NGI The Weekly Gas Market Report | Markets | NGI All News Access

Despite Short-Term Supply Challenges, Relief On Horizon For Mexico’s Natural Gas Market

Mexico’s natural gas market faces multiple short-term challenges, the most urgent of which is a lack of supply to power generators, petrochemical plants, and industrial consumers in the southern and southeastern part of the country, as the state-owned oil and gas producer struggles to increase output.

Amid declining gas output by national oil company Petróleos Mexicanos (Pemex) and delays to critical midstream infrastructure that would bring abundant and inexpensive gas from Texas, consumers in southern Mexico now face the prospect of switching to more expensive fuel oil, diesel and liquid petroleum gas (LPG) in order to continue operating over the coming months.

A lack of Pemex supply and scarce available cross-border pipeline capacity for private sector gas shippers, as well as a dearth of storage capacity, are compounded by the fact that a new government will take over on Dec. 1.

However, relief appears to be on the horizon. The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline is expected to enter operation next month or in January, with the Cempoala compressor station reversal project slated to finish in April. Both projects should provide relief to consumers in the south, the energy ministry’s general director of natural gas and petrochemicals, David Rosales, told NGI’s Mexico Gas Price Index.

While details of a planned tender to construct 45 Bcf of underground storage capacity still need to be ironed out, Rosales said the hope is for the new administration to give an order to proceed with the tender by early next year.

“I think it’s very clear for them that this is a [project] that will not cost the state, and will be paid for by the users of the gas system themselves,” Rosales said.

The incoming administration has generated unease among investors with its proposed oil policies, such as a pledge to halt crude exports and to divert Pemex investments from exploration and production to new refineries, but Rosales said a dramatic shift in course on natural gas policy is less likely. An efficiently run gas segment translates directly to cheaper electricity prices for end-users, he noted.

Recent days have also seen progress on other cross-border pipeline projects that should help meet rising demand from the power sector.

San Antonio, TX-based Mirage Energy Corp. last week said it has a memorandum of understanding (MOU) for reserved capacity on its proposed Texas-to-Mexico gas pipeline with commodities trader TrailStone NA Asset Holdings LLC.

The nonbinding MOU would allow TrailStone to purchase 150,000 MMBtu/d (146 MMcf/d) of reserved capacity for 10 years at a fixed tariff from the Banquete/Agua Dulce area in South Texas to Compressor Station 19 and Los Ramones interconnection points on the national pipeline network Sistrangas,” Mirage said. TrailStone is a partner and commercial operator in the recently commissioned Banquete header near Corpus Christi, TX.

The 42-inch diameter, bi-directional pipeline system under development would include nearly 140 miles of pipeline in Texas and about 103 miles of pipeline in Mexico. In addition to the four sections of pipelines in the two countries, Mirage said another interconnect in Falfurrias, TX, also in far South Texas, to Transcontinental Gas Pipe Line (Transco) is being considered, as is a 14-mile pipeline in Mexico known as the Storage Line that would connect the Progreso, TX, on the border to the Brasil storage field in Tamaulipas, Mexico.

Mirage expects to begin final development work on the project in December, “with a view toward receiving required United States and Mexico permits and authorizations in 3Q2019. The company has completed the necessary engineering and design of the pipeline. The alignment for the pipeline has also been substantially completed and Mirage is in the process of securing right-of-way agreements.”

Valley Crossing To Supply CFE Import Capacity

The Mirage news follows the startup of Enbridge Inc.’s Valley Crossing gas pipeline, which spans 168 miles in Texas from the Agua Dulce hub near Corpus to the Gulf of Mexico east of Brownsville.

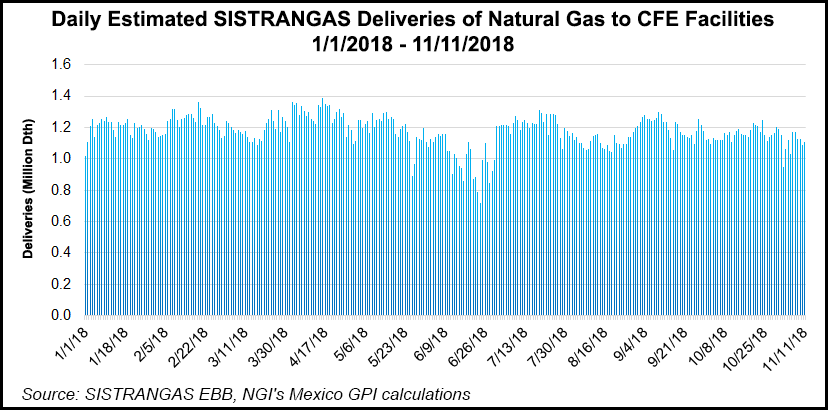

Valley Crossing’s primary customer is Mexican state power utility Comisión Federal de Electricidad (CFE), which is undertaking a massive shift to combined-cycle gas turbines (CCGT) from fuel oil and diesel-fired power generation capacity. Mexico’s installed CCGT capacity stood at 28,084 MW at the end of 2017, a figure that is expected to double by 2032, according to the Energy Ministry’s 2018-2032 power sector development program.

“Valley Crossing is expected to account for about half of the CFE’s total import capacity,” Enbridge said last week. Transport capacity is “half the average daily production output of the entire Eagle Ford Shale basin — in fact, it’s more than 10% of the average daily production for the entire state of Texas.”

The pipeline is designed to “support Mexico’s growing electricity generation needs, as power companies like the CFE choose natural gas,” which is a “cleaner” burning fuel and more economical than imported liquefied natural gas, the Calgary-based operator said.

“Supply in Mexico continues to decline, but at the same time their demand continues to grow,” said Enbridge Executive Vice-President Bill Yardley. “And the U.S. has some of the most economical, plentiful and reliable natural gas supplies in the world.”

Valley Crossing connects to the Sur de Texas-Tuxpan pipeline, a joint venture of Sempra Energy unit Infraestructura Energética Nova and TransCanada Corp.

Fitch Bullish On Mexico Power Sector

A FitchRatings unit said last week it holds a positive outlook for Mexico’s gas-dependent electric power sector over the next 10 years, despite uncertainty over the energy and infrastructure policies of incoming President Andrés Manuel López Obrador, who is commonly known by his initials AMLO.

“We expect the Mexican power sector to register strong growth and offer investors significant opportunities over the coming decade, thanks to rising energy demand, a supportive market structure and favorable policies,” Fitch analysts said. “Our positive view for the market is premised on the expectation that AMLO will adopt a pragmatic approach and will not reverse reforms of the power sector that contribute to attracting investment in the market.”

Fitch analysts said they expect “Mexico’s total installed capacity — net of project retirements — to increase by almost 30% between 2018 and 2027, driven primarily by the development of wind, solar and thermal power projects. Moreover, we expect Mexico’s power consumption to increase by an annual average of 2.4% over the same period.”

Although wind and solar capacity is expected to increase the most on a proportional basis to current levels, conventional thermal power is seen accounting for about two-thirds of the country’s total capacity through 2026, Fitch said, citing projections from Mexican energy ministry Sener and the U.S. Energy Information Administration.

Despite the overall optimistic outlook, analysts cautioned that, “AMLO’s unorthodox approach toward decision making for the infrastructure sector could weaken private companies’ interest in investing in the market.” Fitch cited investor unease over López Obrador’s recent decision to cancel a $13 billion airport for which construction was more than 30% complete via a referendum in which only about 1.1 million of Mexico’s 129.2 million people voted.

Other risks to the power sector include López Obrador’s ability, because of the comfortable majorities held by his coalition in both of the national legislative chambers, to reverse the 2013-14 energy reform of predecessor Enrique Peña Nieto.

“AMLO has long opposed the liberalization of the Mexican energy sector, although his criticisms have mostly focused on the oil and gas industry rather than the electricity industry. A risk of changes to the power sector’s regulatory framework, however, must be taken into account.”

Fitch also cited the risk of an economic slowdown in Mexico, but noted that this risk is mitigated by the tentative agreement reached Oct. 1 by Mexico, Canada and the United States on the U.S. Mexico Canada Agreement, an updated version of the North American Free Trade Agreement. The agreement has yet to be completed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |