NGI Data | Markets | NGI All News Access

Natural Gas Prices Absorb Impact of Big Bearish Miss in EIA Storage Report

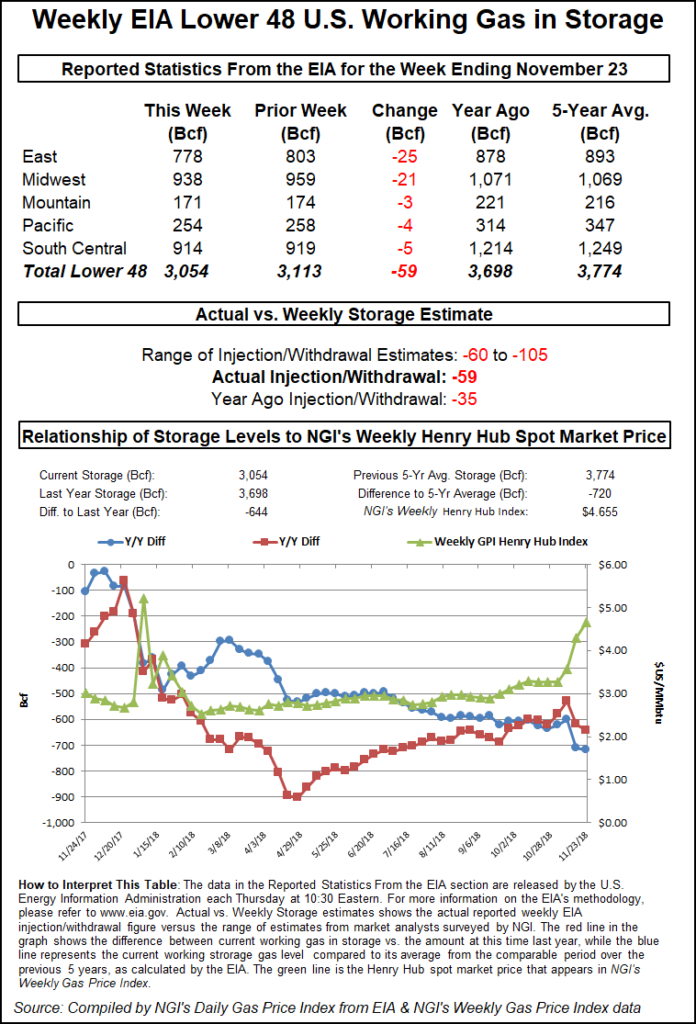

The Energy Information Administration (EIA) reported a 59 Bcf withdrawal from U.S. natural gas stocks that missed well to the bearish side of expectations, but futures managed to largely absorb the immediate impact Thursday.

The 59 Bcf withdrawal for the week ended Nov. 23 compares to a year-ago pull of 35 Bcf and a five-year average withdrawal of 49 Bcf. While larger than average for the period, the 59 Bcf pull came in well below most estimates, potentially signaling a greater than expected impact on demand from last week’s Thanksgiving holiday.

The looser-than-expected withdrawal also counters last week’s bullish 134 Bcf pull, which topped most estimates by a similarly large margin.

January natural gas futures were already trading lower Thursday morning in the lead-up to EIA’s report, giving back some of the gains posted during Wednesday’s December expiry. When the final number crossed traders’ screens at 10:30 a.m. ET, the January contract quickly dropped a little over 10.0 cents, going from $4.560 down to as low as $4.453. But by 11 a.m. ET, the front month had recovered to trade around $4.522, down a few pennies from the pre-report trading but about 17.7 cents below Wednesday’s settle.

Estimates ahead of Thursday’s report showed many market participants looking for a withdrawal around 10-20 Bcf tighter than the actual figure.

A Reuters survey of traders and analysts had pointed to a 77 Bcf pull for the week, with responses ranging from minus 62 Bcf to minus 105 Bcf. A Bloomberg survey had showed a median withdrawal of 82 Bcf, with a range of minus 60 Bcf to minus 88 Bcf. Intercontinental Exchange EIA financial weekly index futures settled Wednesday at a withdrawal of 68 Bcf.

“This helps cancel out some of the massive draw the prior week, and we see much of this as being weekly EIA noise in a market that is seeing wild demand, weather and price gyrations,” Bespoke Weather Services said. “This far looser print can be rather easily discounted due to the Thanksgiving impact that we saw as very significant, though it still reflects that we need to keep” heating degree days “near record levels to maximize nonlinear weather demand.

“Later in winter this will become easier, and this print certainly does not erase storage concerns. However, it indicates that on average weather prices can fall back very quickly with current balances, increasing downside back towards the $4 level should we see a week or two of mild weather in mid-December, as seems fairly likely still.”

Total Lower 48 working gas in underground storage stood at 3,054 Bcf as of Nov. 23, according to EIA, down 644 Bcf (17.4%) from a year-ago and 720 Bcf (19.1%) below the five-year average.

By region, the East posted the largest withdrawal for the week at 25 Bcf, followed by a 21 Bcf pull recorded in the Midwest. The Pacific withdrew 4 Bcf, while the Mountain region withdrew 3 Bcf on the week. In the South Central, 5 Bcf was withdrawn, with a 14 Bcf pull from nonsalt offsetting an 8 Bcf injection into salt stocks, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |