NGI All News Access | E&P | Infrastructure

U.S. Drops One Natural Gas Rig; Oil Drilling Sees Small Increase

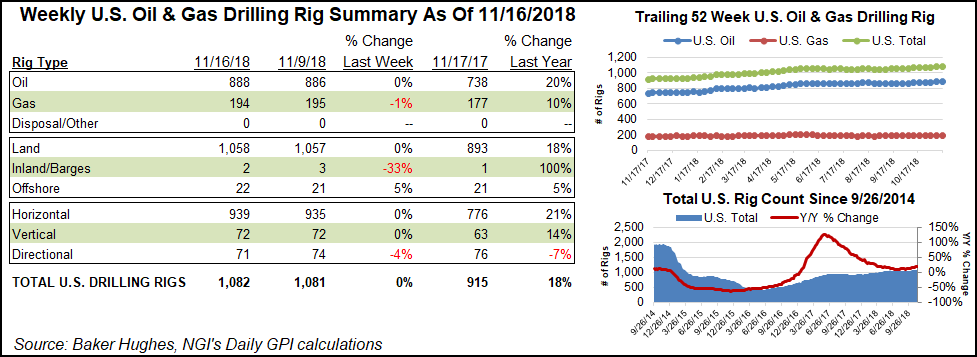

The U.S. natural gas rig count fell by one to 194 for the week ended Friday (Nov. 16) while an uptick in oil activity drove a small increase in the overall domestic count, according to data from Baker Hughes, a GE Company (BHGE).

The United States finished the week with 1,082 rigs overall, including the addition of two oil-directed rigs. The combined domestic count finished 167 units ahead of its year-ago tally.

Four horizontal units returned to the patch, while three directional units departed. The total number of domestic land rigs increased by one, and the Gulf of Mexico also added one rig. One rig departed from “inland waters,” according to BHGE.

Canada added one rig — oil-directed — to grow its tally to 197. The combined North American rig count ended the week at 1,279, up from 1,123 a year ago.

Among plays, the Eagle Ford posted the week’s largest increase, with three rigs returning to action to grow its count to 79, versus 67 rigs in the year-ago period. The Permian Basin, Granite Wash and Cana Woodford each added a rig, while the Barnett Shale saw one rig pack up shop.

In Appalachia, the Marcellus Shale picked up two rigs to climb to 58 (42 a year ago), offsetting the departure of two rigs from the Utica Shale, which as of Friday had 17 active rigs, lagging its year-ago count of 30.

Among states, Texas added three rigs overall to grow its count to 535 (449 a year ago). On the other side of the ledger, Oklahoma dropped two rigs to fall to 146, still outpacing its year-ago tally of 122. Pennsylvania added a rig, while New Mexico and Ohio each dropped a rig for the week, according to BHGE.

U.S. land activity for drilling rig specialist Helmerich & Payne Inc. increased nearly 6% in fiscal 4Q2018, with spot pricing up about 5%, the Tulsa-based operator said Friday.

Quarterly domestic land rig revenue on an adjusted basis climbed by 4% sequentially to more than $900/day on average, on high demand for the super-spec FlexRig line.

“In accordance with the trend toward greater well complexity, we expect to see additional demand for the company’s super-spec FlexRigs heading into our new fiscal year, particularly as customers continue to push increased lateral lengths and their use of pad drilling,” CEO John Lindsay said.

“…The super-spec rig market in the U.S. is effectively fully utilized, and we continue to see indications that additional demand is forthcoming, even as oil prices have recently moved lower.”

Meanwhile, U.S. oil and gas drilling permits climbed 23% year/year in October and were up 39% from September, a strong sign that activity is likely to improve early next year, Evercore ISI said Thursday.

According to the compiled data, a total of 4,820 U.S. permits were issued last month, a sharp uptick both month/month and year/year, said analyst James West and his team.

“This suggests drilling activity should improve in early 2019,” West said. “We continue to believe the high spec rig count will remain fully utilized for the foreseeable future.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |