NGI All News Access | E&P | Infrastructure

U.S. Drops Five Natural Gas Rigs but Oil Count Inches Higher, Says BHGE

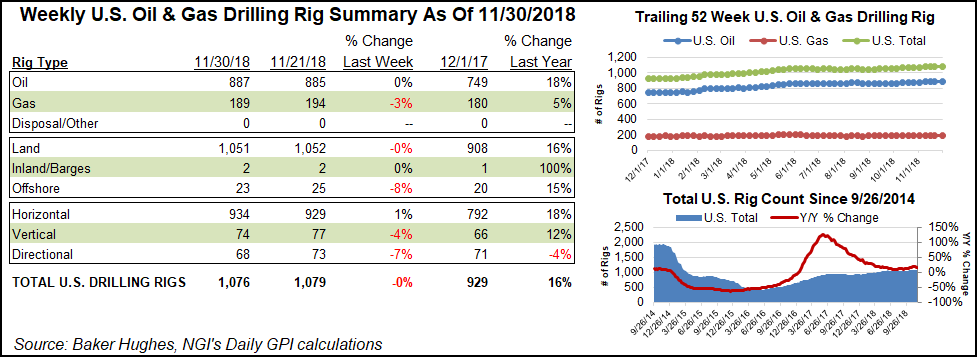

The number of active natural gas rigs in the United States fell by five to 189 for the week ended Friday (Nov. 30) but oil activity picked up slightly, according to data from Baker Hughes, a GE Company (BHGE).

The drop in natural gas-directed drilling, offset partially by net increase of two oil-directed rigs, sent the domestic rig count down three to 1,076 units for the week, outpacing its year-ago count by 147 units.

The loss of five directional rigs and three vertical rigs offset a net increase of five horizontal rigs. The total number of active land rigs fell by one to 1,051, while the Gulf of Mexico (GOM) saw two rigs pack up to finish at 23 units, BHGE data show.

Canada’s rig count fell by five for the week to 199, with all of the losses occurring in the oil patch. The combined North American rig count finished at 1,275, up from 1,151 units in the year-ago period.

Among plays, the Marcellus Shale saw two rigs exit, dropping its count to 56, versus 42 a year ago. The Eagle Ford and Haynesville shales each added a rig to their respective tallies.

Among states, Louisiana saw a net decline of four rigs, dropping its count to 65, up from 62 a year ago. Matching the losses in the Marcellus, West Virginia saw two units pack up shop, leaving 11 active rigs in the state, according to BHGE. The biggest gainer among states for the week was Wyoming, which added two rigs to reach 30, outpacing its year-ago count of 25.

Also among states, Alaska, Oklahoma and Utah each added a rig, while Colorado and Texas dropped a rig a piece.

The Fraser Institute’s recently released annual survey found that nine of the world’s top 10 places to invest in global oil and gas are in the United States, including eight states. The 12th annual Global Petroleum Survey by the Canadian-based research firm quizzed 256 petroleum industry executives and managers regarding barriers to investment in oil and gas exploration and production around the globe.

The United States far and away is considered the most attractive place to invest, led by Texas, Oklahoma, Kansas, Wyoming, North Dakota, Alabama, Montana, GOM, UK-North Sea and Louisiana. In the 2017 survey, six U.S. jurisdictions made the top 10 list.

Meanwhile, producers heavily invested in the Permian Basin have encountered difficulties finding a home for all of the region’s associated natural gas output, as a handful of trades veered into negative territory earlier in the week. And the severe constraints that helped drive these negative prices could last months, said analysts, as the infrastructure buildout catches up with production.

Zero and negative prices do not happen often, but they are not unprecedented, noted NGI’s Patrick Rau, director of strategy & research. “There have been several times since 2010 when prices either reached zero or fell into negative territory, especially in the Marcellus Shale and in Western Canada.

“The problem in the Permian today is exactly what has happened at various times in Pennsylvania and Western Canada — too much production chasing not enough pipeline takeaway capacity,” Rau said. “Existing pipeline companies have done what they can to create additional capacity, but there is only so much they can do without building an entire new system. At some point, the dam had to break.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |