Erratic Natural Gas Market Behavior Continues as December Nets 50-Cent Gain

The natural gas forward market remained firmly strapped in on the roller coaster ride it’s been on the last couple of weeks as bitter cold continues across major population centers with no clear end in sight. December prices averaged 50 cents higher between Nov. 16 and 20, while the balance of winter (defined as January-March) averaged 48 cents higher, according to NGI Forward Look.

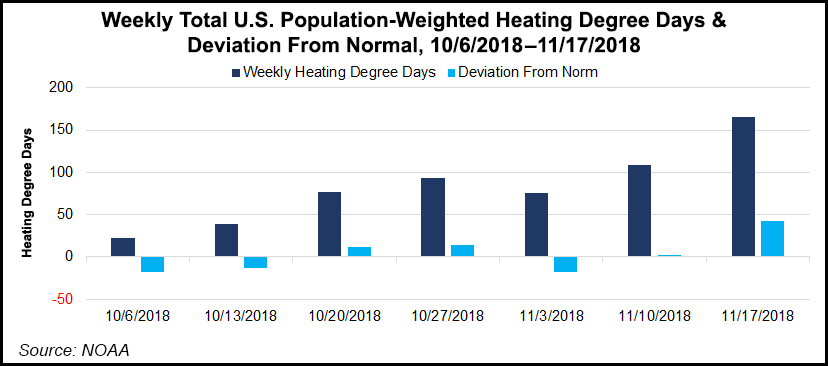

Nymex natural gas futures led the rally, logging far more days in positive territory than in the red in recent weeks as early season cold, which began circulating across the United States in October, has continued mostly unabated aside from brief breaks between weather systems. With storage inventories at historically low levels before the peak of the winter season begins, traders have driven up the price of natural gas to levels not seen in years.

The most recent week, shorter because of the Thanksgiving holiday, was no different, as weather models maintained an overall bullish pattern through early December. Overnight Wednesday European guidance had the most impressive cold signals in the long range, showing a weak lingering negative North Atlantic Oscillation (NOA) with the potential development of another upstream negative Eastern Pacific Oscillation (EPO) to force significant cold down into the East, according to Bespoke Weather Services.

“The development of this negative EPO is uncertain and with the Global Ensemble Forecast System not having it, the model ends up being markedly warmer with long-range heating degree days (HDD) just slightly above average,” Bespoke chief meteorologist Jacob Meisel said.

The forecaster, however, said there was significant risk for the European model to verify given the expected blocking regime, and therefore Meisel was continuing to forecast “very impressive” gas-weighted degree days for the first week of December. Bespoke’s team is still looking for the negative NAO downstream block to ease the second week of December, “and a more progressive pattern can easily allow a warm-up into mid-month, but for now the focus remains on cold risks late Week 2.”

Meanwhile, storage stocks remain far below historical averages and the jump in gas demand so early in the season created uncertainty about supplies this winter, given that the traditional injection season failed to tighten deficits. As of Tuesday’s settle, the December contract sat at $4.523, while the balance of winter sat at $4.344. Summer 2019 prices averaged $2.74.

The gas market was dealt another blow on Wednesday when the Energy Information Administration (EIA) delivered storage data that fell well outside the range of market estimates. The EIA reported a whopping 134 Bcf withdrawal for the week ending Nov. 16, more than 10 Bcf greater than even the largest projection.

A collective “wow” was heard among market observers on a social media chat room hosted by The Desk as the print hit the screen. December natural gas prices responded accordingly, shooting up 14 cents within a one-minute time period in the minutes after the EIA’s release. By 12:30 p.m. ET, the Nymex prompt month was trading at $4.674, up 15.1 cents from Tuesday’s settle. Some late-session profit-taking, however, sent December back down to $4.451, a drop of 7.2 cents on the day.

Clearly, there is “frustration by many market participants as they wonder what major entities are driving prices and why,” NatGasWeather analysts said. “Or maybe it’s algorithms to blame for these illogical moves. Either way, extremely dangerous trade continues to lead to feast or famine moves.”

Broken down by region, the East and Midwest each posted a 32 Bcf withdrawal, while the South Central shocked with a 55 Bcf pull. The Pacific withdrew 8 Bcf.

It was the substantial draw in the South Central region that resonated with market observers. “Texas growth — that is the key. Texans can take the heat, but not the cold. If Texas is cold this winter, salts have serious issues,” said Kyle Cooper of IAF Advisors.

Indeed, salt dome storage facilities posted a 21 Bcf withdrawal, leaving stocks at 251 Bcf, down from 340 Bcf in the same week last year.

A trader on The Desk’s chat room said with liquefied natural gas demand and a hot summer, “it feels wrong that we go back below $3 even with record production.”

Still, the next storage report should look quite different in the South Central region as several storage facilities in the region switched back to injection mode in the previous weekend. “I don’t see the same kind of billish surprise at all,” said Wood Mackenzie’s Gabriel Harris, a natural gas analyst.

Bespoke’s Meisel said while power burns surprised to the upside this past summer, unless there is another hot summer, which is a real risk, then summer 2019 (April-October) prices under $3 “may actually still make sense even as the front of the strip blows out.”

The 8 Bcf draw in the Pacific region also took market observers by surprise. Even with increasing southbound flows on Enbridge Inc.’s Westcoast Transmission, the year/year deficit in supplies may be too large to overcome, a trader said. Pacific inventories stood at 258 Bcf, down from 314 Bcf a year ago.

Total working gas in storage as of Nov. 16 stood at 3,113 Bcf, 620 Bcf less than last year and 710 Bcf below the five-year average, according to EIA.

Northeast Posts Largest Gains

Unsurprisingly, the Northeast markets posted the largest increases across the forward curve for the Nov. 16-20 period as demand was projected by Genscape Inc. to hold in the 12 Bcf level through the Thanksgiving holiday weekend and the last week of November before rising to 14.05 Bcf by Dec. 5.

The weather data has been struggling about whether there will be a break between cold shots around Dec. 2-3, according to NatGasWeather. The Tuesday overnight GFS and European models resolved it to be more likely, although the Wednesday midday GFS model was a little colder trending with it, “but still suggested some sort of break before another round of below normal conditions returns Dec. 4-8,” the forecaster said.

Points along the Transcontinental Gas Pipe Line (aka Transco) posted gains of more than 75 cents at the front of the curve, while increases further out were less pronounced but still hefty.

Transco Zone 5 South December shot up 76 cents from Nov. 16 to 20 to reach $6.09, while January rose just 7 cents to $9.11, while the balance of winter climbed 23 cents to $7.62, Forward Look data show.

At Transco Zone NY, December was up $1.08 to $7.24, January was up 24 cents to $11.50 and the balance of winter was up 42 cents to $9.36.

In Appalachia, Dominion South and Transco Leidy generally followed the lead of Nymex futures, but Texas Eastern M-3 put up gains that were more in line with those seen in the Northeast. December rose 79 cents from Nov. 16 to 20 to reach $5.83, January edged up 44 cents to $8.52 and the balance of winter tacked on 46 cents to hit $7.10.

Meanwhile, Northwest Sumas in the Rockies marched to its own beat during the Nov. 16-20 period as Enbridge increased flows on its Westcoast Transmission pipeline. Westcoast planned another partial increase to its southbound flow capacity at Huntingdon effective Thanksgiving Day, restoring an additional roughly 200 MMcf/d of flow capacity after the Oct. 9 explosion that curtailed exports to the U.S. Pacific Northwest.

Capacity has been incrementally increasing over the past several days, from 938 MMcf/d to 1,000 MMcf/d to 1,042 MMcf/d, the data and analytics firm said. “Both this capacity increase, as well as the slightly milder weather expected for the Pacific Northwest, should put downward pressure on Sumas basis, which last week spiked to record highs following an unexpected reduction of Huntingdon flow capacity,” Genscape natural gas analyst Joe Bernardi said.

Meanwhile, planned maintenance on Westcoast at the British Columbia (BC)-Alberta (AB) border was expected to cut about 50-160 MMcf/d of eastbound deliveries to the NGTL and Alliance pipelines, according to Genscape. Cleaning tool runs on Westcoast’s 26-inch diameter mainline were to limit total deliveries at Gordondale (near the BC-AB border) to 109 MMcf/d for four days beginning Thursday, with a fifth day of zero capacity on Monday (Nov. 26).

Month-to-date at Gordondale, Westcoast had delivered an average of 86 MMcf/d to NGTL and an average of 71 MMcf/d to Alliance, Bernardi said. The 157 MMcf/d average for total deliveries is 48 MMcf/d above the initial operating capacity restriction beginning Thursday.

As for prices, Northwest Sumas December plunged $5.63 from Nov. 16-20 to reach $11.41, while January tumbled $2.39 to $8.77 and the balance of winter dropped $1.33 to $6.15, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |