Coast Express comes online late next year, followed by other big pipelines into 2020 and beyond.

“South of the border, trends are certainly positive, but slow moving relative to Permian supply growth,” said the Raymond James team. Mexico produces about half of the gas that it consumes, a gap that is expected to increase over time.

In addition, the inauguration on Saturday of Mexico’s new president, Andrés Manuel Lopez Obrador, “is likely to reduce foreign investment in the country’s E&P industry,” which could mean more U.S. imports.

“Permian ethane recovery could also be a wildcard,” according to Jenkins and Weston. “As Gulf Coast ethane cracking demand and U.S. ethane export demand ramp up, the Permian is one of the likely contributors to meet the corresponding ethane supply growth needs. In other words, ”recovering’ ethane in the Permian should increasingly make sense.”

Most Permian ethane already is recovered from the gas stream, but it provides an opportunity to reduce gas pipeline volumes.

Overall, however, the Permian gas constraints should have no impact on the basin’s massive oil production, analysts said. “Permian gas, while constrained, will be a non-event from a broader industry perspective due to several ”workarounds.’”

First, gas flaring could be supplemented by waivers for E&Ps, resulting in 2-3 Bcf/d by the end of this year, if needed, they noted. Texas regulators are expected to be flexible when it comes to enforcing compliance with the state’s anti-flaring regulations.

If flaring is unavoidable, the basin’s liquids-weighted output economics still should work, even if lower West Texas Intermediate and higher Midland-Cushing differentials play a role in the equation.

The Permian has a “sizeable inventory” of legacy gas wells, which could be shut in before the liquids-rich production is stopped, Jenkins and Weston said.

“Simply put, we feel comfortable stating that there will be no slowdown of Permian crude oil production due to Permian gas takeaway issues.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |