NGI Weekly Gas Price Index | Markets | NGI All News Access

Big Rallies Bookend Week as Natural Gas Markets React to Wintry Forecast

Thanks to a significantly colder shift in forecasts for the season’s first stretch of legitimate winter heating demand, bullish sentiment abounded in natural gas markets during the week ended Friday (Nov. 9); the NGI Spot Gas Weekly National Avg. jumped 44.5 cents to $3.395/MMBtu.

As wintry temperatures were beginning to descend on the Lower 48, and with more expected in the week ahead to drive up national heating demand, markets throughout the eastern two-thirds of the country posted healthy gains for the week. The broad gains were underpinned by a 30.5 cent increase at Henry Hub, which finished the week at $3.580.

In the Midwest, Chicago Citygate added 59.5 cents to $3.725, while Dawn picked up 41.5 cents to $3.755.

While colder temperatures weren’t expected to reach East Coast markets until over the weekend, Algonquin Citygate added 80.0 cents to $3.705 on the week, with Transco Zone 6 NY adding 63.5 cents to $3.505.

Elsewhere, constrained West Texas locations saw averages slide on the week, while an uptick in demand in the Pacific Northwest sent Northwest Sumas soaring as the region continued to experience supply restrictions in the aftermath of last month’s pipeline rupture on Enbridge Inc.’s Westcoast Transmission system.

Northwest Sumas spiked $5.945 to $10.190. North of the Canadian border, Westcoast Station 2 got crushed during the week, falling C$1.310 to average well into the negatives at minus C$1.005/GJ.

Turning to the futures, after several relatively quiet sessions, the winter strip rallied sharply Friday as forecasters puzzled over volatile models to piece together the long-range trends following intense short- and medium-range cold. After surging overnight heading into Friday’s session, the December Nymex contract traded as high as $3.824 before sliding back to settle at $3.719, up 17.6 cents on the day.

After gapping up over the weekend to finish 28.3 cents higher on Monday, the market followed with three range-bound sessions before breaking higher Friday. The prompt month gained a whopping 43.5 cents week/week after settling at $3.284 the Friday before.

Friday’s $3.719 settlement takes out the previous front month high recorded in January 2018, when the February 2018 contract settled at $3.631. That’s also the highest the front month has settled since December 2016.

Price risks over the weekend were looking “incredibly mixed” following Friday’s session, according to Bespoke Weather Services.

“It was another week of extreme model volatility, as after a huge gap higher on Monday prices held in a tight range,” Bespoke said. “Balances slowly tightened through the week with production off highs, Canadian imports falling off and power burns struggling to loosen more. This helped keep prices from breaking lower mid-week on warmer model trends.” Then on Thursday models began trending colder, setting up prices to “break out higher on major cash leadership” Friday.

“Into the weekend we now see risks as incredibly mixed; prices settled more than 10 cents off their highs as afternoon model guidance marginally warmed, but they also shot far above the $3.70 level we were looking for,” Bespoke said. “The market was in a state of fear this morning; with balances marginally tighter and risks that cold lingers, low storage means all that much more, and as cash prices shot higher futures followed.”

Weather models on Friday continued to show a milder break for much of the country Nov. 19-23, according to NatGasWeather.

“As far as weekend risk, most of the weather data is currently neutral to a touch bearish for Nov. 23-26, depending on the weather model,” with the Global Forecast System coming in colder than the rest of the data. “There will likely be very cold air over western Canada Nov. 23-26, but the data is unsure if it will be able to push across the border into the U.S. or not. If it were to do so, bullish sentiment would be expected” and Friday’s spike in the futures “might be justified.

“If it holds north of the border, the pattern is likely to be mild enough that sentiment for those days would be neutral to a touch bearish,” the forecaster said. “The current odds favor cold holding at the border by a slight margin.”

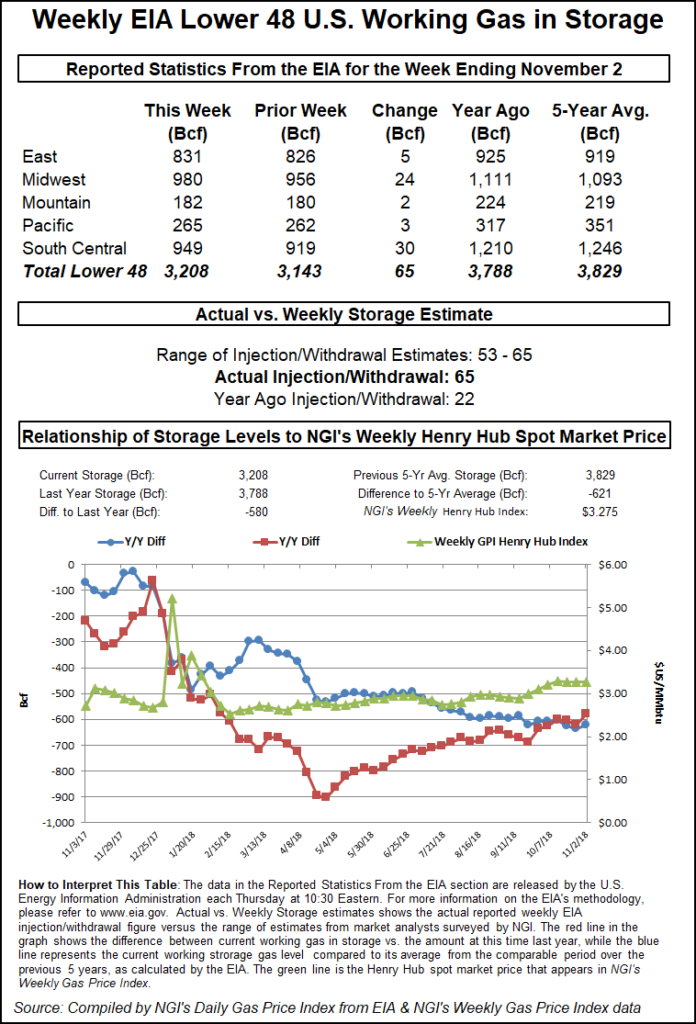

Meanwhile, the Energy Information Administration (EIA) reported a 65 Bcf injection in its weekly U.S. natural gas storage report Thursday, surprising to the high side of most estimates on the strength of a hefty gain in South Central inventories.

The 65 Bcf net build for the week ended Nov. 2 compares to a 22 Bcf build recorded in the year-ago period and a five-year average injection of 48 Bcf. The injection — well above many estimates and nearly outside the range of major surveys — shrinks deficits more than expected as the market prepares for the season’s first serious stretch of winter heating demand.

With so much focus on cold temperatures forecast for this week and next, what the plump build showed about last week’s supply/demand balance did not appear to dramatically alter the market’s overall outlook, at least not at first.

As the final number went live at 10:30 a.m. ET, December Nymex futures dropped a few cents to trade as low as $3.506 before recovering to around $3.520-3.530 over the next 10-15 minutes. By 11 a.m. ET, December was trading around $3.520, down about 3.5 cents from Wednesday’s settle.

Prior to the report, major surveys showed market participants looking for a build in the upper 50s Bcf. Intercontinental Exchange EIA financial weekly index futures had settled Wednesday at 59 Bcf.

Total Lower 48 working gas in underground storage stood at 3,208 Bcf as of Nov. 2, down 580 Bcf (15.3%) from last year and 621 Bcf (16.2%) below the five-year average, according to EIA.

By region, the South Central recorded the largest injection for the week at 30 Bcf, including 19 Bcf injected into salt and 10 Bcf into nonsalt. Midwest operators refilled 24 Bcf for the week, while 5 Bcf was injected in the East. The Mountain region saw a 2 Bcf injection, while 3 Bcf was injected in the Pacific, according to EIA.

“Expectations this week were clearly for a smaller build,” said Genscape Inc. analyst Margaret Jones. “…Compared to degree days and normal seasonality, the 65 Bcf injection is about 3.8 Bcf/d loose versus the five-year average. Next Thursday’s number will be one more build before a hefty draw as cold-weather demand ramps up” during the week ahead.

With wintry temperatures set to move into the East and more heating demand on tap for the week ahead, spot price gains were widespread heading into the weekend; the NGI Spot Gas National Avg. climbed 17.5 cents to $3.630/MMBtu.

Physical prices for weekend and Monday delivery picked up across most of the country Friday with wintry conditions expected to for the populated East Coast. Benchmark Henry Hub added 17.5 cents to $3.780.

Cold was expected to continue spreading across the southern and east-central United States Friday before pushing into the East over the weekend, according to NatGasWeather.

“With lows behind the cold front dropping into the teens to 30s, locally single digits, national demand will be well above normal,” the forecaster said Friday. “The next cold blast will drop out of southern Canada late this weekend, then rapidly advance down the Plains into Texas early” in the upcoming week, “then across the Great Lakes, Tennessee Valley and East.”

The National Weather Service (NWS) was calling for a surface cyclone to develop in the East, bringing “brief but heavy rain” headed for the northern Mid-Atlantic and into southern New England early Friday.

“Cold air wrapping around the low-mid level center of the system will support locally heavy lake effect snow from the upper peninsula of Michigan into northern Wisconsin and portions of Lower Michigan through early Saturday morning,” NWS said. “The storm system will quickly move northeast into Quebec for Saturday evening but cold and blustery conditions will be left in its wake across portions of New York and New England on Saturday, with light to moderate lake effect snow east of Lakes Erie and Ontario.”

Algonquin Citygate jumped 69.0 cents to $4.330, while further south, Transco Zone 5 climbed 43.0 cents to $4.090.

In the Midwest and Midcontinent, Dawn climbed 12.5 cents to $3.895, while Northern Natural Ventura added 10.5 cents to $4.015.

ANR has begun flowing volumes on its Wisconsin South Expansion Project just in time for the arrival of winter cold following an Oct. 22 in-service authorization from FERC, Genscape Inc. analyst Vanessa Witte said.

“The Alliance/ANR interconnect showed an increased day/day of about 200 MMcf/d beginning Nov. 2, while flow through the Sandwich East and North meters increased upwards of 300 MMcf/d,” according to Witte. “The increased nominations were not fully due to the project in-service, as citygate demand in Wisconsin showed a notable ramp on Nov. 1 as well. However, overall flow into Wisconsin via Kewaskum and Sandwich has remained consistently higher since the project began.”

In the West, locations in the Rockies generally gained, including Cheyenne Hub, which added 13.0 cents to $3.670. Kingsgate picked up 11.0 cents to $3.240.

A Gas Transmission Northwest force majeure was reducing capacity through its Kingsgate location to 2,184 MMcf/d Friday after it was already scheduled to be reduced to 2,284 MMcf/d due to planned maintenance, according to Genscape analyst Dan Spangler.

“The force majeure restriction is projected to last through Nov. 13, while the planned restriction is expected to last through Nov. 21,” Spangler said. “Kingsgate’s previous 30-day average of flows into Idaho from British Columbia has been 2,135 MMcf/d.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |