NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Lingering Cold Keeps Natural Gas Forwards on Bumpy Road This Winter

With cold weather forecast for the medium range but the possibility of warmer weather later next month, forward prices across the country were mixed but mostly stronger for the Nov. 21-28 period, according to NGI’s Forward Look. December prices averaged 24 cents higher, while January tacked on an average 21 cents.

As has been the case since October (and really the entire summer), weather remained a central focal point for the natural gas market during the past week as frigid temperatures across key demand regions continue to drain already low storage stocks. But the Thanksgiving break and the light trading activity that typically accompanies the stuffed bird faded by midweek, when the Nymex December futures contract unexpectedly shot up 45 cents leading into its $4.715 expiration.

As for weather, Wednesday night’s data brought mixed messages with the Global Forecasting System (GFS) trending milder and the European model colder, according to NatGasWeather. The early morning GFS run held the milder trend, and the latest midday GFS data was slightly milder for the middle of next week, but flipped back colder Dec. 8-12, seeing a stronger cold shot across the Great Lakes and East.

“There’s no change to timing with a milder break Friday through the weekend for much of the U.S. besides the West, followed by strong cold shots next week into the following weekend,” NatGasWeather said.

Meanwhile, another mild break is still advertised in all datasets for Dec. 11-14, building across the central and southern United States first, then eventually moving into the East. There is uncertainty, however, over how long the mild weather will ultimately last, with this likely being the focus of the gas markets before the weekend break.

“We expect colder air will try to make an attempt to weaken the ridge around Dec. 16-17, but that’s quite far out and with more to prove,” the forecaster said.

Poor weather model accuracy presents the possibility of a colder outbreak for mid-December followed by increasing warming thereafter, according to EBW Analytics. Following the week ending Dec. 13, the potential for a stronger ridge in Alaska and slower transition to warmer outcomes may present downstream cold risks for the Lower 48, the firm said.

“With stratospheric conditions supportive of further blocking, the possibility for stronger cold — or a return to colder outcomes following a mid-December warm-up — remains a critical near-term price risk,” EBW CEO Andy Weissman said.

Given that storage inventories trail historical levels by more than 600 Bcf, the margin for error is thin, the company chief said. Even a 100 gas heating degree day (gHDD) increase in the forecast — a less than 3% change from current balance-of-winter outlooks — could rapidly add 200 Bcf of demand and put the storage trajectory in peril, according to EBW.

In addition to increasing weather-driven demand, colder weather can bring production freeze-offs and cut supply by another 50-100 Bcf, the firm said. “In a situation with another 100 gHDDs of demand and 100 Bcf of freeze-offs, end-of-March storage is near 900 Bcf, perilously close to the 800-850 Bcf minimum storage levels needed to maintain pipeline pressure and deliverability,” Weissman said.

For now, though, the market got a glimpse of a slightly improving storage picture when the Energy Information Administration (EIA) reported a much smaller-than-expected withdrawal from storage inventories for the week ending Nov. 23. The EIA said 59 Bcf was pulled from stocks, far below estimates that showed a 10-20 Bcf tighter draw and a sharp turn from last week’s bullish 134 Bcf draw. Last year, 35 Bcf was pulled from storage for the similar week, while the five-year average withdrawal stood at 49 Bcf.

Inventories as of Nov. 23 stood at 3,054 Bcf, 644 Bcf below year-ago levels and 720 Bcf below the five-year average.

That bearish report, however, didn’t seem to bring the bears out of hibernation, Societe Generale natural gas analyst Breanne Dougherty said. Indeed, Nymex January futures, which had been 15 cents lower before the report’s 10:30 a.m. ET release, went on to settle Thursday at $4.646, down just 5.3 cents.

Going forward, Societe Generale expects prices to average $3.50-3.75/MMBtu during the next couple of months, “but the front of the curve is very much exposed to a sustained upside volatility session until further notice,” Dougherty said.

The firm remains bearish to the curve, but over the next eight weeks, “we do see more upside than downside risk to our current price view.”

Permian December Prices Crash

There was no shortage of volatility in the forward markets this week as milder weather on tap for major population regions like the Northeast sent prices there sliding back a bit, while strong structural demand and low storage stocks lifted markets in the South Central region up more than 20 cents at the front of the curve.

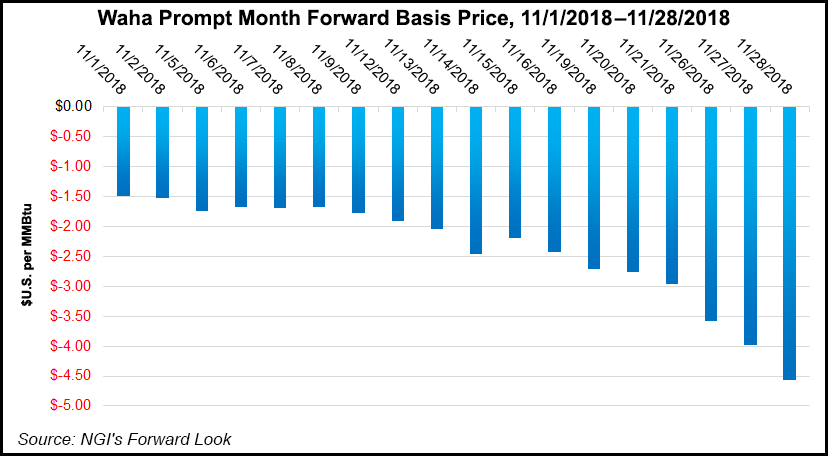

Meanwhile, overwhelming supply growth in the Permian Basin has proven to be too much to handle for the network of pipelines coming out of the basin as West Texas pricing hubs like Waha and El Paso Permian have traded at an increasingly wide deficit to benchmark Henry Hub in both the cash market and forwards.

As of Tuesday’s trading, year-to-date Waha spot prices have averaged about $1.035 back of Henry Hub, compared to an average cash basis of roughly minus 27.0 cents for the comparable 2017 period, an analysis of Daily GPI historical data shows.

Meanwhile, on Tuesday, spot prices at Waha dropped as low as negative 25.0 cents before going on to average 65 cents. And while no negative deals were executed in Wednesday trading, the impact of the cash weakness has spilled over into the forward markets.

Waha December prices fell $1.34 from Nov. 21-28 to reach just 14.5 cents as that contract rolled off the board, according to Forward Look. Traders appeared more confident of an improving price scenario early next year as January fell just 27 cents to $2.08 and the balance of winter (January-March) dropped 31 cents to $1.79.

El Paso-Permian December ended the week 91 cents lower at $1.035, while January slipped just 3 cents to $2.53 and the balance of winter slid 6 cents to $2.23.

Pricing hubs in the Midwest and Northeast also posted losses for the week amid the moderating temperatures on tap. NatGasWeather said while it remained cool across the Great Lakes and Northeast on Thursday, warming was expected across the central and southern United States, where highs will reach the 50s to 70s, locally 80s as high pressure strengthens. This mild ridge was forecast to expand to include the Great Lakes, Ohio Valley and East this weekend, where highs will warm into the 50s and 60s while remaining comfortable in the 70s and 80s across the southern United States.

Chicago Citygate December dropped 32 cents to $4.486, January fell a penny to $4.953 as did the balance of winter, which landed at $4.70, Forward Look data show.

In the Midcontinent, points along Northern Natural Gas posted double-digit declines but still priced at a premium to the benchmark Henry Hub. Northern Natural Ventura December was down 12 cents to $5.087, January was flat at $5.414 and the balance of winter moved up a penny to $5.02.

In the Northeast, Transco Zone 6 NY December fell 19 cents from Nov. 21-28 to $6.684, while January rose 11 cents to $11.47 and the balance of winter tacked on 6 cents to $9.20. New England’s Algonquin Citygate December plunged $1.24 to $10.56, January tumbled 90 cents to $12.83 and the balance of winter slid 67 cents to $11.10, according to Forward Look.

Over in the Rockies, the cold wintry air that has descended over much of the country in recent weeks has been exacerbated by ongoing import restrictions from Enbridge Inc.’s Westcoast Transmission. The Westcoast pipeline had a system-wide operational flow order in effect Wednesday and Thursday, with the operator citing reduced capacity on its T-South segment that stretches south across British Columbia to the U.S.-Canadian border.

Northwest Sumas prices — both in cash and forward markets — have been on a tear since the Oct. 9 Westcoast explosion that led to the reduced imports from Canada. Northwest Sumas December prices jumped $8 from Nov. 21-28 to reach $18.19, a little more than a $1 premium to Wednesday’s cash price. January rose $2.17 during that time to $9.83, and the balance of winter was up $1 to $6.60.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |