Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

QEP Selling Williston Assets for $1.7B as Permian Takes Priority

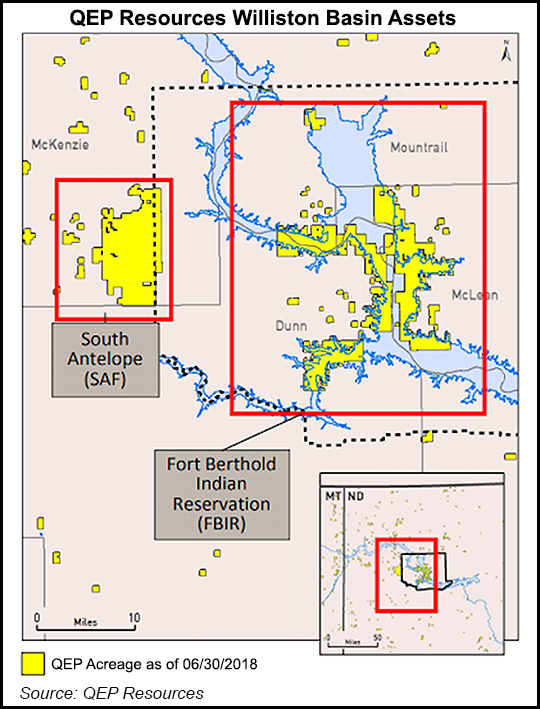

QEP Resources Inc. has secured a deal to sell its Montana and North Dakota assets in the Williston Basin to Vantage Energy Acquisition Corp.

The Williston sale, for up to $1.725 billion, was anticipated as QEP has signaled its intent to become a Permian Basin pure-play. It mostly works in the Midland sub-basin of West Texas.

“The Williston Basin assets have been a significant contributor to QEP for many years and were critical in our pivot towards a more oil-focused portfolio,” CEO Chuck Stanley said. “This transaction marks an important milestone in simplifying our asset portfolio as we continue on our path to becoming a Permian pure-play operator.

“We intend to use the proceeds from asset sales to fund the ongoing development of our core Permian assets, reduce debt, and return cash to shareholders through a share repurchase program.”

Under terms of the deal, QEP would receive $1.65 billion cash. It also would receive up to $75 million of contractual rights, depending on Vantage’s share price. QEP would receive $50 million if the daily volume of Vantage common stock exceeds $12 for 10 of 20 consecutive days, or $25 million if the stock price exceeds $15 over 10 of 20 consecutive days. The contractual rights are for anytime over a five-year period once the transaction is completed.

Vantage agreed to buy all the North Dakota and Montana assets, which include the South Antelope and Fort Berthold leasehold.

The transaction, set to close by mid-2019, is subject to Vantage shareholder and regulatory approvals.

Williams Capital Group LP analysts said the sale is a positive for QEP as it unlocks value, deleverages the company, returns cash to shareholders and provides “opportunities to fund its core Midland Basin activity…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |