Jumpy Natural Gas Markets Get Big Bullish Surprise from Season’s First EIA Storage Withdrawal

The Energy Information Administration’s (EIA) first reported storage withdrawal of the heating season proved a doozy, a bullish surprise that beat most estimates by a wide margin and prompted a sharp rally for natural gas futures.

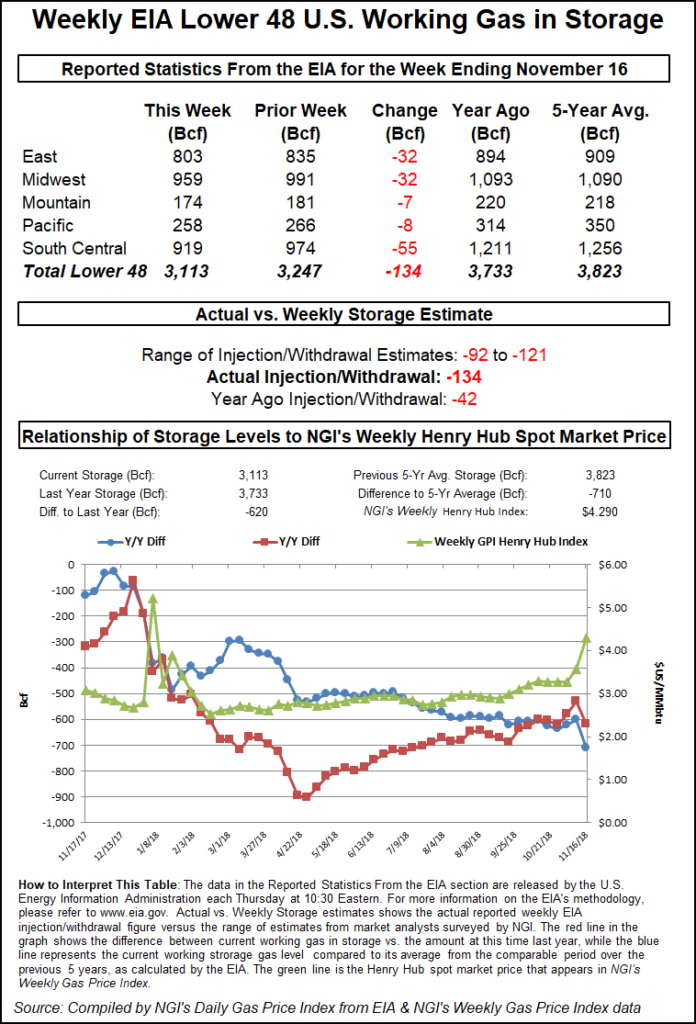

EIA reported a 134 Bcf pull from U.S. gas stocks for the week ended Nov. 16, ushering in the withdrawal season with a figure that significantly widens year-on-year and year-on-five-year inventory deficits for a market already fretting over historically lean stockpiles. The 134 Bcf figure easily topples both the 42 Bcf withdrawal EIA recorded for the year-ago period and the five-year average 25 Bcf withdrawal.

In the lead-up to the noon ET release of the EIA data, prompt month Nymex futures had slid to around $4.500-4.550 after probing as high as $4.864 overnight, the kind of jumpy back and forth action that foretold a potentially explosive response when the final number flouted the market’s expectations.

The minute the 134 Bcf figure showed up on traders’ screens, the December contract immediately popped about 20 cents higher to $4.750. By 12:30 p.m. ET, prompt-month futures were trading at $4.674, up 15.1 cents from Tuesday’s settle.

Prior to Wednesday’s report, market participants had been looking for a triple-digit withdrawal but one significantly lighter than the actual figure. Major surveys had hinted at a pull in the vicinity of 108-109 Bcf, with responses ranging from the high 90s Bcf to around 120 Bcf. Intercontinental Exchange EIA financial weekly index futures had settled Monday at a withdrawal of 119 Bcf.

Bespoke Weather Services attributed the bullish surprise to a “combination of pipe packing on the first real significant cold as well as an implicit revision” from the prior week’s reported 39 Bcf injection that came in to the bearish side of estimates.

“We had seen risk to the high side with the draw, as it often is with the first major cold shot of the season, but this is still a very impressive draw that skews natural gas price risk even higher on any cold risks,” Bespoke said. “Prices initially shot right into our $4.70-4.75 range, which seems justified given long-range cold risks and this print, and highs at $4.93 are in play” on any additional heating degree days from forecasts.

Balances “have loosened dramatically this week,” and the firm expects a “far looser print next Thursday, but risk will very clearly be skewed higher off this until long-range forecasts show major moderation.”

Total Lower 48 working gas in underground storage stood at 3,113 Bcf as of Nov. 16, 620 Bcf (16.6%) below year-ago stocks and 710 Bcf (18.6%) below the five-year average, EIA data show.

By region, the South Central recorded the heftiest withdrawal week/week at 55 Bcf, including 21 Bcf pulled from salt and 34 Bcf pulled from nonsalt. Both the East and Midwest regions saw withdrawals of 32 Bcf. The Pacific region recorded an 8 Bcf pull for the week, while 7 Bcf was withdrawn in the Mountain region, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |