Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Shale Development Helps Push U.S. Proved Reserves to Record Highs in 2017, Says EIA

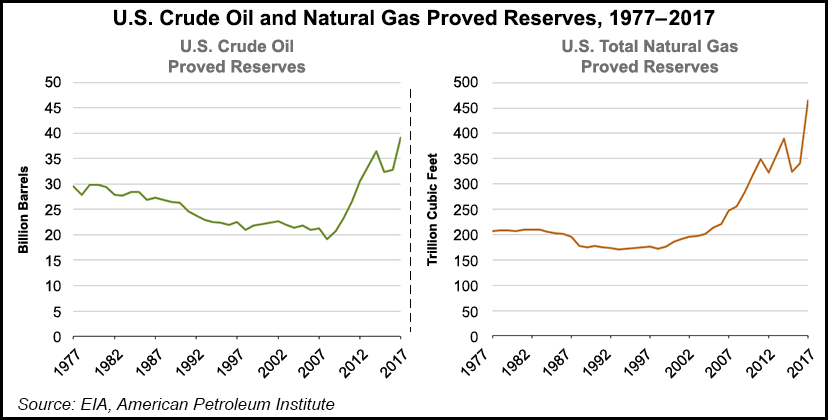

Strengthening prices, combined with continuing development of shales and low permeability formations, drove both U.S. natural gas and crude oil proved reserves to record levels in 2017, about double their levels a decade earlier, according to the Energy Information Administration (EIA).

Total domestic proved reserves of natural gas surged to 464.3 Tcf at year-end 2017, a 123.2 Tcf (36.1%) increase compared with year-end 2016, breaking a 2014 record, according to an EIA report released Thursday. At the same time, U.S. production increased 4% compared with 2016.

“Producers in Pennsylvania added 28.1 Tcf of natural gas proved reserves, the largest net increase of all states in 2017, as a result of increased prices and development of the Marcellus and Utica shale plays,” EIA said. “The next largest net gains in natural gas proved reserves came in Texas (26.9 Tcf) and Louisiana (18.4 Tcf) as a result of development of the Wolfcamp/Bone Spring shale play in the Permian Basin and the Haynesville/Bossier shale play in eastern Texas and northern Louisiana.”

The share of natural gas proved reserves from shale increased from 62% of total U.S. natural gas proved reserves in 2016 to 66% in 2017, according to the report.

Proved reserves of crude oil reached 39.2 billion bbl, a 19.5% increase compared with year-end 2016 and breaking the previous record of 39.0 billion bbl set in 1970.

“Producers in Texas added 3.3 billion bbl of crude oil and lease condensate proved reserves, the largest net increase of all states in 2017,” EIA said. “This growth in proved reserves was a result of increased prices and development in the Permian Basin of the Spraberry Trend and the Wolfcamp/Bone Spring shale play. The next largest gains in crude oil and lease condensate proved reserves in 2017 were in New Mexico (1.0 billion bbl) and in the Federal Offshore Gulf of Mexico (729 million bbl).”

EIA defines proved reserves as those volumes “that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.”

Average Henry Hub natural gas spot prices increased 21% last year compared with 2016, to $2.99/MMBtu, according to the report. The annual average spot price for West Texas Intermediate (WTI) crude oil at the Cushing hub in Oklahoma increased 20% in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |