November Chill, Low NatGas Storage Stocks Boost Forward Prices

Bone-chilling cold that caught off guard a natural gas market plagued by historically low storage inventories sent Nymex futures and forwards markets screaming more than $1 higher from Nov. 8-14, according to NGI’s Forward Look.

Nymex futures led the way as the December contract started building momentum on Friday as intense cold was set to hit major population centers during the Nov. 10-11 weekend. The cold risks continued on Monday, when the prompt month notched another roughly 7 cents. By Tuesday, natural gas prices had breached the $4 mark even as signs of moderating temperatures began showing up in longer-range weather models. In fact, some market observers saw little further upside potential after Tuesday’s more than 30-cent run across the winter strip.

But notably colder trends in Wednesday’s weather data solidified another rally for natural gas prices — this time to the tune of 70-plus cents throughout the winter months. December, which had soared as high as $4.929 during intraday trading, settled at $4.837, the highest front-month settlement since February 2014. January jumped 75.1 cents to $4.898, February rose 75.1 cents to $4.770 and March climbed 76.0 cents to $4.472.

“The sudden move up was just a tinder-next-to-fire situation begging to be lit with cold spell,” said Refinitiv’s Reza Haidari, head of natural gas research. “A three-week cold spell in November is nothing to sneeze at, but the price move is not exactly with surgical precision. But was anything else to be expected going into winter at 3.2 Tcf?

Meanwhile, CME Group reported that its suite of energy futures and options reached a daily trading volume record of 5,103,881 contracts on Wednesday, surpassing the previous record of 5,067,833 contracts set on Dec. 1, 2016.

“Customers are increasingly accessing the deep liquidity across our energy markets to manage price risk during this time of increased volatility and uncertainty,” CME Group Global Head of Energy Peter Keavey said.

Henry Hub natural gas futures contracts hit a record 1,602,673, surpassing the previous record of 1,232,635 contracts set one day earlier on Nov. 13. Electronic Henry Hub natural gas financial options contracts reached a record 210,561, beating the previous record of 208,793 contracts set on Nov. 9.

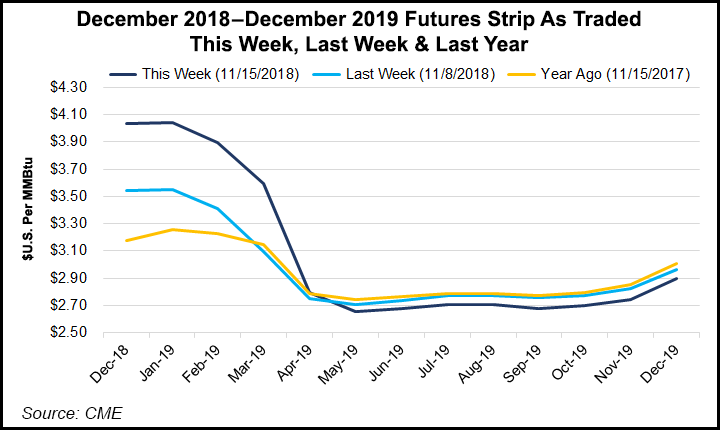

The recent rally prompted financial services company Morgan Stanley to increase its natural gas price outlook for 1Q2019 to $3.60 from $3.15. Its long-term outlook for natural gas “remains challenged” and as a result, the investment bank’s full year 2019 price forecast increased more modestly to $3.00 from $2.90, with the remainder of its 2020-plus outlook unchanged.

At the heart of the volatility are weather models that had turned increasingly colder with each run during most of the week. By Thursday, however, thawing in long-range weather outlooks appeared more clear, easing some concerns about the cold weather’s impact on already low gas stockpiles and sending Nymex futures firmly back into negative territory.

“All of a sudden, bulls are hoping to hold $4 instead of taking $5. Clearly, the [natural gas] trade has become completely irrational and dangerous if caught to the wrong side,” NatGasWeather said.

The rally was reminiscent of hedge fund Amaranth Advisors LLC, which lost $6.6 billion in a wrong-way trade in natural gas futures and led to the company’s 2006 implosion, as well as more oversight of energy markets.

As for the midday weather data, the milder trend that showed up in overnight Wednesday runs held, but didn’t trend any milder, at least in the Global Forecasting System (GFS) model, which in recent days has been the more accurate model.

Chilly conditions over the central, southern and eastern United States were expected to moderate by late Thursday and into Friday as a break between cold shots sets up, according to NatGasWeather. Another strong cold shot remained on track to impact the central, southern and eventually eastern United States this weekend through Tuesday to Wednesday of next week with another round of temperatures dropping 15-30 degrees below normal, just slightly less extreme than the past two runs, the forecaster said.

Another brief break between weather systems was still expected beginning Thanksgiving Day (Nov. 22-24), which was considerably shorter in duration compared to what the data showed early in the week, but was a touch milder the past two runs as well, NatGasWeather said.

“Most of the weather data continues to see cold shots returning into the U.S. Nov. 26-29, including the latest mid-day GFS, although with important details in need of resolving as far as just how cold, which regions will be impacted greatest, and also what kind of breaks between cold shots should be expected,” the firm said.

Despite the overall cold scenario expected for the remainder of November, Weather Decision Technologies meteorologist Steven Strum said it is hard to see cold persist from November through February “without a warmer month in there somewhere. It can happen, but it’s not common.”

On a social media energy-related chat room hosted by The Desk, Strum said cold risks remained really high, although there were some concerns “that we end up with more cold early and mid-winter and then February doesn’t end as cold.”

If the first half of December is cold and then the second half is warmer, though, “then I think we go back to a more typical colder mid-January through February regime that is common for these types of El Ninos,” he said.

For now, the blistering conditions are expected to lead to an abrupt shift in storage inventories. While the Energy Information Administration (EIA) on Thursday reported a slightly larger-than-expected 39 Bcf build that lifted inventories to 3,247 Bcf, some market observers were pointing to a 100-plus withdrawal for next week’s report. With stocks sitting some 528 Bcf (14.0%) below last year and 601 Bcf (15.6%) below the five-year average, accurately predicting where inventories will sit at the end of winter is challenging given recent weather model volatility, according to Morgan Stanley.

“Based on the latest weather outlook, we forecast end-March inventories of about 1.36 Tcf, below five-year normal levels of around 1.65 Tcf. However, looking at potential weather fluctuations within one standard deviation above or below 30-year normal gas-weighted heating degree days, we see a potential end-March inventory range of 885 Bcf-2 Tcf,” analysts said.

The low end of this range (in the case of a very cold winter) could push 1Q2019 gas prices into the $4.50-5.00 range, while the high end (mild winter) would likely drive 1Q2019 prices back into the $2.50-3.00 range, Morgan Stanley analysts said.

With the moderating weather outlooks and the EIA’s larger-than-expected storage build, December natural gas plunged 79.9 cents to $4.038. The balance of winter, defined as January through March, tumbled 86.8 cents to $3.845.

“The markets clearly don’t know what fair price should be, and we must expect these feast-or-famine moves to continue through the end of the week. With that said, trade direction has lined up fairly well based on temperature trends in the 15-day forecast, just with extreme moves that weather trends cannot justify,” NatGasWeather said.

Northeast Spikes, Permian Trails

The vast majority of pricing hubs across the United States put up substantial gains of well more than $1 for the Nov. 8-14 period as bitter cold showed no signs of slowing in the coming weeks. But with gas pipelines already running at full capacity heading into New England, the constrained market boosted December prices well above $10.

At the Algonquin Citygates, December forward prices spiked $2.88 to reach $11.49, while January rose $1.78 to $14.376 and the balance of winter jumped $1.92 to $12.43, according to Forward Look.

The same upward trajectory was seen at Tennessee Zone 6 200L, where December hit $11.60, January hit $14.49 and the balance of winter hit $12.57.

Elsewhere in the Northeast, gains outweighed those seen along the Nymex futures curve, but still came up far short of those in New England. Transco Zone 6 NY December was up $1.94 from Nov. 8-14 to reach $7.308, January was up $2.47 to $12.23 and the balance of winter was up $2.17 to $9.90.

Prices at Dominion Cove Point, a new pricing location added to Forward Look earlier this month, also rose significantly amid the increased demand. December shot up $1.75 to $6.42, January rose $1.83 to $9.97 and the balance of winter picked up $1.70 to $8.33, Forward Look data show.

But while most U.S. forward markets saw hefty gains during the week, Permian Basin pricing failed to see strength of the same magnitude. El Paso-Permian December rose just 49 cents from Nov. 8-14 to reach $2.48, while January climbed 73 cents to $2.82 and the balance of winter moved up 77 cents to $2.58.

Waha posted similar increases as December rose to $2.376, January hit $2.77 and the balance of winter reached $2.54.

The smaller gains are no surprise given the weak pricing that has been prevalent in the Permian recently as pipeline constraints have evolved given robust drilling activity in the basin. Cash prices, which had gotten a boost this week because of the loss of a natural gas liquids pipeline, also retreated in Wednesday trading amid word of the pipeline’s return to service by Friday.

Still, production as of Wednesday remained curtailed, with Genscape Inc.’s production group estimating that top-down volumes were down more than 1.8 Bcf/d from the month-to-date average. Total Permian (Texas and New Mexico) gas volumes remained more than 0.9 Bcf/d below the month-to-date average.

Genscape also noted that the magnitude, rapidity and geography of the Lower 48 production drops coincide with areas that experienced a rapid temperature drop, “suggesting we may be seeing the first freeze-offs of the winter,” according to natural gas analyst Nicole McMurrer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |