Shale Daily | NGI All News Access | NGI Archives

Lower 48 Oil, Natural Gas to Dominate Global Supply into 2020s, Says IEA

The United States is forecast to contribute 40% of global natural gas production by 2025 and nearly 75% of oil growth in the next six years, driven mainly by unconventional onshore supplies, the International Energy Agency (IEA) said Tuesday.

The supplies of low cost U.S. gas output should keep Henry Hub prices relatively low until the mid-2020s, the IEA said in its World Energy Outlook 2018 (WEO).

The global energy watchdog also said increasing levels of global liquefied natural gas (LNG) would begin to narrow the gap between regional prices around the middle of the next decade.

Natural gas is the fastest growing fossil fuel in the WEO’s New Policies Scenario, the IEA’s central outlook. Gas is forecast to overtake coal by 2030 to become the second-largest source of energy after oil.

IEA also reported that U.S. oil supplies should reach 9.2 million b/d by the mid-2020s.

“The shale revolution continues to shake up oil and gas supply, enabling the U.S. to pull away from the rest of the field as the world’s largest oil and gas producer,” Paris-based IEA said in its central outlook. “By 2025, nearly every fifth barrel of oil and every fourth cubic meter of gas in the world come from the United States.”

New Policies, the most likely forecast, analyzes what would happen under announced global policies and targets. The Current Policies Scenario is one in which there would be no changes in policy from today, while the Sustainable Development Scenario envisions what would happen if the renewable energy transition were to be accelerated.

Gas demand would soar worldwide under the most likely scenario. Researchers raised their gas demand estimate to 2040 by almost 100 billion cubic meters (bcm) from the 2017 analysis to reflect rapidly growing efforts in China to replace coal generation and improve air quality.

“With demand growing by 1.6%/year, gas consumption is almost 45% higher in 2040 than today,” under the main scenario. “Industry takes over from power generation as the main sector for growth.

The WEO “does not aim to forecast the future, but provides a way of exploring different possible futures, the levers that bring them about and the interactions that arise across a complex energy system,” IEA Executive Director Fatih Birol said. “The world is gradually building a different kind of energy system, but cracks are visible in the key pillars,” including affordability, reliability and sustainability.

“The movement toward a more interconnected global gas market, as a result of growing trade in liquefied natural gas (LNG), intensifies competition among suppliers while changing the way that countries need to think about managing potential shortfalls in supply. Robust data and well-grounded projections about the future are essential foundations for today’s policy choices.”

According to the New Policies Scenario, unconventional gas is forecast to increasingly underpin future supply, with shale and tight gas production expanding by 770 bcm to 2040 and exceed conventional gas growth.

“After 2025, additional growth comes from a more diverse range of countries including China, Mozambique and Argentina.”

The New Policies Scenario envisions gas demand in China tripling to 710 bcm by 2040, up 100 bcm from the 2017 analysis because of a concerted coal-to-gas switch.

“China’s gas consumption moves from being roughly half that of the European Union (EU) today to 75% higher by 2040,” researchers estimated. “China soon becomes the world’s largest gas-importing country, with net imports approaching the level of the EU by 2040. It is also on track to surpass Japan as the largest LNG importer.”

By 2040, emerging economies in Asia as a whole are forecast to account for around half of total global gas demand growth in the new policies analysis. Their share of global LNG imports is forecast to double to 60% by 2040.

The likely forecast model sees most of the growth in the global gas trade coming from LNG, with its share swelling to almost 60% by 2040 from 42%.

“LNG import flows continue to go mostly to Asia, while the export picture becomes more diverse with a new roster of suppliers,” researchers said. “The global gas market comfortably absorbed a recent ramp-up in LNG liquefaction capacity,” but even though “new LNG investment decisions are starting to come through…it remains challenging to reconcile buyer expectations of greater flexibility on contractual terms with supplier needs for bankable longer term commitments.”

The New Policies Scenario revised down its estimate for EU gas demand on the back of new targets for efficiency and renewables, “but gas infrastructure retains a strong role in ensuring security of supply, especially to meet seasonal peaks in heating demand that cannot be met cost effectively by electricity.”

Even with lower gas demand, “declines in indigenous production mean that the EU’s import dependence rises to 86% by 2025.” Russia should remain the largest single gas source to the EU, “but the leverage that this provides is set to wane in an increasingly integrated European gas market in which buyers have access to multiple sources of imported gas.”

Surging global gas trade, underpinned by the gas revolution in the United States and the rise of LNG, “continues to accelerate the transformation of gas markets,” under the New Policies Scenario.

“Although talk of a global gas market similar to that of oil is premature, LNG trade has expanded substantially in volume since 2010 and has reached previously isolated markets,” researchers said. “Spot trading, liquidity and flexibility are all on the rise, meaning that gas is more accessible to a wider variety of market players and is more responsive to short-term changes in supply and demand across regions.”

Some uncertainty exists around the position of gas in Asia’s future energy mix, “particularly since several potential new export projects do not look profitable at the price levels that have supported the recent rise in the region’s gas consumption,” researchers noted.

“While strong policy efforts may establish gas as a mainstream fuel in the energy system, signs of supply security risks or frequent price spikes could push gas to the margin and increase the prospect of Asian markets relying on a mix of coal and renewables.”

Uncertainty also impacts investments, and only a handful of liquefaction plants received the go-ahead from mid-2016 until mid-2018, researchers noted.

“Project approvals have picked up since then, but there are signs that exporters are still searching for commercial models suited to the new market order.”

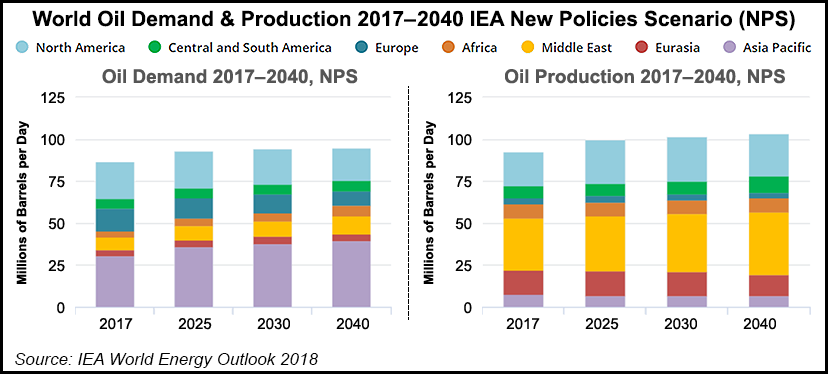

Meanwhile, U.S. onshore oil production is expected to plateau in the mid-2020s, the central forecast estimated, ultimately falling by 1.5 million b/d in the 2030s as a result of resource constraints. After 2025, the “baton gradually passes” to the Organization of the Petroleum Exporting Countries, i.e. OPEC, to meet “continued — albeit slowing — growth in global oil demand.”

The world’s appetite for oil is seen growing by 1 million b/d on average to 2025 before slowing to around 250,000 b/d. Oil use for vehicle fuel should peak in the mid-2020s on stronger fuel efficiency standards and the rise in electric vehicles, with demand then driven by petrochemicals and fuel use for trucks, planes and ships.

In its Sustainable Development Scenario for gas, researchers said demand would continue to grow to 2025 before flattening out at around 4.2 trillion cubic meters. Gas is seen as the only fossil fuel in which demand in 2040 is higher than today, “and it becomes the largest fuel in the global energy mix,” researchers noted.

“The dynamics are different from those in the other scenarios. Gas demand for power generation declines as gas increasingly provides peaking and balancing power rather than baseload generation. Instead, gas increases its share in the industry and transport sectors, where there is a strong impetus to curb the use of more emissions-intensive fuels.”

Lower gas demand in the sustainable outlook would translate into lower prices and lower investment needs for supply, with the cumulative investment requirements amounting to $6.3 trillion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |