NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weekly Natural Gas Spot Markets Gain as Withdrawal Season Starts Strong

Natural gas spot markets continued to build on the recent bullish momentum during the holiday-shortened week ended Wednesday (Nov. 21), while futures markets proved difficult to predict; the NGIWeekly Spot Gas National Avg. climbed 47.5 cents to $5.040/MMBtu.

With near-record cold temperatures forecast over the Thanksgiving holiday in the Northeast, weekly spot prices there posted elevated premiums. Algonquin Citygate jumped $4.280 to $11.385, while Tenn Zone 6 200L added $4.450 to $11.515.

Prices throughout the middle third of the country generally strengthened about 30 cents or so outside of the constrained West Texas producing region, where the stronger prices that coincided with a natural gas liquids pipeline disruption a week earlier proved fleeting. Waha tumbled $1.305 to $1.890.

In the West, several locations across California and the Rockies saw strong gains on the week as forecasts called for colder temperatures and precipitation impacting parts of those regions. Malin climbed $1.380 to $5.870.

A notable exception was Northwest Sumas, which sold off $15.855 to average $8.795 as reports indicated increased capacity to flow gas into the Pacific Northwest through Enbridge Inc.’s Westcoast system following last month’s rupture.

Looking at the futures, a big bullish miss from government storage data ultimately failed to impress markets Wednesday as the winter strip settled lower to wrap up yet another day of large swings. The December Nymex futures contract settled 7.2 cents lower at $4.451 after trading as high as $4.864 and as low as $4.430. January slid 4.4 cents to $4.477, February gave up 1.8 cents to $4.368 and March settled at $4.108, down 1.7 cents.

NatGasWeather described it as “another day of nonsensical moves” for markets after big swings to either direction. “Clearly there’s frustration for many market participants as they wonder what major entities are driving prices and why.”

All midday weather models Wednesday came in a little colder for the first week of December, and the European model was also colder compared to a day earlier.

“Cold blasts are favored to return across much of the country Dec. 4-7 with below normal conditions” leading to strong demand, “spreading from the west-central U.S. initially into the East,” the forecaster said. “Overall, still a solidly bullish pattern being advertised for much of the next two weeks. You wouldn’t know it the way prices have traded.”

The Energy Information Administration’s (EIA) first reported storage withdrawal of the heating season proved a doozy, a bullish surprise that beat most estimates by a wide margin but couldn’t inspire a sustained rally.

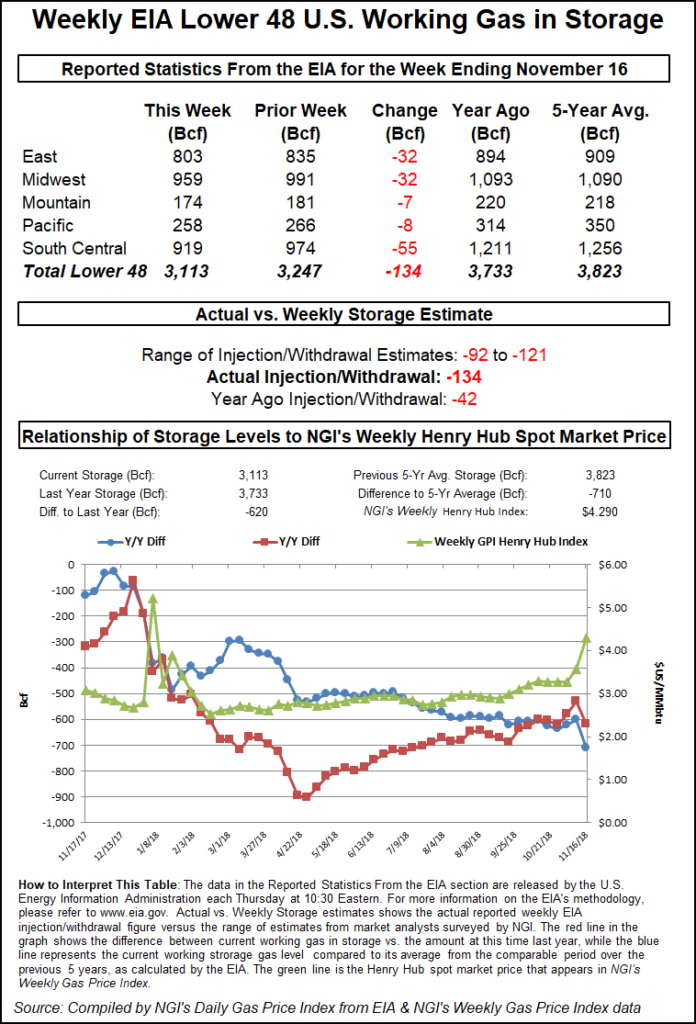

EIA reported a 134 Bcf pull from U.S. gas stocks for the week ended Nov. 16, ushering in the withdrawal season with a figure that significantly widens year-on-year and year-on-five-year inventory deficits for a market already fretting over historically lean stockpiles. The 134 Bcf figure easily toppled both the 42 Bcf withdrawal EIA recorded for the year-ago period and the five-year average 25 Bcf withdrawal.

In the lead-up to the noon ET release on Wednesday of the EIA data, prompt month Nymex futures had slid to around $4.500-4.550 after probing as high as $4.864 overnight, the kind of jumpy back and forth action that foretold a potentially explosive response when the final number flouted the market’s expectations.

The minute the 134 Bcf figure showed up on traders’ screens, the December contract immediately popped about 20 cents higher to $4.750. But it was downhill from there as prices worked steadily lower over the next few hours.

Prior to the EIA report, market participants had been looking for a triple-digit withdrawal but one significantly lighter than the actual figure. Major surveys had hinted at a pull in the vicinity of 108-109 Bcf, with responses ranging from the high 90s Bcf to around 120 Bcf. Intercontinental Exchange EIA financial weekly index futures had settled Monday at a withdrawal of 119 Bcf.

Bespoke Weather Services attributed the bullish surprise to a “combination of pipe packing on the first real significant cold as well as an implicit revision” from the prior week’s reported 39 Bcf injection that came in to the bearish side of estimates.

“We had seen risk to the high side with the draw, as it often is with the first major cold shot of the season, but this is still a very impressive draw that skews natural gas price risk even higher on any cold risks,” Bespoke said. “Prices initially shot right into our $4.70-4.75 range, which seems justified given long-range cold risks and this print, and highs at $4.93 are in play” on any additional heating degree days from forecasts.

Balances “loosened dramatically” during the short work week, and the firm expects a “far looser print next Thursday, but risk will very clearly be skewed higher off this until long-range forecasts show major moderation.”

Total Lower 48 working gas in underground storage stood at 3,113 Bcf as of Nov. 16, 620 Bcf (16.6%) below year-ago stocks and 710 Bcf (18.6%) below the five-year average, EIA data show.

By region, the South Central recorded the heftiest withdrawal week/week at 55 Bcf, including 21 Bcf pulled from salt and 34 Bcf pulled from nonsalt. Both the East and Midwest regions saw withdrawals of 32 Bcf. The Pacific region recorded an 8 Bcf pull for the week, while 7 Bcf was withdrawn in the Mountain region, according to EIA.

Meanwhile, the recent spikes in natural gas prices have allowed coal-fired power generation to reclaim market share, increasing the ratio of coal burned versus gas to recent highs, according to Genscape Inc.

“Since mid-May, the ratio had tightened to record-low levels, averaging just 1.08 MMBtu of coal for every MMBtu of gas, and posting 27 days where more MMBtus of gas were consumed than coal for power generation,” Genscape senior natural gas analyst Rick Margolin said. “…That has all changed recently as the recent rally in gas prices has eroded the gas cost advantage.

“The coal-to-gas ratio on Oct. 16 was at just 1.05, but since then has averaged 1.24. During this time, the Henry Hub cash prices averaged $3.58, about 30 cents above mid-October spots. On Friday (Nov. 15) the cash price hit $4.62, its highest mark since mid-January. Just two days later the coal-to-gas ratio then spiked to 1.64, its largest point since last February.”

Northeast Moderates Ahead of Frigid Holiday

In the spot market Wednesday, price moves on deals for delivery over the long weekend were mixed as traders appeared to have already priced in the impact of a potentially chilly holiday for the Northeast; the NGISpot Gas National Avg.slid 39.5 cents to $4.895/MMBtu.

Physical prices at several Northeast locations pulled back Wednesday from elevated premiums established a day earlier amid calls for near-record cold temperatures across the region during the Thanksgiving holiday.

On Wednesday NatGasWeather was calling for cold conditions across much of the country over the next several days, “aided by a reinforcing cold front pushing through the Northeast where lows will drop into the single digits to 20s, with snow showers downwind of the Great Lakes.

“A brief milder break is still on track to build across the west-central U.S. and Midwest Friday, then advancing into the East” over the holiday weekend, “easing national demand to near or slightly lighter than normal for a couple days.” The forecaster was calling for another cold shot to “drop out of Canada and advance into the central U.S. as the weekend progresses with rain and snow increasing, but more importantly bringing another round of colder than normal temperatures.”

This cold front was expected to bring below-normal temperatures deep into Texas and the South, dropping lows into the 20s and 30s, and it was expected to sweep across the Great Lakes and East early in the upcoming week, according to the forecaster.

Algonquin Citygate dropped $4.305 to average $9.015, while further south Transco Zone 6 NYheld steady, adding 0.5 cents to $5.065.

In Canada, Enbridge Inc.’s Westcoast Energy Inc. was planning to restore an additional 200 MMcf/d or so of capacity at its Huntingdon Delivery Area starting Thursday (Nov. 22) following last month’s pipeline rupture that disrupted exports to the Pacific Northwest, according to Genscape analyst Joe Bernardi. Operating capacity through Huntingdon was expected to increase to roughly 1,150 MMcf/d.

“Capacity has also been incrementally increasing over the past several days, from 938 MMcf/d to 1,000 MMcf/d to 1,042 MMcf/d,” Bernardi said. “Both this capacity increase, as well as the slightly milder weather expected for the Pacific Northwest, should put downward pressure on Sumas basis, which last week spiked to record highs following an unexpected reduction of Huntingdon flow capacity.”

Bernardi also noted that cleaning tool runs on Westcoast’s 26-inch diameter mainline were expected to limit deliveries at Gordondale near the British Columbia/Alberta border to 109 MMcf/d from Thursday through Sunday (Nov. 22-25), with capacity dropping to zero on Monday (Nov. 26).

“Month-to-date at Gordondale, Westcoast has delivered an average of 86 MMcf/d to NGTL and an average of 71 MMcf/d to Alliance,” the analyst said. “The 157 MMcf/d average for total deliveries is 48 MMcf/d above the initial operating capacity restriction” beginning Thursday. “Fundamentally this event could put some downward pressure on Westcoast Station 2 basis price due to the slight backup of gas within northern British Columbia, although Station 2 should be gaining some support from Westcoast’s planned increase to southbound flow at Huntingdon.”

Prices in the Rockies were mixed Wednesday. Kingsgate climbed 33.0 cents to $5.910, while Northwest Sumas fell 88.0 cents to $7.910.

In California, most locations moderated heading into the weekend. SoCal Citygate shed 78.5 cents to $7.230.

A force majeure event affecting deliveries from El Paso Natural Gas (EPNG) to Mojave over the holiday weekend was not expected to have a significant impact on flows, according to Genscape’s Bernardi.

“A mechanical failure of the No. 2 compressor unit at Topock, AZ, has reduced operating capacity at the ”MOJTHRU’ meter to 336 MMcf/d effective Wednesday, with an anticipated return to service next Monday (Nov. 26),” Bernardi said. “This location’s previous month-to-date average is 380 MMcf/d, which translates to an expected cut of 44 MMcf/d.

“During similar past events, flows have come in higher than reported operating capacity, so actual flow cuts during this event may end up lower than this 44 MMcf/d. EPNG’s deliveries to Mojave do not typically show any correlation with downstream Kern River/Mojave deliveries” to Southern California Gas (SoCalGas). “This event may translate to slightly higher deliveries from EPNG to SoCalGas at their Topock interconnect.”

Further upstream in West Texas, locations saw steep declines Wednesday. El Paso Permian tumbled $1.055 to $1.705.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |