NGI Mexico GPI | Infrastructure | NGI All News Access

Enbridge’s Valley Crossing Pipeline Begins Flowing Texas-to-Mexico Natural Gas

Natural gas began flowing Oct. 31 on the Texas-Mexico Valley Crossing Pipeline LLC project, one day after Enbridge Energy Inc. delivered its third quarter earnings.

CEO Al Monaco during a 3Q2018 conference call emphasized that the Calgary operator is keeping focused on the U.S. Gulf Coast, the market of choice for most of its North American shippers.

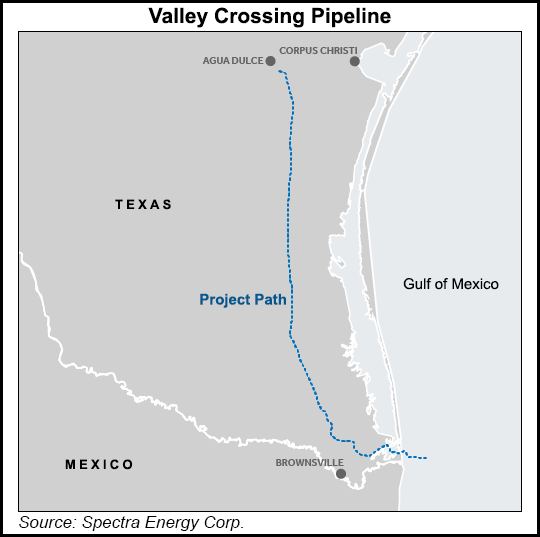

Valley Crossing’s Border Crossing Project, which was delayed in September, includes a 1,000-foot stretch of 42-inch diameter pipeline that extends from a point in Texas state waters, about 30 miles east of Brownsville, to the international border with the Mexican state of Tamaulipas.

A presidential permit was issued last year to construct and operate the 2.6 Bcf/d cross-border gas pipeline between Texas and Mexico, where it will be used for power generation and industrial customers [CP17-19]. Valley Crossing received FERC authorization to begin construction earlier this year.

During a conference call to discuss quarterly results last week, Monaco said Enbridge has a “fundamental and strategic story” to link low-cost U.S. supply with growing export markets in Mexico.

“We are connected to significant upstream supply,” including through the Kinder Morgan Inc.-led Gulf Coast Express (GCX), a 1.92 Bcf/d gas line that would carry supply from the Permian Basin to the Texas coast. GCX was given the green light in late 2017 by Kinder subsidiary, DCP Midstream LP, and an affiliate of Targa Resources Corp.

“We’re building on our Texas Eastern Gulf Coast position with the recently acquired Pomelo Connector and the South Texas expansion coming into service later this quarter,” Monaco said.

The Gulf Coast is “going to be a big area of focus in the coming years for us as our network is positioned with significant supply growth and last-mile connectivity to capitalize on market pull.”

Monaco noted during the conference call that gas has also begun flowing on the Great Lakes-to-Ontario Nexus project. Enbridge expects to have up to 1 Bcf/d of contracts in hand by the end of November.

“We’re working on more commitments here, and we continue to see good interest for market connections along the Nexus line,” Monaco said.

He also cited progress on the “mega-scale” utility in Ontario, following approval by provincial regulators to combine Union Gas Ltd. and Enbridge Gas Distribution Inc. on Jan. 1. Monaco said it would be the second-largest in North America in terms of customers and No. 1 in terms of volumes of gas delivered. The combined utility would have 3.7 million customers and 270 Bcf of gas in storage.

In response to a question on ongoing takeaway constraints from Western Canada, Monaco said constraints are found in other parts of North America, and “if you just look at the basis differentials, obviously we are going through a difficult time right now.”

Cautioning patience in working through what he calls a “massive supply growth” in North America, Monaco said he was optimistic that more takeaway capacity across North America would be developed in the next two to three years.

The CEO also said at least two noncore assets are “in the hopper” for a potential sale.

“Given the more than doubling of our asset sale targets that we had, there is no immediate rush on this given where they are and the work [the past sales] are doing,” he said. “I think we’ve demonstrated that we make good capital allocation decisions when we see good value, and we’ll continue to monitor that.”

Net income was $104 million (21 cents/share), compared with $93 million (19 cents) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |